E&P | Markets | NGI All News Access | NGI The Weekly Gas Market Report

Moody’s Anticipating U.S. Oil, Gas Default Risk to Subside in 2018

The global speculative-grade default rate, which hit the oil and gas sector particularly hard, remained flat in the last half of 2017, but a better economic climate should reduce the rate through this year, according to Moody’s Investors Service.

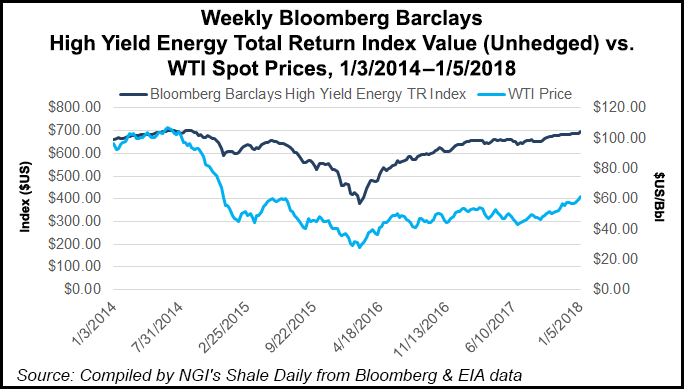

A lack of liquidity stung the energy sector beginning in late 2014 and continued to torment operators into last year following the plunge in oil prices. Moody’s oil and gas liquidity stress index reached a record high in March 2016 at 31.6%.

“Oil and gas companies accounted for nine of the final quarter’s defaults, the largest number among sectors,” Moody’s noted. “Even so, Moody’s analysts anticipate the default risk for U.S.-domiciled oil and gas firms to continue subsiding this year, with a projected default rate of 2.2%.”

The credit ratings agency said its global speculative-grade default rate during 4Q2017 ended the year at 2.9%, unchanged from 3Q2017. The global rate is set to fall below 2% this year, with the United States projected by year’s end to decline to 2.4%, and in Europe to 1.2%.

“Under our baseline scenario, we expect the global speculative-grade default rate to continue its downward path this year and to close it at 1.9%,” said Moody’s Senior Credit Officer Sharon Ou. “This forecast aligns to the pick-up in global economic momentum and narrow option-adjusted high-yield spreads, and generally good liquidity and low refinancing risk among Moody’s-rated speculative-grade issuers.”

Overall, 90 defaults worldwide were recorded in 2017, compared with 143 in 2016, Ou said.

By region, 58% of the fourth quarter defaults occurred in North America and 29% in Europe, while the largest defaulter was Venezuela’s state-owned oil and gas producer Petroleos de Venezuela SA, which missed an interest payment on more than $20 billion of debt.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |