Markets | NGI All News Access | NGI Data

Natural Gas Futures Near Even As Storage Stats No Surprise; Rockies Spot Prices Climb

A bearish government storage report that offered few surprises and an uninspiring weather outlook kept a lid on natural gas futures Thursday. Temperature shifts put spot prices in the Rockies on the ascent as East Coast points moderated; theNGI National Spot Gas Average shed 18 cents to $2.71/MMBtu.

The March contract, searching for a reason to move to either side of $2.70 Thursday, couldn’t find one. March traded as high as $2.758 Thursday morning before settling at $2.697, down 0.5 cents. April settled 0.7 cents lower at $2.685.

The Energy Information Administration (EIA) reported a weekly natural gas storage withdrawal that was slightly larger than market expectations, and futures traded in a narrow range following the release.

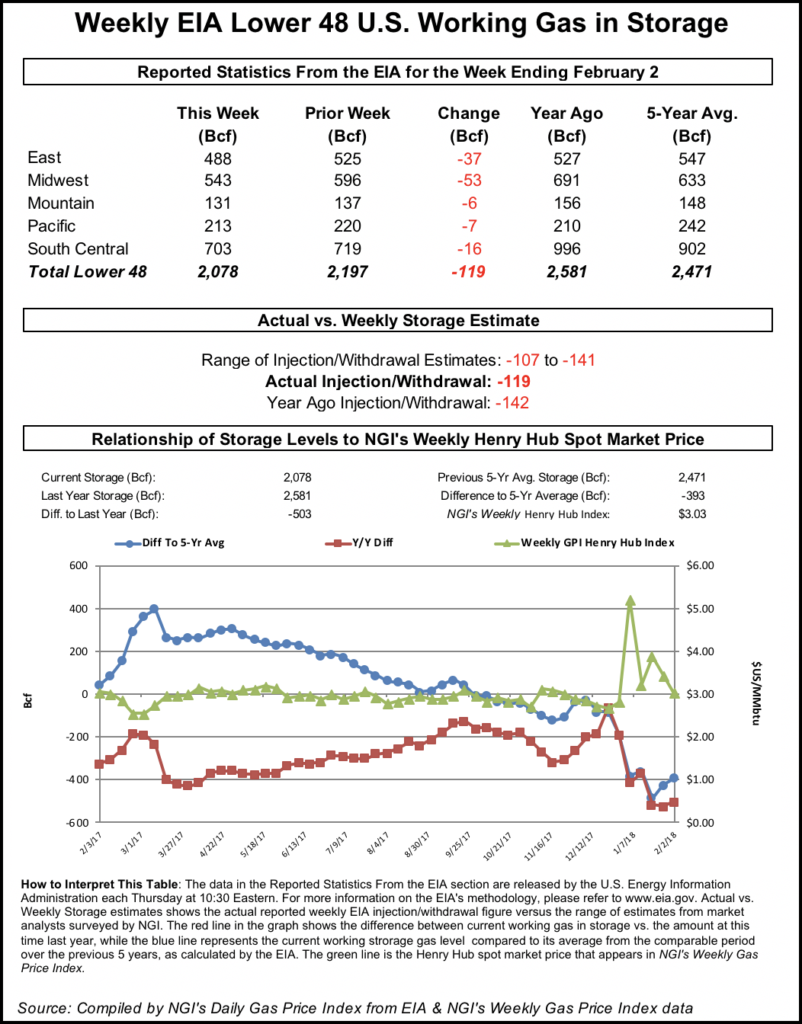

EIA reported a 119 Bcf withdrawal from U.S. gas stocks for the week ending Feb. 2, versus a year-ago withdrawal of 142 Bcf and a five-year average pull of 151 Bcf.

Shortly after the number crossed trading desks at 10:30 a.m. EDT, the March futures contract climbed above $2.740 before pulling back to around $2.720. By 11 a.m. EDT, March was trading around $2.723, up about 2 cents from Wednesday’s settle.

Prior to the report the market had been looking for a withdrawal close to the actual figure. A Reuters survey of traders and analysts on average had estimated a withdrawal of 116 Bcf. Survey responses ranged from -107 Bcf to -141 Bcf.

Kyle Cooper of ION Energy had estimated a 118 Bcf withdrawal. PointLogic Energy in a note Monday had estimated a 116 Bcf withdrawal for the period. Stephen Smith Energy Associates in a revised estimate Tuesday had predicted a withdrawal of 121 Bcf.

Intercontinental Exchange storage futures settled Wednesday at -118 Bcf for the period.

Bespoke Weather Services said in a note to clients that this week’s number “continues to reinforce the idea that the natural gas market is still sensitive to forward weather expectations, as it is tight enough for colder weather to put a sizable dent in storage into the spring.

“However, production remains high enough to keep a ceiling on prices as well, and the price reaction off the number was not particularly bullish,” Bespoke said. “We see this number reaffirming our neutral market outlook and confirming upside once models trend colder.”

Analysts with Wells Fargo Securities LLC said Thursday they expect a cumulative 258 Bcf withdrawal over the next two weeks based on their model and current forecasts from the National Oceanic and Atmospheric Administration.

Total working gas in underground storage as of Feb. 2 stood at 2,078 Bcf, versus 2,581 Bcf a year ago and five-year average stocks of 2,471 Bcf. The current year-on-year storage deficit narrowed week/week from -526 Bcf to -503 Bcf, while the year-on-five-year deficit shrank from -425 Bcf to -393 Bcf, EIA data show.

By region, the largest pull came in the Midwest (-53 Bcf), followed by the East (-37 Bcf). The Pacific region saw a 7 Bcf withdrawal for the week, while 6 Bcf was withdrawn in the Mountain region. Net withdrawals in the South Central region totaled 16 Bcf, with 32 Bcf pulled from nonsalt, offsetting 15 Bcf injected into salt, according to EIA.

“Deficits were reduced to -393 Bcf but will jump back over -400 Bcf after next week’s storage report accounts for the two rather cold weather systems that swept across the North and East this week,” NatGasWeather.com told clients Thursday. “However, it’s the pattern next week into the following where overall conditions just won’t be cold enough to impress a hard-to-please market that clearly requires widespread frigid cold to sustain a rally.”

The midday weather data came in “a little colder over the northern U.S.” beginning next Wednesday (Feb. 14) through Feb. 20, “with a little stronger push of Canadian air across the border to add some demand,” the firm said. “Inconsistencies between suites of weather data are likely to continue as there has been some flip-flopping due to the models struggling to resolve exactly how much colder Canadian air will make it into the northern U.S.”

Following Thursday’s close, Bespoke said a bearish afternoon run for the European model guidance offset “slightly more supportive” changes to the American guidance earlier in the day.

“Model volatility continues to remain extremely high, meaning the market movements off individual model runs appear relatively muted,” the firm said. “This may continue into Friday unless there are sizable coherent trends across models that set a consensus before the weekend, which seems unlikely given the complex upstream pattern.”

In order to move off support at $2.70, the market “would need to see more risks of cold later in February that could lower storage levels before injection season,” Bespoke said. “European guidance decreased most of those risks, and if these trends continue overnight then we see risks that prices test our short-term downside target at $2.58 either Friday or early next week.”

Meanwhile, Societe Generale is maintaining its 2018 average Henry Hub price estimate at $3.03, analyst Breanne Dougherty said in a note to clients Thursday.

“We advise watching core summer contracts (August) for dips, like the one observed this week, to enter into long positions, because demand strength from cooling loads makes that season prone to price spikes,” she said.

A “return of upside momentum” during the shoulder months presents an opportunity to enter short positions, she said, since “spring demand softness and ongoing production growth makes the season vulnerable to price weakness.

“There is a mix of fundamental bearish (strong production trends/signals) and bullish (continued export growth and year-on-year constructive weather profile) indicators at play right now, and market reaction to them has been erratic of late,” Dougherty said. “Strong 2018 price conviction is hard to establish given extreme volatility in market sentiment.”

In the spot market, points in the Rockies got a lift as temperatures in the region were expected to drop starting Friday. Weather Underground was calling for Denver to go from highs in the low 60s Thursday to highs in the 20s and lows in the teens by Saturday.

Genscape Inc. forecast regional demand to climb to 2.72 Bcf/d Saturday, about 1 Bcf/d above the recent seven-day average.

The Rockies Regional Average jumped 16 cents to $2.12, including a 20-cent gain at CIG, which averaged $2.20.

“A strong cold front is exiting the East with chilly conditions left in its wake,” NatGasWeather said in its one- to seven-day outlook Thursday. “Strong demand will continue into Saturday morning as lows reach the 20s to -10 degrees over the Midwest and Northeast, with 20s and 30s into the Southeast.

“A milder ridge will expand over the South and East this weekend, with highs of 50s to 70s, while fresh cooling arrives into the Rockies and Plains,” the firm said. “Some of this colder air will advance into the Midwest and South early next week. The West Coast and Southwest will be mostly mild. Overall, strong demand this week will be easing this weekend.”

Along the East Coast, prices eased off as temperatures were expected to moderate heading into the weekend. Radiant Solutions was forecasting temperatures to climb to around 10 degrees above normal by Saturday in Atlanta, Boston, New York, Philadelphia and Washington, DC.

Genscape’s forecast for the Southeast and Mid-Atlantic region Thursday showed demand falling to 13.66 Bcf/d by Saturday versus a recent seven-day average of just under 18 Bcf/d.

Transco Zone 5 dropped $1.12 to average $2.88 Thursday, while Tetco M3 Delivery fell $1.29 to $2.86.

Texas Eastern Transmission Co. (Tetco) declared a force majeure Thursday because of an unplanned outage at its Shermans Dale compressor station in Pennsylvania. The pipeline said customers downstream of the compressor on the Penn-Jersey Line could see lower delivery pressures from the outage.

“While efforts to repair the compressor station to full capacity are underway, the estimated time of restoration is unclear at this time,” Tetco told shippers Thursday.

With frigid temperatures expected to linger across the north central United States into the weekend, several Midcontinent points saw gains Thursday. Northern Natural Gas extended a safe operating limit alert through the weekend “due to lower than normal system weighted temperatures.”

Northern Natural Demarcation climbed 16 cents to $2.80, while Northern Natural Ventura jumped 25 cents to $3.03.

Horsepower issues at Natural Gas Pipeline Co. of America’s (NGPL) compressor station 105 on Segment 11 in the pipeline’s Midcontinent zone were expected to reduce operational capacity of northbound flows by about 200 MMcf/d for Friday’s gas day, according to Genscape.

NGPL’s Segment 11 “spans almost the entirety of Kansas, and flows gas northbound” into the Midwest, the firm said.

NGPL Midcontinent dropped 13 cents to $2.17.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |