E&P | NGI All News Access | NGI The Weekly Gas Market Report

BHGE Sees Rising Demand for North American OFS, Equipment

Baker Hughes Inc., a GE company, made its debut on the global oilfield services (OFS) stage last summer as the energy market began its slow recovery, a trend that should continue in 2018, the management team said Wednesday.

The merged Baker Hughes Inc. and General Electric oil and gas unit has made “strong progress on our integration efforts and aligning our team to the priorities of growing market share, improving margins and generating more cash,” said CEO Lorenzo Simonelli, who helmed the fourth quarter conference call Wednesday.

“We secured important customer wins in a market environment that continues to be uncertain…” During the final three months of 2017, BHGE delivered “growth in our shorter-cycle businesses and declines in our longer-cycle businesses.” All of the North America product lines grew, even though the U.S. rig count had declined from the third quarter.

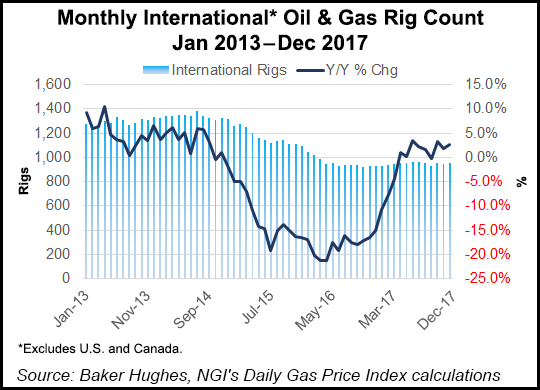

“Overall, we continue to see improvement in activity as early indications of customer capital spending in 2018 are encouraging, particularly for our shorter-cycle businesses,” the CEO said. “International activity is stabilizing, and we are seeing signs of activity increase, both in the volume and size of tenders for new work, as customers feel more confident about their operating costs and commodity price stability.”

The CEO spent a few minutes addressing the “elephant in the room,” as one analyst put it, regarding 60% owner GE, which has launched a strategic review of the combination. GE last fall acknowledged that it is “evaluating exit options for its stake in our company,” Simonelli said.

Even if GE wants to pull out, it has a contractual two-year lock up in place.

“What I can assure you is that I run a strong independent company with a focus on executing our strategy for the benefit of our customers and all of our shareholders,” Simonelli said. “The synergies remain on track…for 2018 and the majority of the value creation is within our control and we feel very good about that. So the independence from a GE perspective to achieve those is minimal.”

Going forward, this year looks positive across the board for BHGE, “as early indications of customer capital spending are encouraging, particularly for our short-cycle businesses…The recent strength in commodity prices underscore this year.

“However, we do expect the market for the long-cycle businesses to continue to lag. We expect strength in our oilfield services business, driven by the well construction product line and increased completions activity, as operators work down the drilled but uncompleted wells inventory in North America.”

Said the CEO, “It’s clear that coming out of the most recent downturn, the market and our customers’ expectations have structurally changed…Oil and gas service providers have and will continue to look at ways of improving efficiency and cost for customers, regardless of where the price of oil and gas may move.”

Orders for the quarter totaled almost $5.76 billion, up 1% sequentially but down 2% year/year.

The sequential increase was driven by service orders, up 2%, and partially offset by equipment orders, down 1%.

The total book-to-bill ratio in 4Q2017 was 1.0; equipment book-to-bill ratio was 0.9. Backlog grew in the final three months, ending at $21 billion, an increase of 1% sequentially. Equipment backlog was $5.4 billion, down 6% sequentially. Services backlog was $15.7 billion, up 3% from the third quarter.

BHGE reported an operating loss of $92 million (minus 7 cents/share) in 4Q2017. Adjusted operating income was $303 million (15 cents/share), excluding charges mainly related to restructuring, merger and related costs. Net capital expenditures totaled $152 million in 4Q2017.

North America revenue was $1.09 billion, a 4% sequential increase, on increased volumes across completions, artificial lift and drilling services.

On the technology and operations front, BHGE said its AutoTrak Curve rotary steering system drilled a Permian Basin curve and lateral in only four days, half the time as a standard system, and set numerous 24-hour footage records. The drillbits product line also increased activity in the Permian fueled by the new Dynamus extended-life drillbit.

BHGE also completed the first field installation of IntelliStream with a North American-based customer, and deployment for three more contracts is underway. IntelliStream provides analytic-driven insights to optimize production and reduce nonproductive time.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |