Markets | NGI All News Access | NGI Data

EIA Natural Gas Storage Report a Bearish Miss; Futures in Retreat

The Energy Information Administration (EIA) reported a natural gas storage withdrawal Thursday that fell short of consensus estimates, and in response, futures sold off sharply.

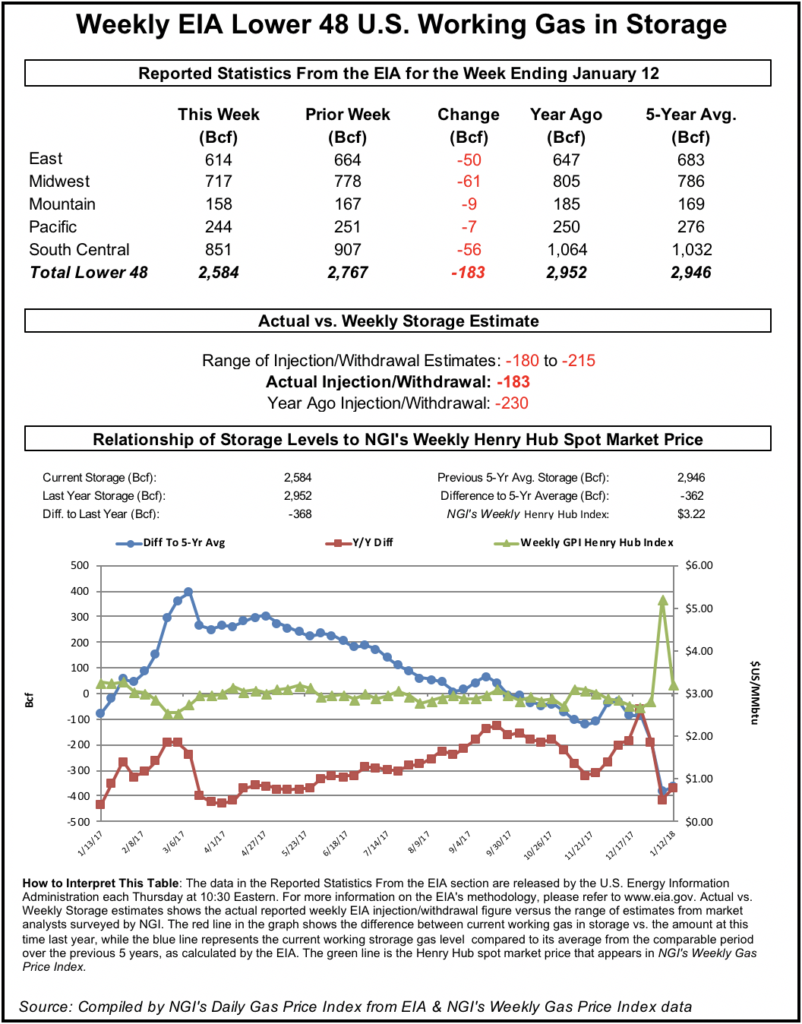

EIA reported a 183 Bcf withdrawal from U.S. gas stocks for the week ending Jan. 12, about 15 Bcf looser than what the market had been expecting. Last year 230 Bcf was withdrawn, and the five-year average for the period is a pull of 203 Bcf.

The February contract fell promptly as the figure reached trading desks at 10:30 a.m. EDT, plunging within minutes from around $3.190 to just under $3.130. By 11 a.m. EDT, February was trading around $3.100, down 13 cents from Wednesday’s settle.

Thursday’s selling came after February rallied to as high as $3.288 on Wednesday, an eight-month intraday high for a spot month contract.

A Reuters survey of traders and analysts this week had showed the market on average expecting EIA to report a 199 Bcf withdrawal. Responses ranged from -180 Bcf to -215 Bcf.

Stephen Smith Energy Associates in its Weekly Gas Outlook had predicted a withdrawal of 196 Bcf, versus a seasonally normal weekly withdrawal of 187 Bcf based on 2006-2010 norms. PointLogic Energy had predicted a 197 Bcf withdrawal, while Kyle Cooper of ION Energy had called for a withdrawal of 193 Bcf.

Last week, EIA reported a record-shattering 359 Bcf withdrawal from U.S. gas stocks for the week ending Jan. 5.

Bespoke Weather Services said that while the final number “came in decently below most analyst expectations…we see it as an implicit revision following a drawdown that likely was a bit exaggerated last week.

“Combine that with production returning from freeze-offs, and the print is clearly not as supportive for the market,” Bespoke said. “This has us tweaking lower drawdown expectations in the coming weeks as concerns about inventory levels may ease a bit. With any further warming to the forecast we could see $2.92 back in play by early next week, as though the print today was quite tight, it clearly underwhelmed.”

Total working gas in underground storage stood at 2,584 Bcf as of Jan. 12, versus 2,952 Bcf in the year-ago period and five-year average stocks of 2,946 Bcf, according to EIA.

The year-on-year storage deficit shrank week/week from -415 Bcf to -368 Bcf, while the year-on-five-year deficit narrowed from -382 Bcf to -362 Bcf, EIA data show.

By region, 61 Bcf was withdrawn in the Midwest for the week, while 50 Bcf was withdrawn from the East, according to EIA. In the South Central, 56 Bcf was withdrawn, including 18 Bcf from salt and 37 Bcf from nonsalt. The Mountain region finished at -9 Bcf for the week, while the Pacific stood at -7 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |