Marcellus | E&P | Eagle Ford Shale | Haynesville Shale | NGI All News Access | Utica Shale

Exco Resources Files For Chapter 11 Protection

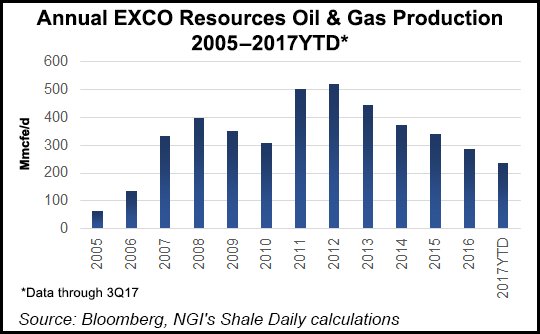

Exco Resources Inc. has voluntarily filed for bankruptcy protection as it looks to reorganize and strengthen its balance sheet.

The Dallas-based producer said Monday it was continuing to negotiate with creditors over the terms of a restructuring plan, and would explore “potential strategic alternatives to maximize value for the benefit of its stakeholders.” Exco said the strategy “may result in a sale of certain or substantially all of its assets” as it looks to reorganize under Chapter 11.

“As Exco moves through this court-supervised process, it intends to operate by-and-large in the ordinary course of business,” the company said. “Exco remains committed to maintaining the strong relationships it has with stakeholders, including its service providers and business partners, as it strengthens the company’s balance sheet.”

Exco went into default in early 2015, but it completed a distressed debt exchange, which was one of several exploration and production (E&P) companies to do so in the wake of ongoing low commodity prices. At the time, the company also shut down its drilling program in the Eagle Ford Shale to focus on the Haynesville and Bossier shales in East Texas.

In March 2016 to preserve liquidity, Exco trained its focus on completing a handful of wells in East Texas and North Louisiana. It also worked during 2016 to renegotiate gathering and transportation contracts.

Last month, Exco began trading on the OTC Pink Marketplace under the ticker symbol “XCOO” after the New York Stock Exchange (NYSE) began proceedings to delist its common shares. Exco had failed to maintain an average global market capitalization of at least $15 million over 30 consecutive trading days and was suspended from NYSE trading.

Exco is primarily focused on its remaining assets in East Texas and North Louisiana, but it also is an Appalachian Basin producer. The company last year sold its assets in the Eagle Ford to an affiliate of Kohlberg Kravis Roberts & Co. LP for $300 million.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |