Markets | NGI All News Access | NGI Data

Big EIA Storage Draw Can’t Stop Prompt-Month Pullback; NatGas Spot Prices Weaken

The Energy Information Administration (EIA) reported a mammoth natural gas storage withdrawal that surprised to the bullish side of expectations, but that couldn’t stop prompt-month futures from sliding Thursday after they had rallied to one-year highs earlier in the week.

Prices weakened in the spot market as well, especially in the Northeast, where some chilly temperatures Thursday were expected to moderate heading into the weekend. The NGI National Spot Gas Average gave up 32 cents to $3.49/MMBtu.

The February contract settled 6.2 cents lower at $3.447 Thursday after trading as high as $3.581 and as low as $3.398. March, meanwhile, settled 1.9 cents higher at $3.099.

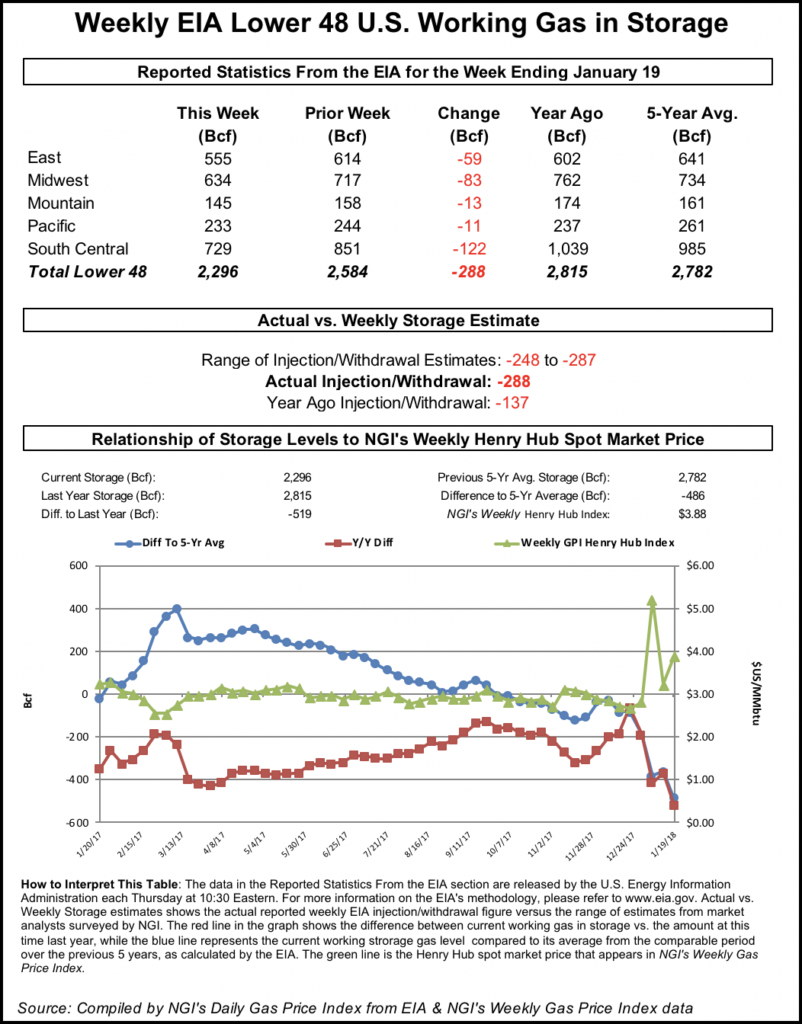

EIA reported a 288 Bcf withdrawal from U.S. gas stocks for the week ending Jan. 19, a bigger pull than the market had been expecting. Last year, 137 Bcf was withdrawn, and the five-year average is a withdrawal of 164 Bcf.

This week’s reported withdrawal is tied for the second largest on record going back to at least 2010, matching the 288 Bcf withdrawal reported Jan. 10, 2014. That -288 Bcf number had stood as the largest on record until earlier this month, when EIA reported a whopping 359 Bcf pull for the week ending Jan. 5.

When EIA published the final figure at 10:30 a.m. EDT, the February contract briefly climbed above $3.50 after selling off to around $3.420 a few minutes before. By 11 a.m. EDT, February was trading around $3.460, down about a nickel from Wednesday’s settle. Shortly after 11 a.m. EDT, the March contract was trading about 5 cents higher at around $3.130.

Prior to the release of the final number, a Reuters survey of traders and analysts had showed estimates for a 272 Bcf withdrawal on average for the week ending Jan. 19. Intercontinental Exchange futures had been trading at -280 Bcf for the period as of Wednesday.

Stephen Smith Energy Associates had called for a 268 Bcf pull for the week. PointLogic Energy had estimated a withdrawal of 272 Bcf, while Kyle Cooper of ION Energy had been looking for a pull of 271 Bcf.

Bespoke Weather Services said it viewed the 288 Bcf withdrawal as “extraordinarily tight overall,” noting that it exceeded its estimate by 29 Bcf.

“We caution that next week’s print should be far looser, with production loosening and weather turning warmer exactly when” the current report period “ended, which is tempering the impact of the print a bit,” Bespoke said.

Total working gas in underground storage stood at 2,296 Bcf as of Jan. 19, according to EIA. That’s versus 2,815 Bcf a year ago and five-year average inventories of 2,782 Bcf.

The year-on-year deficit increased week/week from -368 Bcf to -519 Bcf, while the year-on-five-year deficit widened from -362 Bcf to -486 Bcf, EIA data show.

By region, the largest withdrawal came in the South Central, which finished at -122 Bcf for the period, including 55 Bcf withdrawn from salt and 68 Bcf pulled from nonsalt. The Midwest saw a weekly withdrawal of 83 Bcf, while 59 Bcf was withdrawn in the East. The Mountain and Pacific regions saw withdrawals of 13 Bcf and 11 Bcf, respectively.

Price Futures Group’s senior market analyst Phil Flynn said the rally this week appeared to be a short squeeze, with traders “starting to realize this draw was going to be bigger than anticipated.

“But I think that played out,” Flynn told NGI Thursday. “The number came out a little bit bullish, as the whisper number did, and then we pulled back. We’re going to see a less spectacular draw” in next week’s report, likely leading to some profit-taking this week.

As for the current storage deficits, the market appears to be thinking “that would be a problem if the production weren’t so high. I think people are looking beyond this report,” maybe having doubts about the forecasts for cold to return in February, Flynn said.

The lean EIA storage numbers helped support prices, but Thursday “afternoon guidance decreased cold risk in the first week of February modestly to pull prices lower into the settle,” Bespoke said after the close. “As expected, the February contract led the way lower, while the March contract exhibited far more strength, though it came off a bit in the settle.

“With less cold risk the February contract should continue to lag more into the weekend, especially if the mid-February cold pattern we expect does not become apparent on modeling guidance by Friday afternoon,” the firm said.

Meanwhile, the supply growth over the past year shows no signs of slowing down. After recently topping 77 Bcf/d, Lower 48 dry gas production could reach the 80 Bcf/d mark by October, according to PointLogic Energy.

“There are a fair amount of traps that could open to discourage this type of growth, but considering the trajectory of production over the past six months, it is ultimately achievable,” PointLogic Vice President Jack Weixel told clients Thursday. “…Lower 48 dry production has grown by 6.5 Bcf/d over the past 12 months and 4.3 Bcf/d over the past six months. This is a growth rate of 9.2% and 5.9% respectively, with the lion’s share of the growth occurring since the end of July.”

PointLogic is projecting another 3.2 Bcf/d of growth (4.1%) over the next nine months, “which is actually considerably slower than the growth seen over the last six months,” Weixel said.

While the Haynesville Shale and Permian Basin are expected to make strong contributions, 2.3 Bcf/d of the projected growth over the next nine months is expected to come from the Northeast, according to Weixel. However, growth would be “dependent on increased utilization of new and recently completed pipeline projects that will be coming online over the course of the spring and summer.”

One of the biggest Northeast pipeline expansions currently under development, the 3.25 Bcf/dRover Pipeline, encountered a setback this week when the Federal Energy Regulatory Commission put on hold a horizontal directional drill (HDD) under the Tuscarawas River in Ohio because of environmental concerns and problematic geology.

Genscape Inc. told clients Thursday that the problems at the Tuscarawas HDD could delay Rover’s Phase 2, which would bring the pipeline to its full 3.25 Bcf/d capacity. It is scheduled for completion by the end of March.

“The Tuscarawas HDD is a particularly problematic drill as it is lengthy (in footage and time needed to drill) and located near sensitive resources,” Genscape said. “In addition, it has attracted extra scrutiny from regulators as the first crossing caused a large” inadvertent return last year.

“Any significant delays in obtaining permission to resume drilling will generate an associated delay for Rover’s Phase 2 in-service date,” the firm said.

In the spot market, Northeast and New England prices moderated Thursday as forecasters expected temperatures in the region to rise. AccuWeather was calling for temperatures in the teens and 20s in Boston Thursday to get into the 40s and 50s by Saturday. New York was expected to see highs in the upper 30s Friday and highs in the 50s over the weekend.

According to Genscape, demand in the New England region reached 4 Bcf/d Thursday, but the total to fall to 3.46 Bcf/d Friday and to around 2.5 Bcf/d by the weekend.

Algonquin Citygate fell $5.21 to average $9.77, helping drive a $2.17 day/day drop in the Northeast Regional Average. Transco Zone 6 New York gave up $1.46 to $3.66.

In the Appalachia region — including New York and New Jersey — Genscape projected demand to fall from 16.47 Bcf/d Thursday to 14.78 Bcf/d Friday and 11.40 Bcf/d by Saturday.

Tetco M3 Delivery fell $1.21 to average $3.30 Thursday, while Dominion South fell 5 cents to $2.73.

Prices in the Midwest and Midcontinent also weakened Thursday, trading at a wider negative basis to Henry Hub, which traded near even. Chicago Citygate fell 15 cents to $3.12, a 45 discount to the Hub.

AccuWeather was forecasting highs in the 50s and lows in the upper 30s in Chicago Friday, while Genscape projected demand in the Midwest to fall to just above 13 Bcf/d Friday, down from 15.64 Bcf/d earlier in the week.

Analysts at Tudor, Pickering, Holt & Co. (TPH) noted Wednesday that spot price gains in the Midwest this week failed to keep pace with gains at Henry Hub.

For fiscal 2018, forwards prices at the export constrained AECO hub were sitting at $1.74 negative basis, “with Dawn and Chicago trading at average discounts of 10 cents and 28 cents relative to Henry Hub,” the TPH analysts noted. “Pricing dynamics appear to be sending a message that we need to move more gas from the northern producing regions to the demand centers at the Gulf Coast, supporting our concern around Midwest basis risk in 2018 and 2019.”

Dawn gave up 11 cents Thursday to trade at $3.34, while NOVA/AECO C was even at C$2.17/GJ.

Meanwhile, the prospect for a return of bone-chilling Arctic temperatures in the Lower 48 has lifted prompt-month forwards at a number of points this week.

Tetco M3 February fixed prices have jumped more than $2 since Jan. 19 to settle Wednesday at $8.537, according to NGI‘s Forward Look. Transco Zone 6-New York February forwards have similarly rocketed $2.32 to $10.886. Transco Zone 5 South has also seen a surge in February prices, up $2.43 from last Friday (Jan. 19) to $9.605.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |