E&P | Eagle Ford Shale | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

SM Energy Selling PRB Package to Keep Focus in Permian, Eagle Ford

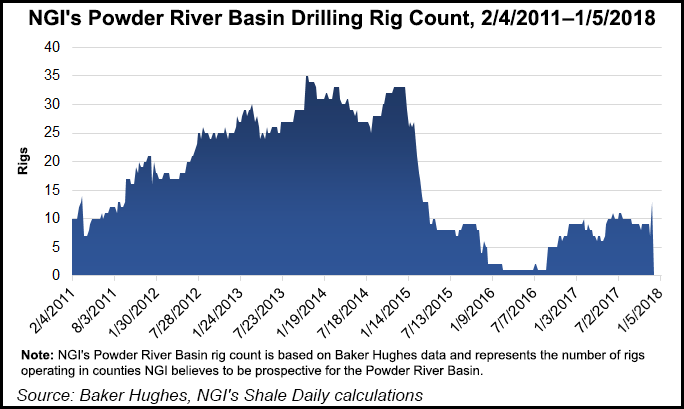

With its exploration attention trained in Texas, SM Energy Co. late Tuesday said it would sell nearly all of its Powder River Basin (PRB) properties for $500 million.

The sale, to Denver-based buyer Northwoods Energy LLC, would improve the bottom line and lend support for activity in Texas within the Permian’s Midland sub-basin and the Eagle Ford Shale.

The assets to be sold, representing about 80% of SM’s total PRB position, include 112,200 net acres in Wyoming in parts of Converse, Johnson and Campbell counties.

Net production at the end of 2017 was estimated at 2,200 boe/d, 51% weighted to oil, 31% to natural gas and 18% to natural gas liquids, with proved reserves estimated at 4.2 million boe.

“Divestiture of these assets is consistent with our strategy of focusing on development of our top tier Midland Basin and Eagle Ford assets and improving our balance sheet by reducing debt,” said CEO Jay Ottoson.

The transaction is expected to close before the end of March, with an effective date of Oct. 1, 2017.

Pro forma for the transaction, SM’s estimated debt at the end of 3Q2017 would be reduced by about 20%, Ottoson said.

Tudor, Pickering, Holt & Co. (TPH) estimated SM received around $3,800/undeveloped acre for the PRB properties, a price that was “likely at the higher en of investor expectations” and above its estimate of $1,000-2,000/acre.

The sale also could signal more deals for more money across the region for private and publicly traded exploration and production (E&P) operators, according to TPH. The SM transaction “may represent a low water mark for 2018,” considering the upside potential in adjacent Rockies formations including the Niobrara in the Denver-Julesburg Basin.

Private and public E&Ps “have been aggressively permitting and likely testing Niobrara…results on overlapping acreage,” said analysts.

“This, in our view, means core acreage trade value would see a big uplift from where the SM deal priced on an undeveloped value.” The transaction also shows that market interest “is high, and we expect private equity and potentially smaller publics may look to consolidate acreage.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |