Up-and-Down Week for NatGas Markets Sees Spot Prices, Futures Slide

Demand swings and a moderating outlook on the relative intensity of forecast February arctic cold made for an up-and-down week in the natural gas markets. A few East Coast points posted weather-driven gains for the week as a sell-off in futures pulled the rug out from large portions of the cash market; NGI’s Weekly Spot Gas Average fell 17 cents to $3.25/MMBtu.

PointLogic Energy analyst Robert Applegate said Friday it had been “a week of contradictions” in terms of natural gas supply/demand shifts.

“On Jan. 29 Lower 48 dry gas production was tearing into the record books and demand was down,” Applegate said. “That day, dry gas production hit 77.8 Bcf, a record that was topped the next day when production hit just 50 MMcf shy of 78 Bcf. The same day, Lower 48 demand was down at 86 Bcf due to population-weighted temperatures being four degrees above average.

“Fast forward to Friday, and production is down,” following a reported explosion on the Rockies Express Pipeline’s (REX) Seneca Lateral in Ohio, “and demand is more than 10 Bcf higher,” he said. “Friday’s Lower 48 population-weighted temperature is expected to be 3 degrees below average and demand is expected to be over 96 Bcf.

“There has been some argument between the weather models for the month of February, but based on the current two-week forecast, this could be the last time the U.S. sees demand this high until at least after Valentine’s Day.”

Some chilly weather sweeping through the Midwest and into the East Coast during the week helped weekly cash prices gain at a number of points throughout the region.

Transco Zone 6 New York added $1.87 to average $5.69 for the week, while Transco Zone 5 gained $1.76 to $5.47. Cove Point jumped $2.07 to average $5.80.

In Appalachia, the incident on REX’s Seneca Lateral appeared to disrupt production volumes in the region, according to analysts. This included a decrease in nominations to the Rover Pipeline, which also connects to the same Seneca processing plant as REX’s lateral.

Dominion South finished higher for the week, up 11 cents to average $2.80, while Columbia Gas dropped 26 cents to $2.88.

In the Midwest, REX into ANR fell 20 cents to $2.87, roughly in line with the 21-cent weekly drop at Chicago Citygate, which finished at $2.92.

Meanwhile, as bidweek drew to a close, physical traders had to navigate the dissonance between a bullish close to the February futures contract and a precipitous fall during March’s first few days as the newly-installed prompt-month. This conundrum was captured in the Henry Hub’s weekly spot price action, where the average tumbled 40 cents week/week to $3.03.

Futures had a quiet day Friday, capping off a decidedly bearish week that saw prompt-month prices plummet from $3.631 (Monday’s February expiry) to as low as $2.837 (Thursday’s intraday low for the March contract). On Friday, March traded near even, settling a penny lower at $2.846. One week earlier, March had settled at $3.175.

A change in the outlook for February cold, combined with production levels recovering from freeze-offs in January, helped the bears wrest control of the market during the week. A bearish government storage report didn’t help either.

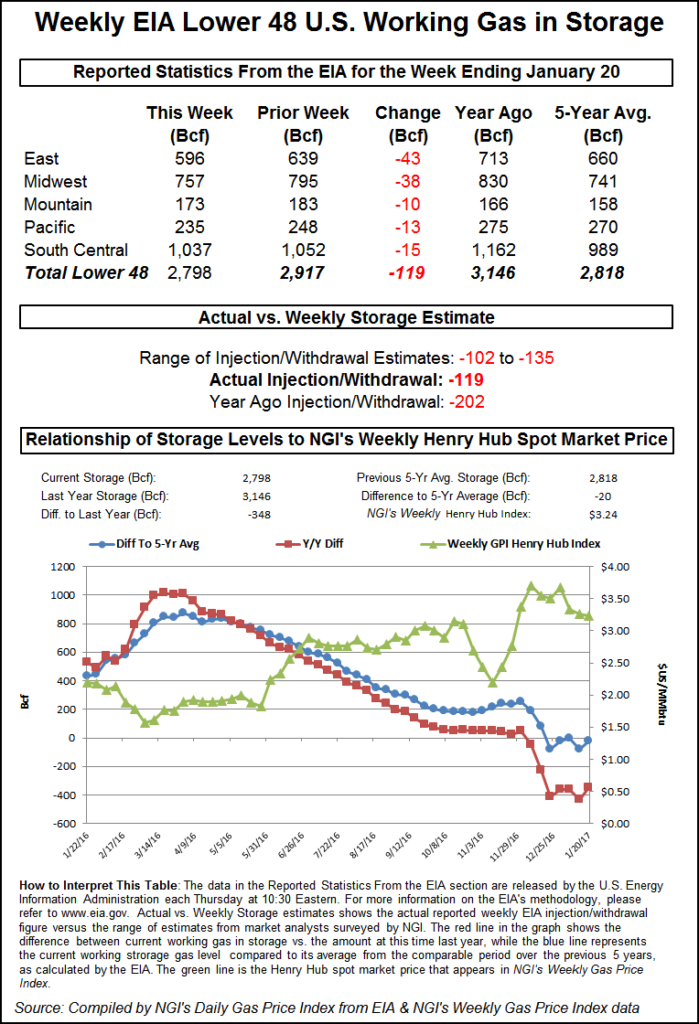

The Energy Information Administration (EIA) reported a storage withdrawal Thursday that fell in line with the market’s bearish expectations, and futures slid further after selling off overnight.

EIA reported a 99 Bcf withdrawal from U.S. gas stocks for the week ending Jan. 26. That’s versus a year-ago withdrawal of 92 Bcf and a five-year average withdrawal of 160 Bcf.

The 99 Bcf pull is a far cry from the 288 Bcf withdrawal reported last week, and it comes as recent weather guidance has backed off on the intensity of arctic cold forecast to sweep into the Lower 48 states later this month.

As the number crossed trading desks at 10:30 a.m. EDT, the March contract briefly dipped below $2.850 before returning to the $2.855-2.875 area, down around 13 cents from Wednesday’s settlement. By 11 a.m. EDT, March was trading around $2.875.

The price action on the March contract Thursday morning stood in stark contrast to the final few trading days of the February contract, which rolled off the board at $3.631.

Prior to the report, the market had been expecting a withdrawal close to the actual figure. The average taken from a Reuters survey of traders and analysts had showed the market expecting a 104 Bcf withdrawal.

PointLogic Energy on Monday estimated a 91 Bcf withdrawal for the week ending Jan. 26. “At this level, net withdrawals would come in 197 Bcf below last week’s reported withdrawal as milder weather spread across the East, Midwest and South Central regions week-on-week,” analysts said in a note. “Additionally, injection demand in the South Central region’s salt cavern storage facilities picked up significantly.”

Kyle Cooper of ION Energy estimated a pull of 111 Bcf. Stephen Smith Energy Associates revised its estimate Tuesday to a withdrawal of 101 Bcf, after previously calling for a 98 Bcf pull. That’s versus a seasonally normal draw of 159 Bcf based on 2006-2010 norms, according to the firm.

“This fits perfectly within the range of expectations and represents clear and significant loosening from the previous week, which makes sense given the rebound in production,” Bespoke Weather Services said of the 99 Bcf withdrawal. “This number confirms that colder weather will be necessary through February to bounce prices, otherwise there could be further downside.”

After EIA’s report the market “bounced right off the $2.85 support level we highlighted this morning, and the strip appears modestly supportive, so any afternoon gas-weighted degree day additions could support prices. Still, no sizable bounces will come without far colder weather.”

Total working gas in underground storage stood at 2,197 Bcf as of Jan. 26, versus 2,723 Bcf a year ago and a five-year average 2,622 Bcf, according to EIA. The current year-on-year deficit increased week/week from -519 Bcf to -526 Bcf, while the year-on-five-year deficit shrank from -486 Bcf to -425 Bcf, EIA data show.

By region, the largest withdrawals came in the Midwest (-38 Bcf) and East (-30 Bcf). The South Central saw a net 10 Bcf withdrawal, based on 28 Bcf pulled from nonsalt, offsetting an 18 Bcf injection for salt. In the Pacific, 13 Bcf was withdrawn, while 8 Bcf was withdrawn in the Mountain region, according to EIA.

After all the selling on the March contract during the week, Bespoke had a slightly bullish outlook Friday.

“The story is complicated heading into the weekend now, as no longer is it a question of how much further we have to drop off warming trends but instead how much we could retrace recent selling should cold risks return,” Bespoke said. “Afternoon American guidance was rather uninspiring…but afternoon European guidance shows favorable trends across the Pacific for increased cold risks into the second half of February.”

The firm cautioned that “this trend has continued for just a couple runs and remains in the relatively distant future” and also noted that “admittedly, the risk that this cold is significant enough and can penetrate far enough south to return all the winter premium we lost last week is relatively low.”

Analysts with Tudor, Pickering, Holt & Co. said early predictions for the upcoming week’s report were coming in around -115 Bcf Friday versus norms of around -140 Bcf.

“Some relief may be provided with arctic weather forecasted around Valentine’s Day, but expect little love for the forward curve with markets leaning balanced to oversupplied — in the teeth of winter, no less,” TPH said.

Taking a much longer-term view, the TPH analysts said natural gas commodity prices could go into “hibernation season” for “the balance of 2018.” There are “lots of moving pieces on the demand side (additional liquefied natural gas export capacity, Mexican demand timing, Gulf Coast petrochemical expansion), but the structural elements appear constructive heading into the next decade,” analysts said.

“None of that is top of mind in conversations with investors right now as North American supply growth is poised to overwhelm, but we do think it worth keeping the sonar fired up for any pings of demand acceleration.” TPH’s team added that, “As far as we can tell, the time-tested economic principle remains firmly intact — nothing stimulates commodity demand like ultra-low prices.”

Punxsutawney Phil saw his shadow Friday, foreboding six more weeks of winter, but maybe it wasn’t obvious by looking at the natural gas markets. Cash prices experienced widespread weakness for a second straight day as a forecast warm-up took the edge off East Coast premiums. The NGI National Spot Gas Average slid 69 cents to $2.92/MMBtu.

The latest weather data Friday was “slightly colder” for the week ahead “and was also slightly colder around Feb. 11-12, but still with the frigid Arctic cold pool retreating north into Canada,” according to NatGasWeather.com.

“There will continue to be swings in demand the next two weeks as numerous weather systems remain lined up to track across the northern and eastern U.S. They just won’t tap into” frigid Arctic temperatures “as impressively as the data showed at the start of the week.”

In the near-term, NatGasWeather noted “colder than normal temperatures” for Friday “covering most of the eastern half of the country for strong demand, aided by lows” overnight “reaching the teens to -10 over the Midwest and Northeast, with 20s and 30s over the southeastern U.S.” A brief break was expected Sunday ahead of another cold shot through the northern and eastern part of the country in the week ahead, “with yet another cold blast right on its heels” by the end of the week.

Volatile East Coast cash prices, which saw a few swings throughout the week on the weather, swung lower Friday. The big declines came after a number of New England points had surged above $10 in Thursday’s trading.

Algonquin Citygate shed $4.99 to average $7.26, while Dracut dropped $4.36 to $8.00.

AccuWeather.com was calling for temperatures in the 20s Saturday in Boston to give way to highs in the lower to mid-40s Sunday and Monday.

New England regional demand was expected to drop from 4.06 Bcf/d on Friday to 2.81 Bcf/d by Sunday, according to Genscape Inc.

Despite forecasts for temperatures in the 20s down into the single digits in Chicago over the weekend and into Monday, Chicago Citygate prices fell for the fifth straight trading day, giving up 13 cents to average $2.76.

In the West, where Radiant Solutions was forecasting above-normal temperatures over the next several days in cities like Denver and Burbank, CA, sub-$2 prices were prevalent Friday.

Utility Southern California Gas was forecasting system demand to drop from around 2.5 million Dth/d Friday to 2.279 million Dth/d by Monday. Deals at SoCal Citygate plummeted 55 cents to $2.05. SoCal Border Average tumbled 32 cents to $1.91.

In the Rockies, Kern River gave up 37 cents to $1.90.

The declines in the cash market Friday followed big markdowns in the futures and Henry Hub spot prices. Henry Hub dropped another 16 cents Friday to average $2.86, bringing it in line with the March contract. That’s a nearly 75-cent swing from Tuesday’s trade day, when Henry Hub cash prices averaged $3.60.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |