NatGas Futures Still Bullish Ahead of Expected Mammoth Storage Draw; Northeast Leads Cash Gains

Natural gas futures continued their run higher Wednesday, supported by predictions for another very large storage withdrawal and by forecasts showing Arctic cold poised to return early next month. Spot prices generally strengthened with the futures, while the constrained Northeast saw another day of weather-driven spikes. The NGI National Spot Gas Average added 29 cents to finish at $3.81/MMBtu.

The February contract settled at $3.509 Wednesday, 6.5 cents higher. But the spot month had its ups and downs, trading as high as $3.624 and as low as $3.461. By around 4 p.m. EDT, February was trading back around $3.440, near even with the prior day’s settle.

The March contract continued to lag the front month Wednesday, settling 4.1 cents higher at $3.080.

Looking ahead to February, Bespoke Weather Services noted warmer changes to the American Global Forecast System (GFS) guidance Wednesday.

“Afternoon European guidance Wednesday confirmed these warmer trends, sending prices lower instead of higher,” Bespoke said. “Generally, these model trends fit with expectations…we do agree with recent European guidance that cold through the first week of February may not be particularly intense.

“…It is cold later on in February through the middle of the month that has our attention, and we feel over the coming week model guidance will pick up more on this,” the firm said. “Once it does it should quickly rally the March contract, yet until that long-range cold signal strengthens again we could see the front of the natural gas strip pull back a bit more, especially given how wide the February/March spread continues to be.”

NatGasWeather.com told clients Wednesday that “the data still advertises the first Arctic front pushing into the central U.S. Feb. 1-2, then spreading into the East Feb. 3-4. However, like the GFS model, the European model is locking onto a more pronounced break around Feb. 4-5, and thus a little milder to lose some demand.

“A second Arctic blast is still expected into the northern U.S. Feb. 6-9, but not quite as deep into the U.S. as it showed Tuesday night, thus trending slightly milder with it, like the GFS model also did midday with this period,” the firm said.

As the market looked ahead to potentially elevated heating demand next month, Thursday’s Energy Information Administration (EIA) storage report was shaping up to deliver another large withdrawal, according to estimates.

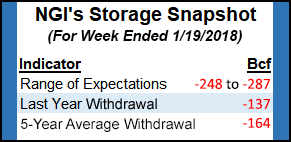

A Reuters survey of traders and analysts showed a 272 Bcf withdrawal on average for the week ending Jan. 19. That’s versus a year-ago pull of 137 Bcf and a five-year average withdrawal of 164 Bcf.

Intercontinental Exchange futures were trading at -275 Bcf for the period as of Tuesday.

Stephen Smith Energy Associates, in its latest Weekly Gas Outlook, was calling for a 268 Bcf pull for the week ending Jan. 19, versus a seasonally normal withdrawal of 174 Bcf based on 2006-2010 norms.

PointLogic Energy estimated a withdrawal of 272 Bcf for the period, citing an uptick in demand in the South Central region for the week. Meanwhile, Kyle Cooper of ION Energy was looking for a pull of 271 Bcf.

This week, Dominion Energy Transmission Inc. and Columbia Gas Transmission LLC both reported storage inventories sharply below comparable levels during the previous two winters.

Columbia reported 138 Bcf in storage as of Jan. 19, versus 160 Bcf in 2017 and 167 Bcf in 2016. Columbia reported 157 Bcf in storage for the week ended Jan. 12.

Dominion reported 164 Bcf in storage through the Jan. 18 gas day, versus 172 Bcf in 2017 and 206 Bcf in 2016. Last week, Dominion reported inventories totaling 184 Bcf for the period ended Jan. 11.

Analysts with Tudor, Pickering, Holt & Co. (TPH) said Wednesday that the “fundamentals have finally shifted in favor” of natural gas “this winter, but the forward curve for the remainder of 2018 held relatively flat” during the prompt month’s recent run higher, “only pushing up 2%.

“After last week, inventories are tracking around 360 Bcf below five-year norms, with Thursday’s print likely to prove an even further storage drain” based on market expectations for “another massive draw,” the TPH analysts said.

Despite some warmer temperatures over the next couple weeks, prices should remain strong “regardless of short-term weather events given depleted inventory levels and continued winter demand potential into February,” according to the analysts.

“Though early, demand projections show storage exiting the winter season well below norms, which should continue to prop up pricing into the spring. However, we still see a supply ramp offsetting those gains, as we’ve seen no material change to supply/demand drivers this year outside of weather.”

Powerhouse Vice President David Thompson said this winter’s storage picture has been bullish, but “even though we’re below the averages, it’s not the case that we’ve changed the landscape of the supply/demand relationship” given production growth.

“I think the market is simply reacting in advance of expectations for another very large number three weeks down the road,” he told NGI.

Meanwhile, the spot market continued its own run higher Wednesday, led by a second day of big gains in the Northeast.

Algonquin Citygate added $2.93 to average $14.98, while Transco Zone 6 New York jumped $1.41 to $5.12.

AccuWeather was calling for temperatures in New York to drop into the 20s overnight Wednesday, with lows in the 20s and 30s forecast for Thursday and Friday. Lows were expected to drop into the teens in Boston Thursday.

Genscape Inc. calculated New England demand at 3.89 Bcf/d Wednesday, with the firm forecasting regional demand to total 3.78 Bcf/d Thursday before falling to around 2.5 Bcf/d over the weekend.

Demand in the Appalachian region — including New York and New Jersey — increased from around 13 Bcf/d earlier this week to just over 16 Bcf/d Wednesday, according to Genscape. Regional demand was expected to climb to 17.61 Bcf/d Thursday.

Other East Coast points prone to weather-driven spikes this winter also posted healthy gains in Wednesday’s trading.

In Appalachia, Tetco M3 Delivery jumped $1.01 to average $4.51 Wednesday. In the Southeast, Transco Zone 5 tacked on 98 cents to $4.63.

Genscape reported demand in the Southeast and Mid-Atlantic region totaling 17.51 Bcf/d Wednesday, with demand expected to climb to 17.78 Bcf/d Thursday after coming in just under 16 Bcf/d earlier in the week.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |