Infrastructure | E&P | NGI All News Access

U.S. Rig Count Climbs by 15 in Largest Weekly Increase Since May

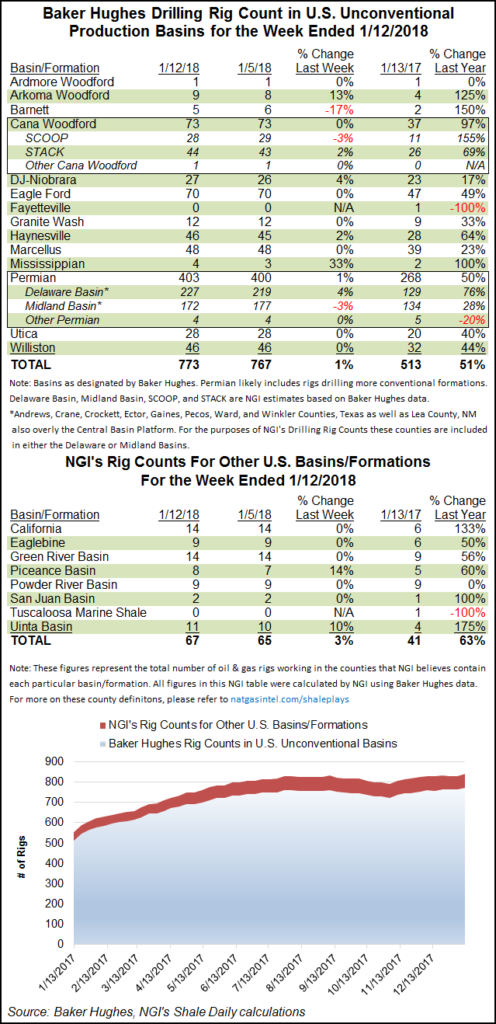

U.S. drillers snapped out of their seasonal lull for the week ended Friday, adding 15 rigs to grow the domestic tally for the first time since May, according to data from Baker Hughes Inc. (BHI).

The United States added 10 oil-directed rigs and five natural gas-directed rigs to end at 939, good for 280 more active rigs than a year ago. Two units were added in the offshore. Eight directional units were added, along with seven horizontal units, while vertical units held flat week/week, according to BHI.

The 15 rigs added represented the largest weekly gain in BHI’s domestic rig count since a gain of 16 units reported for the week ending May 19, 2017, NGI‘s analysis of BHI data showed. The week’s healthy gains followed two previous weeks of a declining rig count.

The gains also came as prompt-month oil prices were steadily climbing, with February crude oil trading above $64/bbl Friday on the New York Mercantile Exchange.

Canada, meanwhile, saw a whopping 102 rigs return during the week, according to BHI’s count, including 87 oil-directed rigs and 15 gas-directed.

The combined North American tally finished the week at 1,215, from 1,098 a week ago and 974 in the year-ago period.

By state, the biggest gains came in Louisiana and New Mexico, which each added five units to end at 61 and 81 rigs, respectively. Oklahoma netted three rigs week/week, although NGI‘s more detailed breakdown showed only a one-rig increase in the SCOOP (South Central Oklahoma Oil Province), which offset a one-rig decline in the STACK (Sooner Trend of the Anadarko Basin, mostly in Canadian and Kingfisher counties).

Also among states, Colorado added two rigs, and Alaska and Utah each added one. Texas was the only state tracked by BHI’s breakdown to see a decrease for the week, finishing down two at 452 units (versus 325 in the year-ago period).

Among plays, the Permian Basin saw a net gain of three rigs for the week to end at 403 units, well above the 268 units running a year ago. The Haynesville Shale, Mississippian Lime and Denver Julesburg-Niobrara formation each saw one rig return during the week, according to BHI.

NGI‘s more detailed breakdown of BHI data showed one rig added in the Piceance Basin for the week, leaving the play at nine active rigs versus five reported during the week ended January 13, 2017.

The strong oil prices of late may give exploration and production (E&P) companies reason for optimism as they put together their 2018 capital expenditure budgets.

The industry is also getting ready to report 4Q2017 earnings. Upcoming earnings conference calls from oilfield services companies include Schlumberger Ltd. on Friday (Jan. 19), Halliburton Co. (Jan. 22) and BHI (Jan. 24), which should provide insights into the industry’s outlook heading into 2018.

Meanwhile, Moody’s Investors Service said in a recent report that it expects default risk in the U.S. oil and gas industry to continue declining in 2018.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |