Infrastructure | E&P | NGI All News Access | NGI The Weekly Gas Market Report

Oil Rigs Up, Natural Gas Rigs Down in Latest North American Count

U.S. drillers dropped one net rig for the week ended Friday, driven by a decline in natural gas-directed drilling, according to data from Baker Hughes Inc. (BHI).

The United States finished at 946 active rigs as of Friday (Feb. 2), with the addition of six oil-directed rigs offset by a net decline of seven natural gas-directed units, according to BHI.

One rig departed in the Gulf of Mexico, while land drilling finished flat for the week. The United States posted a net decline of one directional rig, while horizontal and vertical units were flat.

Canada netted four rigs for the week to finish at 342, with 14 oil-directed rigs offsetting a decline of 10 gas-directed units.

The combined North American rig count finished at 1,288 units, versus 1,072 rigs running in the year-ago period.

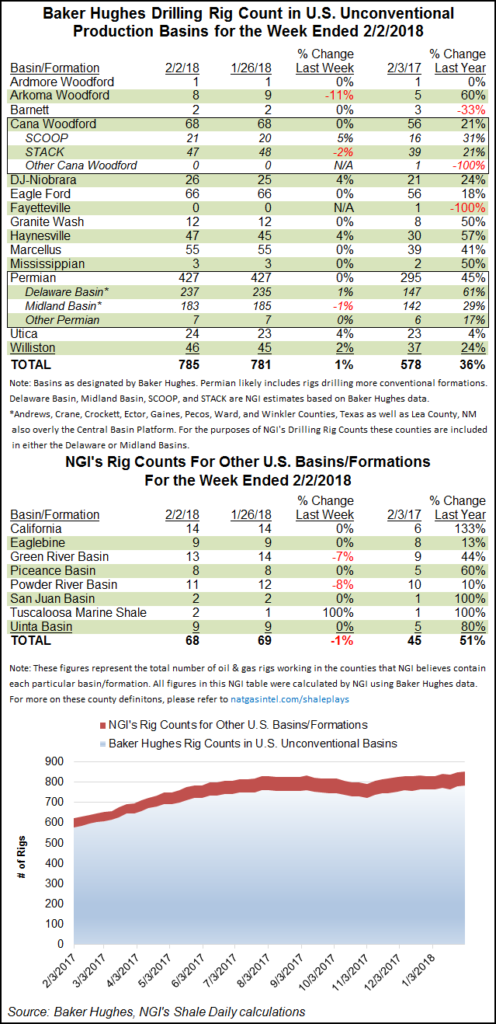

While overall gas-directed drilling decreased for the week, the major gassy basins maintained or added rigs. The Haynesville Shale added two rigs to finish at 47, up from 30 rigs a year ago, while the Utica Shale added a rig to end the week at 24. The Marcellus Shale was flat week/week at 55 active rigs.

Elsewhere, the Denver Julesburg-Niobrara and Williston Basin each added one rig, while one rig was dropped in the Arkoma Woodford, according to BHI’s breakdown.

Among states, the largest decline for the week came in Wyoming, which gave up three rigs to end at 26 from 20 a year ago. Texas and Louisiana each saw one rig depart for the week.

Gainers among states included Colorado (up two), North Dakota (up one) and Ohio (up one).

NGI’s more detailed breakdown of BHI data showed the Green River and Powder River basins each dropping one rig for the week to end at 13 and 11, respectively.

During the week, ExxonMobil Corp. announced plans to triple Permian Basin production to more than 600,000 boe/d by 2025, including a five-fold increase in tight oil output from the Delaware and Midland sub-basins.

On Friday, ExxonMobil and Chevron Corp. each released their 4Q2018 results, demonstrating production prowess in 2017 while failing to hit Wall Street forecasts. Management provided more color about U.S. operations, particularly from unconventional targets in the Delaware and Midland, as well as the Bakken Shale.

“Our total production from the Delaware, Midland and Bakken basins is now about 200,000 boe/d,” ExxonMobil’s investor relations chief Jeff Woodbury said. “We’re progressing plans to ramp up to around 36 operated rigs in the Permian and Bakken by year-end, of which 30 will be in the Delaware and Midland basins.”

Meanwhile, Chevron replaced more than 150% of the reserves it produced during 2017, with the Permian the largest contributor to reserves additions. More liquefied natural gas (LNG) production also lifted reserves.

“As we continue to ramp up our rig fleet, we are confident this pattern should continue,” newly installed CEO Mike Wirth said. “Importantly, we expect that our 2018 production will continue to grow by 4-7%, driven primarily by Australian LNG and the acceleration of development activities in the Permian, where investment economics continue to improve.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |