Natural Gas Futures Retreat Ahead of Expected Record EIA Pull; Cash Gains in Central U.S.

Expectations for the Energy Information Administration (EIA) to report a record pull from U.S. natural gas stocks couldn’t help natural gas futures sustain their recent run higher Wednesday. Meanwhile, forecasts for the mercury to drop in the days ahead helped lift cash prices through the middle of the country as East Coast prices continued to moderate, and the NGI National Spot Gas Average fell 11 cents to $3.09/MMBtu.

After gaining 8.8 cents Tuesday and flirting with $3 earlier Wednesday, the February contract settled 1.7 cents lower at $2.906. March settled 3 cents lower at $2.822.

“The latest midday data was little changed, but could be viewed as a very slight touch milder due to the Global Forecast System model losing a little demand/heating degree days compared to Tuesday night’s run,” NatGasWeather.com said in a note to clients Wednesday.

“The data held on to a series of frigid cold weather systems over the eastern half of the country this weekend through the middle of next week for strong demand, although still advertises a mild ridge expanding across the eastern half of the country Jan. 18-23 with lighter demand,” the firm continued, adding that recent data was mixed on how much cold would reach the East Jan. 24-27.

Meanwhile, coming off the most potent stretch of heating demand since the 2013/14 winter, consensus estimates firmly expect EIA to report a record storage withdrawal Thursday.

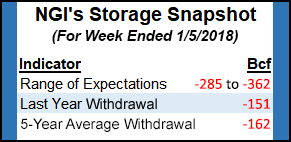

A Reuters survey of traders and analysts showed on average a 333 Bcf withdrawal for the week ending Jan. 5. That would shatter the previous record — a 288 Bcf withdrawal reported Jan. 10, 2014 — and more than double the year-ago and five-year average totals of -151 Bcf and -162 Bcf, respectively. Responses to the Reuters survey ranged from -285 Bcf to -362 Bcf.

A Bloomberg survey showed a median -332 Bcf, with a range of -305 Bcf to -345 Bcf.

PointLogic Energy called for a 325 Bcf withdrawal.

“Net exports in addition to intensely cold winter weather pushed total demand to record highs throughout the storage week,” PointLogic told clients earlier this week. “Total domestic demand gained just over 20 Bcf/d week-on-week,” mostly in the Midwest and East regions.

Stephen Smith Energy Associates updated its weekly estimate Tuesday to show a withdrawal of 316 Bcf, while Kyle Cooper of IAF Advisors predicted a 338 Bcf pull.

“The production numbers are so much higher than a year ago, so the market isn’t getting freaked out,” Price Futures Group senior analyst Phil Flynn told NGI, pointing to recent data showing about 6-7 Bcf/d production growth year-on-year. “If we would have gotten a 330 Bcf withdrawal a year ago, natural gas would have rallied $1.50-2, but over the last year we’ve opened up a lot of new pipeline capacity, allowing production to rise.”

Combine the year-on-year production gains with indications that the weather could warm up after next week’s cold, and “that’s why the market is feeling pretty sassy right now that $3 is resistance,” Flynn said.

Bespoke Weather Services said Wednesday’s move lower “certainly seemed justified; long-range warmth remains likely — even though we do continue to add a few gas-weighted heating degree days in the medium term — and it is clear that the natural gas market needs at least average heating demand to ease overproduction concerns moving forward.”

INTL FCStone Senior Vice President Tom Saal said recent price action suggests the market is not expecting a repeat of the recent Arctic blast that drove up demand to record levels.

“I think initially traders thought we were going to get a cold winter, so they started long…and then as we got into winter, November, early December, obviously it wasn’t cold, so they discounted cold weather,” Saal said. “And here we had some terrific cold weather, but it’s warming up, right?”

At this point the market doesn’t seem to be pricing in the “risk of the rest of the winter being below normal. The market seems to think it’s going to be normal or above-normal” from here. “That may or may not be true, but that’s where the market is pricing it at.”

At some point storage will need to be refilled, Saal noted. The market’s “probably not addressing yet how much gas we need in inventory for the summer, because we don’t know what the rest of winter’s going to look like.”

In the spot market Wednesday, Northeast prices continued to pull back from last week’s weather-driven spikes.

Weather Underground was calling for temperatures in Boston to hover in the 40s and 50s until Saturday, and Algonquin Citygate dropped $5.54 to average $4.48. Most Northeast points finished lower, and the regional average dropped $2.08 to $4.69.

As East Coast prices moderated, prices from Texas up through the Midwest gained ahead of a chill in temperatures expected to arrive by Thursday evening.

According to NatGasWeather, “a colder trending series of weather systems with rain and snow” was expected to reach the central United States later this week before “advancing aggressively into the East this weekend as it taps a healthy dose of frigid Canada air, where lows will again drop to -15 to 15 degrees across the northern U.S., with 20s and 30s into the South and Southeast.”

Houston was expected to see lows in the lower 30s Thursday, according to Weather Underground, and prices in East and South Texas strengthened around 15-20 cents. The East Texas Regional Average gained 24 cents to $2.97.

The Midwest and Midcontinent regions saw similar gains, including a 21-cent bump at Chicago Citygate, which ended the day averaging $3.03/MMBtu. Prices at Northern Border Ventura jumped 24 cents to $3.03. Rockies prices also saw a bump, with the regional average adding 12 cents to $2.52.

A Midcontinent trader told NGI that lower Northeast production, combined with higher demand in Calgary competing for gas flowing out of Western Canada, was putting upward pressure on spot prices Wednesday.

PointLogic’s models showed Northeast production at around 25.5 Bcf/d Wednesday, down from around 26.7 Bcf/d prior to the Arctic blast that pushed through in late December and early January.

PointLogic analyst Warren Waite said earlier this week that “high gas prices have kept local supplies within the region, reducing new outflows to other regions, and storage withdrawals remain elevated. That coupled with nearly every pipeline in the Northeast operating with an Operational Flow Order or a critical day of some kind, and it is hard-pressed for new production to reach downstream markets within and beyond the region.”

In Appalachia, Dominion South gained 6 cents Wednesday to average $2.69, while Columbia Gas added 19 cents to average $2.93.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |