Northeast February Prices Jump by $2-Plus on Frigid Weather Forecast

The potential for another cold blast in February sent natural gas forward prices for the month up by an average of 51 cents from Jan. 19-25, with far stronger gains of more than $2.00 in the Northeast, where recent cold snaps have caused pipeline restrictions and volatility in both cash and forwards markets alike, according to NGI’s Forward Look.

Futures and forwards markets raced out of the gate last Monday (Jan. 22) as weather models pointed to a cold air mass returning to the United States in early February. Those weather forecasts did not change on Tuesday, and strength in the cash market helped lend support to February prices. Last Tuesday alone, the Nymex February futures contract soared 22 cents to $3.44, the highest settlement since Dec. 30, 2016.

“While these forecasts are still low in confidence being so far out, the market is admittedly gun shy as it continues to absorb and recover from the effects of the extreme cold that hit the nation earlier in January,” Mobius Risk Group analysts said Tuesday. “Furthermore, a cold February this year would compare to an extremely warm February last year (warmest on record in fact), and thus would expand that year-on-year storage deficit even wider. That was undoubtedly a big concern for market bears today.”

Interestingly, Thursday’s storage report from the U.S. Energy Information Administration (EIA) appeared to justify those concerns as it reported a 288 Bcf withdrawal from inventories for the week ending Jan. 19. The draw ties for the second largest draw going back to 2010. That negative 288 Bcf number had stood as the largest on record until earlier this month, when the EIA reported a whopping 359 Bcf pull for the week ending Jan. 5.

Last year, 137 Bcf was withdrawn, and the five-year average is a withdrawal of 164 Bcf. Inventories are now at 2,296 Bcf, 519 Bcf less than last year at this time and 486 Bcf below the five-year average of 2,782 Bcf.

Despite the widening of the storage deficit, Nymex February futures ended Thursday down 6.2 cents to $3.447 after trading as high as $3.581 and as low as $3.398. March, meanwhile, settled 1.9 cents higher at $3.099.

Mobius analyst Zane Curry said Thursday’s weakness in February pricing was not reflective of underlying fundamentals, but rather suggested that speculative traders were rolling long positions from February to March.

“Speculative traders typically do not carry positions to expiry and when holding a markedly bullish view, they will sell back their long positions in the nearby contract, and simultaneously buy the following month,” Curry said.

In early Thursday morning trading, the February/March traded as wide as plus-43 cents, but by late morning, position rolling had pulled the spread in to plus-30 cents before an eventual daily close of plus-35 cents.

In absolute terms, Nymex February futures peaked intraday at $3.581, bottomed at $3.398 and eventually closed at $3.447. March futures peaked at $3.169, bottomed at $3.045 and closed at $3.099. The rest of the curve posted modest gains of no more than a couple of pennies, and even the balance of 2018 (February-December) managed to post 1-cent gain to $3.005, the first daily close above $3.00 since Nov. 29.

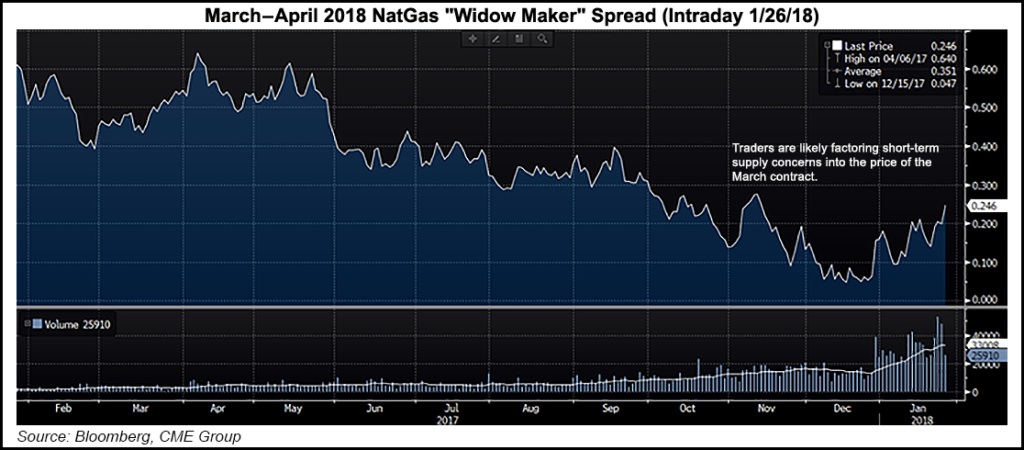

As the Nymex February futures contract rolls off the board Monday, the market is becoming increasingly focused on March, and volatility can be expected if weather continues to flip flop.

March has seen some “good appreciation” over the last couple of days, according to Societe Generale (SocGen), and is trading in line with its view for where it should over the next month. The market is clearly engaged, and “a lot of the money that had exited the market at the end of 2017 has crept back in, which means volatility can continue to be high as long as weather gives market something to care about” the investment bank said.

Indeed, the Nymex March contract could stage a rally of its own if the cold snaps on tap for February play out colder than what current weather forecasts show. Weather data overnight Thursday held colder trends with a weather system into the eastern United States for the last week of January, and with the first arctic blast arriving Thursday (Feb. 1) and lasting through the weekend, NatGasWeather said.

The data continues to look less impressive after Feb. 5, however, as a milder break follows the first Arctic blast. A second arctic blast, however, could push into the Plains and Midwest Feb. 6-9 and is a touch colder in some of the data over the northern U.S., but still fails to advance very far into the South or East as high pressure effectively blocks it, the forecaster said.

“It’s important to note the models are struggling exactly where the sharp arctic front will ultimately set up with this second shot, where just a slight shift south or east, and the data will again look ominous. But until it does, the markets could be disappointed the second week of February isn’t looking quite as cold as it once did,” NatGasWeather said.

If the cold extends further into February, then demand strength will force even stronger storage withdrawals and the potential for new freeze-offs emerges as well, SocGen said. Of course, mild temperatures would bring about more bearish supply/demand balances and could push end-of-March storage higher.

“From a storage optics perspective, we see the first half of the year as most exposed to tightening,” SocGen natural gas analyst Breanne Dougherty said. “As production growth continues through 2018, the market should get brought back to equilibrium and allow for even a shift back into a period of structural oversupply, under a normal weather scenario.”

Meanwhile, a look further out the Nymex futures strip shows smaller increases beyond the front of the curve. Even as the Nymex February futures contract gained 26 cents from Jan. 19-25 to settle at $3.447 and the March contract jumped 16 cents to $3.102, the summer strip (April-October) edged up just 9 cents to $2.92, while winter 2017-2018 rose just 7 cents to $3.09.

“Spring shoulder months are vulnerable because they are a soft demand period, which can allow for a production growth trend to take control of sentiment and create price weakness,” Dougherty said.

Mobius’ Curry said the market appears to be already thinking this way given where the summer strip is pricing. “I don’t think anyone is asking yet what the overall supply/demand balance is looking like and what that implies for October storage. They’re just looking at production. And summer 2018 looks fairly priced if I’m solely considering that.”

Meanwhile, core summer contracts (August) benefit from weather-related cooling load surges, which drives up power generation and creates volatility. Between 2012 and 2017, the August contract never expired below $2.67/MMBtu, a level the market was not far from only a couple of weeks ago, Dougherty said.

While production growth is a near certainty in 2018, the pace has to be consistent over the next nine months to prove that it will more than offset the non-weather related demand growth ahead (increased exports and industrial expansion) and “allow for storage to get back to a level at the end of October that keeps the market comfortable before headed into winter 2018-2019,” Dougherty said. SocGen favors a storage level in the 2.7-2.9 Tcf range.

Midwest, Northeast Markets Return With A Vengeance

One week after posting the sharpest declines in the country, Midwest and Northeast forwards markets came roaring back between Jan. 19 and 25. The dramatic turnaround, which saw February prices climb more than $1.00 in the Midwest and more than $2.00 in parts of the Northeast, came amid the chilly outlooks for February, which were once again confirmed in Friday’s midday weather data.

Most notable were points along the Transco pipeline, which has frequently issued operational flow orders (OFO) on its system during times of high demand, including during the past week. In fact, another OFO was issued Jan. 26 and was to be in effect during the weekend for Transco’s market zones 4, 5 and 6 even as temperatures were forecast to turn milder, albeit for a brief period.

As such, Transco zone 5 South February forward prices rose $2.26 from Jan. 19-25 to reach $9.443, according to Forward Look. March forwards were up an impressive 43 cents to $4.318, while summer 2018 slipped a penny to $2.87. The winter 2018-2019 climbed 8 cents to $4.40.

Transco zone 6 non-New York followed a similar trajectory, with February forward prices climbing $2.26 to 9.447, March edging up 43 cents to $4.224, the summer 2018 slipping 1 cent to $2.56 and the winter 2018-2019 climbing 8 cents to $4.26.

At Transco zone 6-New York, February was up $2.31 to 10.874, March was up 45 cents to $4.633, summer 2018 was up 2 cents to $2.55 and the winter 2018-2019 was up 12 cents to $4.96.

Despite being included in the OFO notice, Transco zone 4 prices put up much smaller gains during the period, although more substantial increases were seen in the summer months. February climbed 28 cents to $3.53, March rose 17 cents to $3.139, summer jumped 10 cents to $2.89 and the winter 2018-2019 tacked on 8 cents to hit $3.06, Forward Look shows.

To the north, New England prices put up solid gains of their own. Algonquin Gas Transmission City-gates February forward prices jumped $1.88 from Jan. 19-25 to reach $12.923, while March shot up 71 cents to $7.264. Summer 2018 was up just 7 cents to $2.87, while winter 2018-2019 rose a dime to $7.40.

Points along Iroquois Gas Transmission also posted hefty increases as conditions remained strained. Iroquois issued a critical capacity notice on Friday, Jan. 26, that was to be in effect for Saturday. The prompt month at Iroquois zone 2 soared by more than $2.00 from Jan. 19-25 to reach $10.947, while Iroquois Waddington February prices were up more than $1.00 to $6.767.

New England is typically a constrained market during the high demand winter season, and this winter has prompted increased liquefied natural gas (LNG) cargo traffic throughout North America’s regasification facilities, data and analytics company Genscape Inc. said.

LNG-loaded vessels recently made deliveries to New Brunswick’s Canaport terminal in St. John, and to the Elba terminal near Savannah, GA, facilities that do not regularly receive cargoes, the Genscape said. Storage volumes were depleted at these regasification terminals during the demand surge that followed frigid temperatures across the East Coast.

On Jan. 14, the Gallina vessel delivered 2.87 Bcf to Elba, which received its last delivery in November. Canaport imported two cargoes aboard the Gaslog Skagen and Meridian Spirit that added a total of 7.15 Bcf to its supplies. The Everett LNG receiving terminal in Massachusetts has also been importing more than usual, bringing in two cargoes within one week, and sending out up to 23.31 MMcf/d during peak demand.

“This facility, along with Canaport further upstream, supplied critical supplemental volumes to the constrained New England market, which experienced record high gas prices and a heating oil shortage during the freeze,” Genscape said.

Meanwhile, Midwest markets also saw a swift climb ahead of more cold weather. At Northern Border Ventura, February forward prices rose $1.30 from Jan. 19-25 to reach $4.868, while March climbed 38 cents to $3.115. The rest of the curve moved less than a dime.

Similar prices were seen at Northern Natural Ventura, while Chicago City-gates put up solid increases as well. Chicago CG February jumped 77 cents during that time to $4.186, while March shot up 29 cents to $3.195. Summer 2018 was up 11 cents to $2.63 and the winter 2018-2019 was up 7 cents to $2.99, according to Forward Look.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 |