Markets | NGI All News Access | NGI Data

EIA’s 288 Bcf Withdrawal Beats Expectations; Natural Gas Futures Lose Ground

The Energy Information Administration (EIA) reported a mammoth storage withdrawal Thursday that surprised to the bullish side of expectations, but prompt-month futures lost ground after rallying earlier in the week.

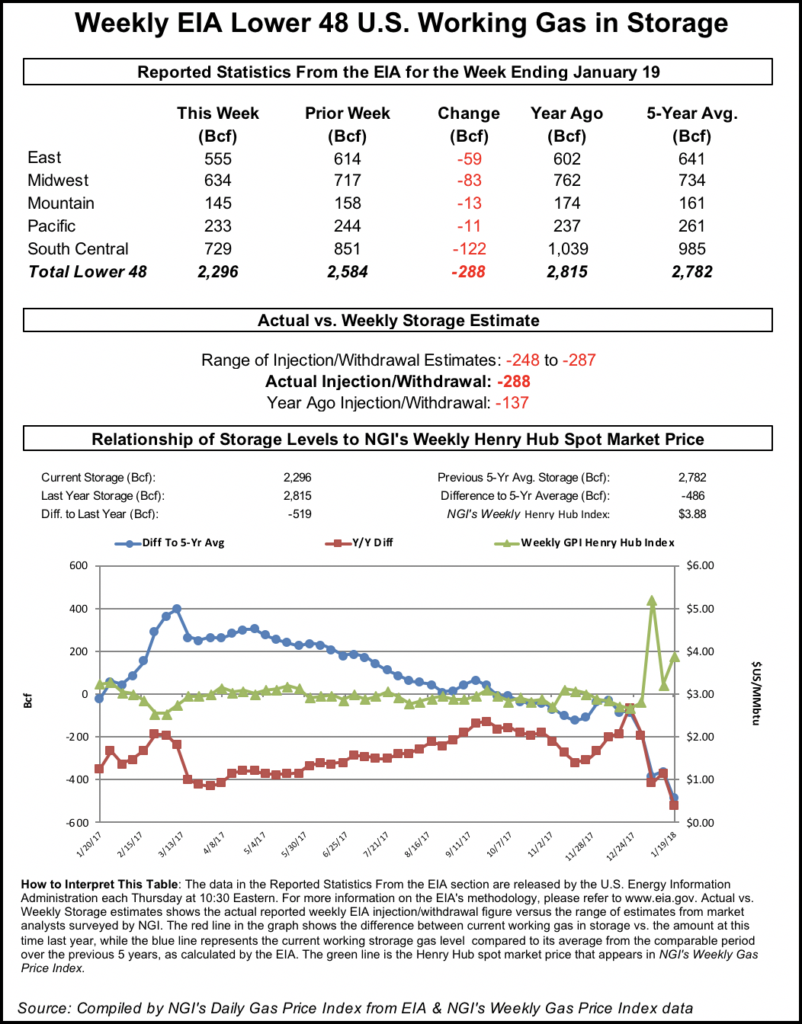

EIA reported a 288 Bcf withdrawal for the week ending Jan. 19, a bigger pull than what the market had been expecting. Last year, 137 Bcf was withdrawn, and the five-year average is a withdrawal of 164 Bcf.

This week’s reported withdrawal is tied for the second largest on record going back to at least 2010, matching the 288 Bcf withdrawal reported Jan. 10, 2014. That -288 Bcf number had stood as the largest on record until earlier this month, when EIA reported a whopping 359 Bcf pull for the week ending Jan. 5.

When EIA published the final figure at 10:30 a.m. EDT, the February contract briefly climbed above $3.50 after selling off to around $3.420 a few minutes before. By 11 a.m. EDT, February was trading around $3.460, down about a nickel from Wednesday’s settle. Shortly after 11 a.m. EDT, the March contract was trading about 5 cents higher at around $3.130.

Prior to the release of the final number, a Reuters survey of traders and analysts had showed estimates for a 272 Bcf withdrawal on average for the week ending Jan. 19. Intercontinental Exchange futures had been trading at -280 Bcf for the period as of Wednesday.

Stephen Smith Energy Associates had called for a 268 Bcf pull for the week. PointLogic Energy had estimated a withdrawal of 272 Bcf, while Kyle Cooper of ION Energy had been looking for a pull of 271 Bcf.

Bespoke Weather Services said it views the 288 Bcf withdrawal as “extraordinarily tight overall,” noting that it exceeded its estimate by 29 Bcf.

“We caution that next week’s print should be far looser, with production loosening and weather turning warmer exactly when” the current report period “ended, which is tempering the impact of the print a bit,” Bespoke said. “Still, this seems to confirm the upside we see for the March natural gas contract on any colder weather in the middle of February, and keeps our bullish sentiment intact for the contract.

“We continue to expect far more support for the March over February contract, as is occurring.”

Total working gas in underground storage stood at 2,296 Bcf as of Jan. 19, according to EIA. That’s versus 2,815 Bcf a year ago and five-year average inventories of 2,782 Bcf.

The year-on-year deficit increased week/week from -368 Bcf to -519 Bcf, while the year-on-five-year deficit widened from -362 Bcf to -486 Bcf, EIA data show.

By region, the largest withdrawal came in the South Central, which finished at -122 Bcf for the period, including 55 Bcf withdrawn from salt and 68 Bcf pulled from nonsalt. The Midwest saw a weekly withdrawal of 83 Bcf, while 59 Bcf was withdrawn in the East. The Mountain and Pacific regions saw withdrawals of 13 Bcf and 11 Bcf, respectively.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |