Markets | NGI All News Access | NGI Data

Winter Hits Deep South to Drive Up Weekly NatGas Spot Prices; Futures Mull Lean Storage

A blast of cold temperatures and a rare winter storm in Texas helped lift natural gas spot prices for the week ending Jan. 19, while a lean storage picture helped futures reach an eight-month high. The NGI Weekly Spot Gas Average climbed 45 cents to $4.06/MMBtu.

East Texas saw the biggest cash gains for the week thanks to a storm that dropped snow and ice in southeastern Texas. The unusually wintry conditions along the Gulf Coast coincided with a flurry of pipeline constraints, helping push cash prices above $9 at some regional points.

Katy ended the week $2.38 higher at $5.59, while Houston Ship Channel added $2.53 week/week to average $5.78.

In South Texas, Tres Palacios finished 80 cents higher at $3.91 after trading as high as $7.25. Tennessee Zone 0 South traded as high as $7.50 and ended the week 65 cents higher at $3.68.

The winter storm swept through to the Southeast as well, pushing prices at Transco Zone 4 as high as $5.20. Transco Zone 4 finished 57 cents higher for the week at $3.85.

The Northeast and Mid-Atlantic also saw wintry precipitation, and points there traded at winter premiums until later in the week as temperatures began to moderate. Algonquin Citygate added 41 cents to average $10.04. Transco Zone 6 New York gained 85 cents to $7.65, while Transco Zone 5 added 96 cents on the week to $7.42.

In the futures, the February contract settled at $3.185 Friday, down from $3.200 to close out the week before.

Building on momentum from the prior week’s record-setting 359 Bcf storage withdrawal, February rallied to an intraday high of $3.288 mid-week, the highest a front-month contract had traded since May 23, 2017, when the June 2017 futures contract reached $3.333.

The Energy Information Administration (EIA) reported a natural gas storage withdrawal Thursday that fell short of consensus estimates, and in response, futures sold off sharply.

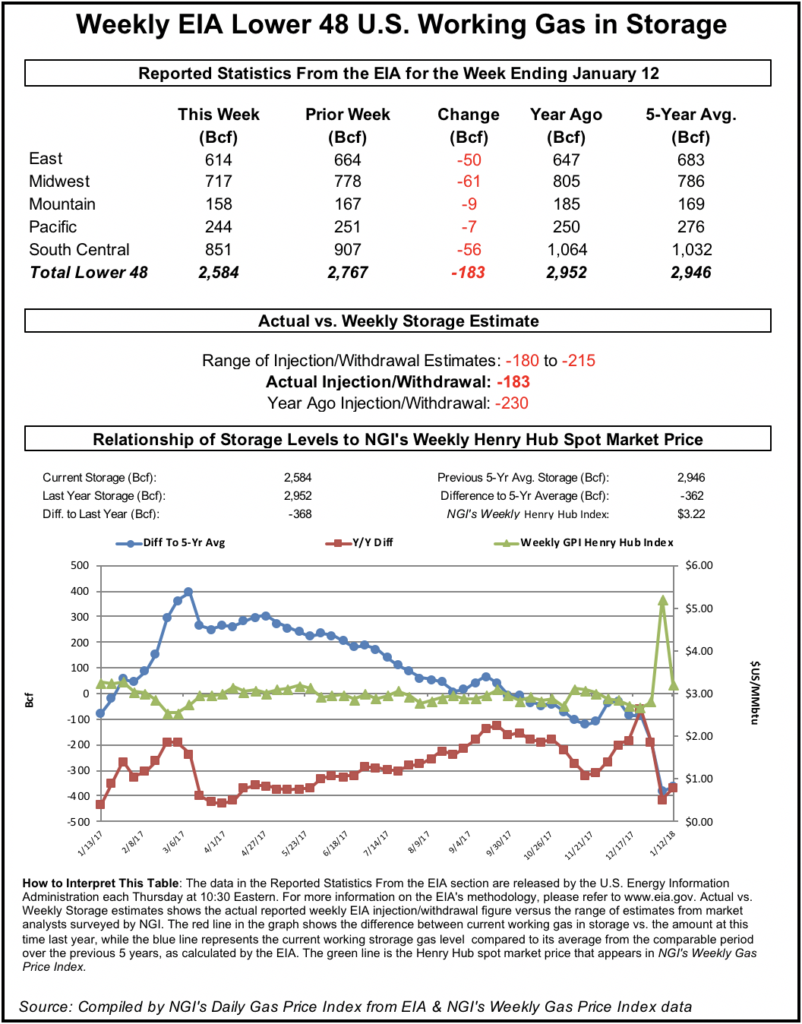

EIA reported a 183 Bcf withdrawal from U.S. gas stocks for the week ending Jan. 12, about 15 Bcf looser than what the market had been expecting. Last year 230 Bcf was withdrawn, and the five-year average for the period is a pull of 203 Bcf.

The February contract fell promptly as the figure reached trading desks at 10:30 a.m. EDT, plunging within minutes from around $3.190 to just under $3.130. By 11 a.m. EDT, February was trading around $3.100, down 13 cents from Wednesday’s settle.

Thursday’s selling came after February rallied to as high as $3.288 on Wednesday, an eight-month intraday high for a spot month contract.

A Reuters survey of traders and analysts this week had showed the market on average expecting EIA to report a 199 Bcf withdrawal. Responses ranged from -180 Bcf to -215 Bcf.

Stephen Smith Energy Associates in its Weekly Gas Outlook had predicted a withdrawal of 196 Bcf, versus a seasonally normal weekly withdrawal of 187 Bcf based on 2006-2010 norms. PointLogic Energy had predicted a 197 Bcf withdrawal, while Kyle Cooper of ION Energy had called for a withdrawal of 193 Bcf.

Last week, EIA reported a record-shattering 359 Bcf withdrawal from U.S. gas stocks for the week ending Jan. 5.

Bespoke Weather Services said that while the final number “came in decently below most analyst expectations…we see it as an implicit revision following a drawdown that likely was a bit exaggerated last week.

“Combine that with production returning from freeze-offs, and the print is clearly not as supportive for the market,” Bespoke said. “This has us tweaking lower drawdown expectations in the coming weeks as concerns about inventory levels may ease a bit. With any further warming to the forecast we could see $2.92 back in play by early next week, as though the print today was quite tight, it clearly underwhelmed.”

Total working gas in underground storage stood at 2,584 Bcf as of Jan. 12, versus 2,952 Bcf in the year-ago period and five-year average stocks of 2,946 Bcf, according to EIA.

The year-on-year storage deficit shrank week/week from -415 Bcf to -368 Bcf, while the year-on-five-year deficit narrowed from -382 Bcf to -362 Bcf, EIA data show.

By region, 61 Bcf was withdrawn in the Midwest for the week, while 50 Bcf was withdrawn from the East, according to EIA. In the South Central, 56 Bcf was withdrawn, including 18 Bcf from salt and 37 Bcf from nonsalt. The Mountain region finished at -9 Bcf for the week, while the Pacific stood at -7 Bcf.

Natural gas futures traded near even Friday as a warm forecast and lean storage picture left the market on the fence. Cash prices sank on expectations for moderate temperatures and lackluster demand over the weekend, and the NGI National Spot Gas Average dropped 25 cents to $3.10/MMBtu.

The February contract settled 0.4 cents lower at $3.185 Friday after trading as high as $3.246 and as low as $3.133. March, meanwhile, fell 4.7 cents to $2.941.

“We head into the weekend with the slightly bearish sentiment that dominated much of the week remaining,” Bespoke Weather Services said in a note to clients Friday. Despite warm trends in the weather outlook and a bearish miss on the week’s storage report, concerns over reduced inventories “remained enough to keep natural gas prices propped up decently through the week.

“The market continues to remain very weather sensitive, with storage levels low enough that any colder weather could quickly spike prices,” but “the risk for any significant cold before the second week of February appears rather minimal,” Bespoke said.

Models were showing signs of a potential colder pattern arriving in the second week of February, according to the firm.

“The market is banking on that cold in February, and it does look like a strong possibility,” Bespoke said. But “there are risks that the cold could be delayed more than some are expecting, allowing prices to pull back. A large gap Sunday evening looks likely, with a bit more risk that it is lower.”

NatGasWeather.com said midday weather guidance Friday “was little changed but could be interpreted as a little colder with a weather system tracking out of the central U.S. and into the East around Jan. 29-30, but milder trending before and after.

“Most importantly, the data failed to trend any colder over the eastern half of the country for the first several days of February,” the firm said. Pointing to a mild ridge “expected to set up Jan. 31-Feb. 2 across the eastern half of the country…the big question is whether this frigid air will advance eastward Feb. 3-7, which we expect will be most important to the markets over the weekend break. If the mild eastern U.S. ridge is able to block the cold air’s advances Feb. 3-7, the markets are certain to return disappointed.”

INTL FCStone Latin America’s Tom Saal, senior vice president, noted that the spot month contract has been making higher highs and higher lows since the January contract settled at $2.598 on Dec. 21.

Citing his monthly Market Profile, Saal noted that prices surpassed the 50% monthly breakout target at $3.273 in the past few days and stayed above the upper end of the initial monthly balance at $3.097.

“Based off the numbers I’m looking at, the momentum in this market for the month is up, even though today may have been a setback,” Saal said. “…The weather’s going to oscillate. You can count on it.” Traders “were expecting a cold winter, and they didn’t get a cold winter until late in the season. So now they’re not too aggressively wanting to bet the farm on the weather.”

Saal said it will be interesting to watch what happens with the March/April spread. “Historically, this winter hasn’t really done a lot of damage yet, but if we get a cold February, that spread’s going to really jump.”

In the spot market, prices fell in most regions Friday as the effects of cold earlier in the week looked to dissipate.

PointLogic Energy was expecting “much more depressed demand” over the weekend in the Lower 48 “due to the weekend effect combined with a nearly 15-degree temperature swing up,” analyst Robert Applegate said Friday.

“The population-weighted temperature on Wednesday for the Lower 48 was 32 degrees, a full 10 degrees below the eight-year average. The population-weighted temperature for Sunday is forecast to be nearly 47 degrees,” Applegate said. “When the temperatures were so low on Wednesday, demand spiked to nearly 120 Bcf, but with the upcoming weekend combined with warmer temperatures, demand is expected to be approximately 75 Bcf,” a nearly 45 Bcf swing.

PointLogic was showing Lower 48 production hovering around 75 Bcf/d as of Friday.

After some points in East Texas got above $8 earlier in the week amid a rare winter storm in the region, prices there weakened further Friday. Katy fell 11 cents to $3.16, while the regional average dropped 8 cents to $3.10.

Over the next several days conditions are expected to “warm across the eastern half of the U.S. in the wake of recent frigid blasts, with highs of 40s and 50s gaining ground over the Great Lakes and Northeast, with 60s and 70s over the South and Southeast,” NatGasWeather said.

“The West will see increasing storms with rain and snow pushing into the central U.S. at times. A weather system will track out of the central U.S. and into the East during the middle of next week for a minor increase in heating demand.”

With the warm-up ahead, East Coast prices showed signs of shedding their winter premiums Friday. At Transco Zones 5 and 6, where prices have been notably volatile during cold stretches this winter, points traded at only a small premium to Henry Hub Friday.

Transco Zone 6 NY averaged $3.40, down $1.05 on the day, while Transco Zone 5 gave up 68 cents to $3.33. Henry Hub dropped 20 cents Friday to average $3.18.

Appalachian prices dropped as well, with Dominion South giving up 14 cents to $2.68.

In the Midwest, AccuWeather was calling for Chicago to see highs in the mid-40s Saturday and Sunday, and prices there fell.

Chicago Citygate finished below $3 for the first time since Jan. 9, falling 8 cents to average $2.93. The Midwest Regional Average shed 11 cents to $2.93.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |