Markets | NGI All News Access | NGI Data

Bearish Storage Stats No Help to Sliding NatGas Futures; Cash Down Too — Except East Coast

Natural gas futures continued to slide Thursday amid a soured outlook for cold temperatures in February and a government storage report that pointed to a loosening supply/demand balance. In the spot market, forecast chilly weather drove up East Coast prices as every other region fell by double digits; the NGI National Spot Gas Average finished 39 cents higher at $3.61/MMBtu.

After falling overnight, the March contract didn’t find much support from Thursday’s Energy Information Administration (EIA) storage report, which fell in line with the market’s bearish expectations. March settled at $2.856 Thursday, down 13.9 cents day/day. April, meanwhile, settled 6.7 cents lower at $2.793.

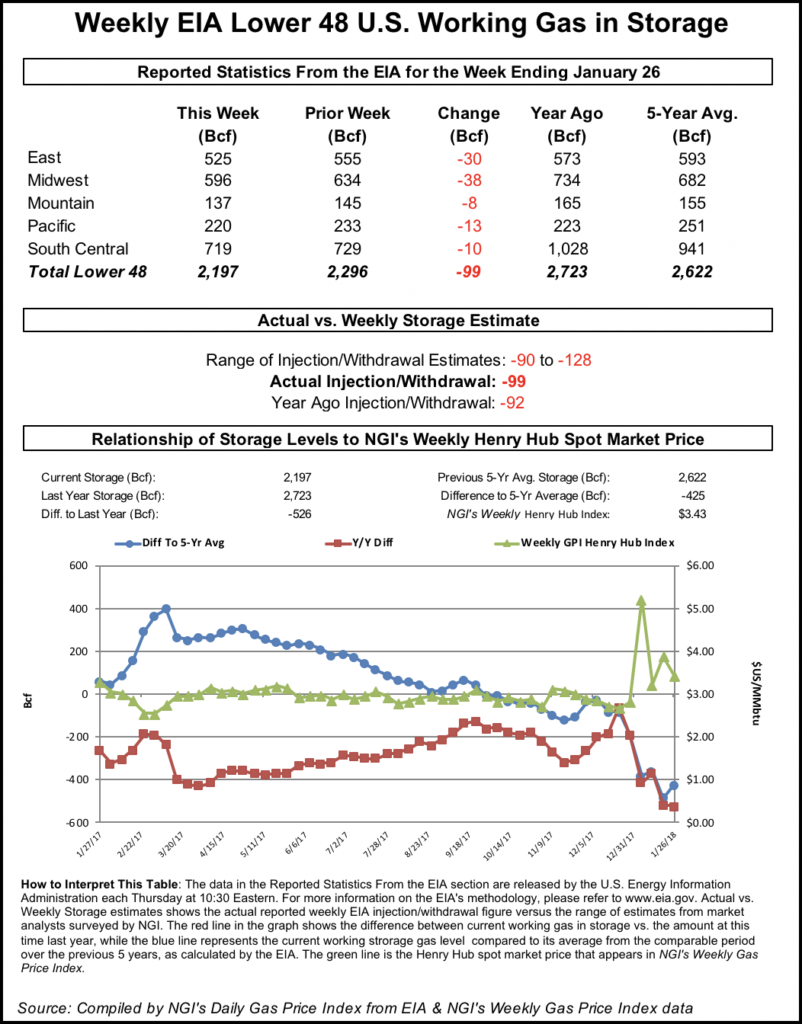

EIA on Thursday reported a 99 Bcf withdrawal from U.S. gas stocks for the week ending Jan. 26. That’s versus a year-ago withdrawal of 92 Bcf and a five-year average withdrawal of 160 Bcf.

The 99 Bcf pull is a far cry from the 288 Bcf withdrawal reported last week, and it comes as recent weather guidance has backed off on the intensity of arctic cold forecast to sweep into the Lower 48 states later this month.

As the number crossed trading desks at 10:30 a.m. EDT, the March contract briefly dipped below $2.850 before returning to the $2.855-2.875 area, down around 13 cents from Wednesday’s settlement. By 11 a.m. EDT, March was trading around $2.875.

The price action on the March contract Thursday morning stood in stark contrast to the final few trading days of the February contract, whichrolled off the board at $3.631.

Prior to the report, the market had been expecting a withdrawal close to the actual figure. The average taken from a Reuters survey of traders and analysts had showed the market expecting a 104 Bcf withdrawal.

PointLogic Energy on Monday estimated a 91 Bcf withdrawal for the week ending Jan. 26. “At this level, net withdrawals would come in 197 Bcf below last week’s reported withdrawal as milder weather spread across the East, Midwest and South Central regions week-on-week,” analysts said in a note. “Additionally, injection demand in the South Central region’s salt cavern storage facilities picked up significantly.”

Kyle Cooper of ION Energy estimated a pull of 111 Bcf. Stephen Smith Energy Associates revised its estimate Tuesday to a withdrawal of 101 Bcf, after previously calling for a 98 Bcf pull. That’s versus a seasonally normal draw of 159 Bcf based on 2006-2010 norms, according to the firm.

“This fits perfectly within the range of expectations and represents clear and significant loosening from the previous week, which makes sense given the rebound in production,” Bespoke Weather Services said of the 99 Bcf withdrawal. “This number confirms that colder weather will be necessary through February to bounce prices, otherwise there could be further downside.”

After EIA’s report the market “bounced right off the $2.85 support level we highlighted [Thursday] morning, and the strip appears modestly supportive, so any afternoon gas-weighted degree day additions could support prices. Still, no sizable bounces will come without far colder weather.”

Total working gas in underground storage stood at 2,197 Bcf as of Jan. 26, versus 2,723 Bcf a year ago and a five-year average 2,622 Bcf, according to EIA. The current year-on-year deficit increased week/week from -519 Bcf to -526 Bcf, while the year-on-five-year deficit shrank from -486 Bcf to -425 Bcf, EIA data show.

By region, the largest withdrawals came in the Midwest (-38 Bcf) and East (-30 Bcf). The South Central saw a net 10 Bcf withdrawal, based on 28 Bcf pulled from nonsalt, offsetting an 18 Bcf injection for salt. In the Pacific, 13 Bcf was withdrawn, while 8 Bcf was withdrawn in the Mountain region, according to EIA.

NatGasWeather.com said midday weather data Thursday “held slightly colder trends with a weather system during the second half of next week, but maintained a rather milder overall U.S. pattern Feb. 11-15, which is where we see the markets being most disappointed.

“There’s still expected to be at least four weather systems tracking across the northern and eastern U.S. in the next two weeks, including the one currently sweeping through the Midwest and East,” NatGasWeather said. “But with the systems next week, and especially Feb. 11-15, failing to adequately tap into the frigid Arctic cold pool just across the border into Canada as the data suggested earlier in the week, prices have sold off an impressive 40 cents in less than three sessions.”

In a recent note, analysts with Tudor, Pickering, Holt & Co. (TPH) attributed this week’s futures “freefall” to a “slew of bearish fundamentals” that had “come center stage.”

“Lower 48 dry gas production hit a record 77.6 Bcf/d Monday, while heating degree day forecasts” for the first week of February “were lackluster, keeping with last week’s trend,” the TPH analysts wrote. Meanwhile, commercial start-up of the Dominion Cove Point liquefied natural gas (LNG) export terminal was “delayed until March, further pushing out any LNG export growth above the current roughly 3 Bcf/d ceiling.”

Analysts with Jefferies LLC pointed to numbers showing production surpassing the 78 Bcf/d mark.

“Supply in the first half of January was impacted by freeze-offs and averaged 75.5 Bcf/d (including falling as low as 72.6 Bcf/d on a single day), but production rebounded in the back half of the month, averaging 77.2 Bcf/d, roughly in line with December 2017 levels,” analysts said. “Supply reached a new daily high over the last week, surpassing 78 Bcf/d for the first time and has since exceeded that level on three days.”

Northeast production experienced a decline this week following a reported explosion on Rockies Express Pipeline’s (REX) Seneca Lateral in eastern Ohio early Wednesday morning, according to analysts.

PointLogic Energy said its data showed “a huge single-day drop” in Lower 48 production from Tuesday to Wednesday of 570 MMcf/d.

Production remained down Thursday, analyst Robert Applegate said. “Utilizing our data, one can drill down to see exactly how this single event has affected production and where. We know the incident was in the Northeast, so we can start by seeing the effects there. Of the 570 MMcf/d drop for the Lower 48, a 600 MMcf/d drop was seen in the Northeast alone, meaning some increased production in other regions offset the Northeast incident.

“Moving slightly deeper down the rabbit hole, we can see that this incident dropped production in the Utica area specifically by 447 MMcf in a single day,” he said.

The incident appeared to impact receipts onto the Rover Pipeline Wednesday, according to Genscape Inc.

REX receipts through the MarkWest Seneca-Noble point — one of two points reduced to zero during repairs on the Seneca line — had averaged 330 MMcf/d in December, but as of Jan. 1 “nominations began to fall precipitously, giving way to Rover’s Seneca location, which also connects to the Seneca processing plant and quickly picked up where REX fell off,” Genscape said.

“…Interestingly, though the explosion was stated to have only affected connections that REX has with the Seneca plant, receipts to the Rover Seneca location dropped from 338 MMcf/d Tuesday to just 69 MMcf/d Wednesday and 0 MMcf/d as of the evening cycle for Thursday’s gas day,” according to the firm.

While receipts increased out of Cadiz, OH, “no other location has countered with significant increased nominations,” Genscape said. “Deliveries to ANR at Westrick dropped around 285 MMcf/d day/day, from 1.08 Bcf/d Tuesday to 750 MMcf/d and 770 MMcf/d Wednesday and Thursday, respectively.”

In the spot market Thursday, most Appalachian points fell for the second straight day. Dominion South dropped 10 cents to average $2.85 after giving up 6 cents the day before.

Weather Underground was reporting temperatures for Chicago on Thursday to be in the teens and 20s, with more cold temperatures expected Friday. However, that wasn’t enough to keep Midwest prices from falling.

Chicago Citygate fell 22 cents to $2.89, while REX into ANR dropped 21 cents to $2.84.

Meanwhile, the usual culprits in recent winter price volatility along the East Coast saw big gains Thursday as forecasters were expecting the mercury to drop in cities like Boston, New York and Philadelphia.

“Total demand in the Lower 48 is expected to reach a 15-day high on Friday of around 103 Bcf/d, led by an increase in residential/commercial (res/com) demand,” Genscape said, citing data from its Macro SD Report. Total residential/commercial (res/com) demand “is projected to be around 48 Bcf/d Friday, made up primarily by the East region (around 20 Bcf/d) and the Midwest region (around 17 Bcf/d). Total res/com demand remains in the mid to high 40s for the remainder of the weekend and next week.”

Transco Zone 6 New York added $3.34 to average $7.87, while Iroquois Zone 2 more than doubled, gaining $4.72 to $8.71.

The bearish headwinds shown in the March contract seemed to pull the rug out from under prices most everywhere else. Henry Hub tumbled 19 cents to average $3.02 Thursday after averaging $3.60 only two days earlier.

Sub-$3 prices were widespread throughout the Gulf Coast and Texas. Points in supply regions saw trades below $2. In West Texas, El Paso Permian averaged $2.06, giving up 22 cents on the day, while further north, OGT tumbled 31 cents to $1.69.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |