Infrastructure | E&P | NGI All News Access

Permian Adds Rigs but U.S. Count Falls by Three

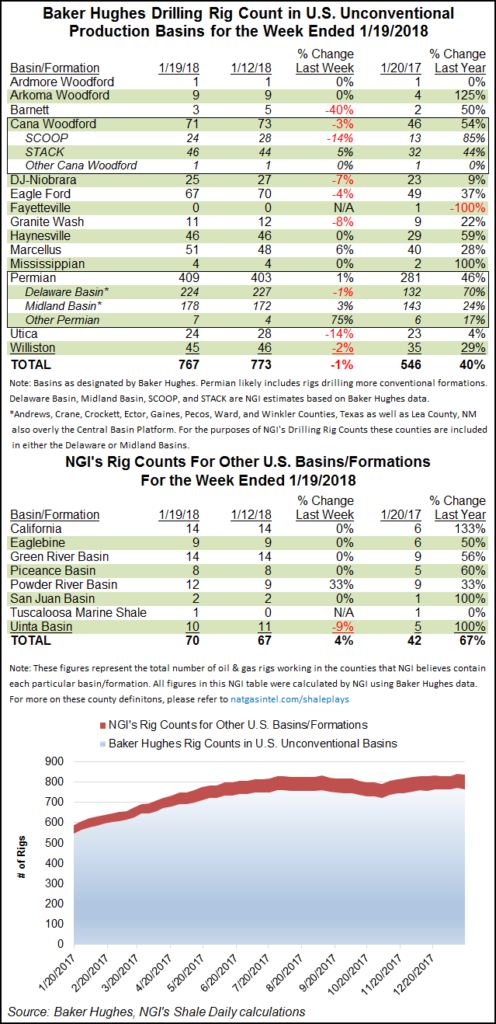

A strong week in the Permian Basin couldn’t keep the U.S. rig count from falling by three for the week ended Friday, according to data from Baker Hughes Inc. (BHI).

The United States saw five oil-directed rigs pack up shop for the week, offsetting the addition of two natural gas-directed rigs. The combined domestic tally ended at 936 for the week, up from 694 a year ago.

Five directional units were added, while five vertical units and three horizontal units left the patch, according to BHI. The U.S. offshore rig tally held flat week/week at 19, down from 24 rigs a year ago.

Canada’s rig count saw big gains for the second straight week, adding 23 oil-directed units and 26 gas-directed to finish at 325, down 17 from 342 active rigs in the year-ago period.

The combined North American rig count finished the week at 1,261, up from 1,036 a year ago.

The Permian enjoyed a strong week, adding six rigs to finish at 409 after tacking on three rigs the week before. Elsewhere, the Barnett Shale (down two) and Eagle Ford Shale (down three) posted week/week declines, as did the Granite Wash (down one), Cana Woodford (down two), Denver Julesburg-Niobrara Basin (down two) and Williston Basin (down one).

In Appalachia, four rigs were dropped in the Utica Shale, which fell from 28 to 24 rigs, versus 23 in the year-ago period. The Utica losses were partially offset by three rigs added in the Marcellus Shale, which surpassed the half-century mark to end the week at 51 units from 40 a year ago.

In its latest Drilling Productivity Report, the Energy Information Administration (EIA) said the Marcellus and Utica are expected to lead natural gas production growth among the U.S. onshore’s big seven unconventional plays heading into February. The Appalachian region is expected to average 26.78 Bcf/d in February versus an estimated 26.4 Bcf/d in January.

Among states, Wyoming (up three) and West Virginia (up two) saw the largest weekly increases, while Pennsylvania, Texas, Louisiana and New Mexico each added one rig. Colorado and Ohio each dropped four units for the week, while Alaska, North Dakota and Utah each saw a net decline of one rig, according to BHI’s breakdown.

Earnings season has arrived for oil and gas companies, and early signs from industry bellwether Schlumberger Ltd. appear bullish. Management for the oilfield services (OFS) giant, in a conference call with analysts and investors Friday, described a bright outlook for its North American operations in 2018 as exploration and production (E&P) companies increase activity.

The No. 1 global OFS operator often sets the tone for earnings season. Schlumberger, whose global operations are in part headquartered in Houston, did not fail to disappoint. Management offered an upbeat forecast not only for North America but for international operations as well.

“Looking forward to 2018, some of the U.S. E&Ps are still indicating that they will invest within cash flow in coming year,” CEO Paal Kibsgaard said. “However, with a positive oil market sentiment and the increased availability of cash, we expect another year of robust growth in North America shale oil production, which will be required to maintain the balance in the global oil market.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |