Mexico | NGI The Weekly Gas Market Report

Mexico’s 10th Bidding Round to Prominently Feature Natural Gas

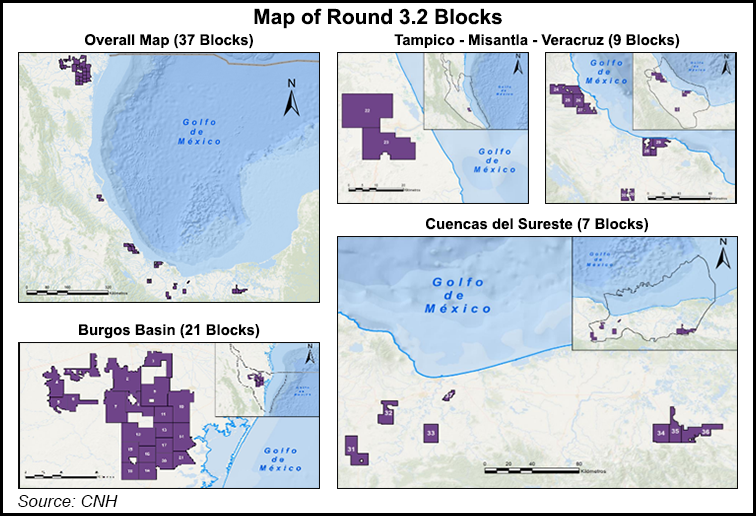

The Mexican government plans to offer 37 blocks of mostly natural gas-rich prospects in the country’s 10th auction of exploration and production (E&P) contracts, scheduled for late July.

The upstream regulator, the Comision Nacional de Hidrocarburos (CNH), on Wednesday approved the list of conventional onshore blocks proposed by the Energy Ministry (Sener) for inclusion in Round 3.2.

“This call will favor exploration activities that increase certainty about the hydrocarbons potential of Mexican subsoil in areas that contain oil and non-associated gas,” according to the ministry.

The blocks span 9,513 square kilometers (3,673 square miles), or 1.5-times the total surface area of the blocks awarded in the three previous onshore tenders. The areas are spread across four different basins, but the majority are in the Burgos Basin, Mexico’s largest producer of non-associated natural gas.

The areas on offer are estimated to hold 260 million boe in prospective resources. They also include 16 previously discovered reservoirs, mostly in the Burgos, with 219 million boe in undeveloped reserves, according to Sener’s Aldo Flores Quiroga, the undersecretary for hydrocarbons.

100-Plus Blocks On Offer

Round 3.2 is one of three auctions scheduled to date for this year, with more than 100 blocks on offer over the coming months. It would also be the first auction to be held after Mexico’s presidential election on July 1. Andres Manuel Lopez Obrador, a critic of the energy reforms who has pledged to review the oil contracts awarded so far by the government, currently leads the polls.

Flores and other senior Mexican energy officials who spoke at the Round 3.2 launch ceremony on Wednesday defended the reforms and emphasized the need for continuity. They also highlighted the proximity of the Round 3.2 blocks to existing oil and gas industry infrastructure initially built by state-owned Petroleos Mexicanos (Pemex).

“The contractual areas have access to production, transport and storage facilities developed years ago by Pemex, as well as to port and highway infrastructure,” Energy Minister Pedro Joaquin Coldwell said. “All this will help strengthen the development of new oil and gas activity in these areas. Likewise, the expansion of the national system of natural gas pipelines triggered by the energy reforms is opening up new markets for these fields, making them more attractive and economically feasible.”

The 21 blocks in Burgos, spanning Nuevo Leon and Tamaulipas states in northeast Mexico, contain mostly wet gas prospects, according to CNH. They are near five pipeline import points along the U.S. border, the Burgos gas processing plant, and several large domestic pipelines, including the 2.1 Bcf/dLos Ramones system. The 621-mile pipeline runs from South Texas to central Mexico.

The challenge for operators in the area would be to find ways to make Burgos gas competitive with U.S. imports, especially when gas prices in the United States are low, according to GMEC’s Gonzalo Monroy, managing director of the Mexico City-based consultancy.

“A lot of the acreage that they’re putting up for tender is in blocks that have strong potential” for gas production, Monroy told NGI. “The problem is that they have low condensate levels” compared to natural gas plays in the United States, making the economics less attractive for producers.

On the other hand, “there are concerns at various levels within Mexican government” about the outcome of the North American Free Trade Agreement negotiations, he said. “Perhaps some kind of tariff or border tax is imposed on the gas that we are importing, which further increases the cost. So an energy policy decision would be to improve, or in this case incentivize, the production of natural gas in Mexico.”

Smaller Blocks Offered In Burgos

Another factor is the type of operator that Round 3.2 draws to Burgos. Smaller blocks are more likely to attract “niche” companies that may be able to produce gas quickly and economically, whereas larger blocks would appeal to operators focused more on exploring and adding new reserves, according to Monroy.

For Round 3.2, “the average block size in Burgos is a touch more than 277 square kilometers,” he said. “This is smaller relative to previous tenders” in Burgos. While the new round does include some larger blocks, “there’s clearly a bias toward smaller areas.”

Farther south in Veracruz state, the Round 3.2 slate includes nine blocks of mostly dry gas prospects in the Tampico-Misantla and Veracruz basins. The remaining seven blocks contain light and super-light oil plays and are in the Sureste Basin, straddling Veracruz and Tabasco states.

One of the Sureste blocks was previously awarded in Round 1.3 to a consortium led by Canamex Energy Holdings. Last year, Canamex agreed to pay a $1.9 million fine to terminate its contract for the Moloacan block, which it said was economically unfeasible because of the consortium’s overly aggressive bid in the 2015 auction. The block’s inclusion in the upcoming auction depends on whether terminating Canamex’s contract is finalized on time, according to CNH officials.

Data Room Opens In February

The Mexican government plans to award the Round 3.2 contracts on July 25. The data room is scheduled to be open from Feb. 9 to May 9, while the prequalification sign-up period would run from May 21 to June 29.

The blocks are to be auctioned as license contracts, in which owners pay a royalty fee to the government in exchange for exploration and production rights. Bidders would offer additional royalties on top of the base fee set by the government, and may also commit to drilling up to two exploration wells and offer a cash bonus.

The contracts would run for 30 years with two optional five-year extensions.

Last year, at the jointly held rounds 2.2 and 2.3, Mexico awarded 24 conventional onshore blocks, which also included gas-rich areas in Burgos and Tampico-Misantla. Mexico City-based Jaguar E&P, in partnership with Calgary-based Sun God, aggressively bid to win 11 of the blocks awarded.

“Those two big winners made offers that were well above the market value. These bids were a big surprise to everyone,” Monroy said.

“I still can’t rule out another scenario like that one. It’s very possible that something similar occurs” in Round 3.2, he said. “But this is where we’d expect to see some of the lessons learned in those previous auctions, both by the industry and by the authorities.”

Round 3.2 would be the second in Mexico’s third cycle of auctions, which kicks off March 27 with Round 3.1. That auction is to offer 35 shallow water blocks across four basins on the Mexican Gulf Coast, with a combined 1.988 billion boe of risk-adjusted resources.

As of Jan. 19, 32 companies had expressed interest in the auction, with 18 signing up to prequalify, according to CNH. The registration period was scheduled to close on Friday (Jan. 26).

CNH in the next week is to receive bids forRound 2.4, Mexico’s second deepwater auction, with 29 blocks on offer across three Gulf of Mexico basins — Perdido Fold, Salinas and Cordilleras Mexicanas.

The auction is shaping up to be one of the most competitive yet. The list of the 29 companies prequalified to bid is a who’s who of the international oil industry, including U.S.-based majors ExxonMobil Corp. and Chevron Corp., as well as independents that include Hess Corp., Murphy Oil Corp. and Noble Energy Inc. Of the 29 potential bidders, 16 companies registered as operators, while the remaining 13 are to participate as nonoperating partners.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 1532-1266 |