NGI Mexico GPI | Markets | NGI All News Access

Mexico’s NatGas Industry Brushes Off Shortage Concerns as U.S. Weather Demand Surges

The Mexican natural gas industry sought to allay concerns about potential natural gas shortages amid reports that the frigid temperatures in the United States were curtailing pipeline exports to its southern neighbor.

The president of local industry group Asociacion Mexicana de Gas Natural (AMGN), Lorena Patterson, said over the weekend that Lower 48 gas supply continued to flow into Mexico despite the severe climate conditions running from the U.S. Gulf Coast to the Northeast, where a deep freeze pushed gas demand and prices to record-setting levels.

“The price fluctuations [in the United States] occurred in areas with supply bottlenecks and restrictions related to the weather, such as the Northeast,” Patterson told NGI. “However, since the gas shipped to Mexico comes from other basins, and also because the United States has large quantities of gas in storage, there was only a minor impact on Mexican prices in these last few days.”

![]()

Bloomberg reported last week that demand on the Gulf Coast led U.S. gas exports to Mexico to plummet to their lowest point on Tuesday (Jan. 2) since Hurricane Harvey curtailed supply last August.

Flows at the Clint border crossing in West Texas have dipped since last week, according to NGI’s Mexico Border Tracker. Exports at Rio Bravo in South Texas fell slightly at the beginning of last week but quickly recovered, and they remain stable at the Roma, TX, crossing.

Most natural gas marketed in Mexico is priced on U.S. indexes in Texas, which rose last week on the cold temperatures.

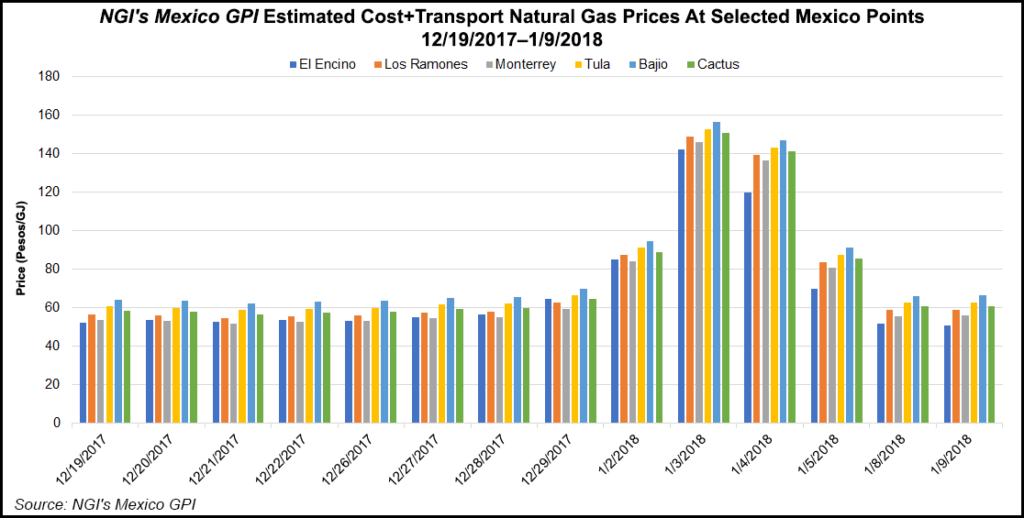

The price for gas deliveries throughout Mexico surged from Jan. 2 through Jan. 4, but prices had settled by Monday, according to NGI’s Cost Plus Transport estimated prices. The highest estimated price was Jan. 3 at Bajio in western Mexico, which peaked at 156 pesos/gigajoule.

Patterson said prices in Mexico had returned to normal levels this week, as gas markets in the United States began to stabilize. A short-term warmup across North America also is forecast ahead of another cold front set to hit late this next weekend.

Mexico is increasingly dependent on U.S. gas to meet local demand. Cross-border pipelines and three liquefied natural gas terminals supply around 4.9 Bcf/d, or 60% of the country’s usage. Excluding the gas that Petroleos Mexicanos uses for re-injections and other activities, imports account for close to 85% of the gas marketed in the country.

As Harvey battered the Texas coast last year, Mexico’s national pipeline operator, Centro Nacional de Control del Gas Natural (Cenagas), issued a critical supply alert. The storm overall curtailed about 1 Bcf/d of imports from the United States, according to Genscape Inc.

Cenagas has not issued any alerts as of Tuesday, nor have any private pipelines operating within Mexico. Kinder Morgan Inc.’s 640 MMcf/d Mier-Monterrey pipeline, which runs from South Texas into Nuevo Leon state, issued an advisory to customers on Dec. 28 ahead of the snowstorms.

Mexico also lacks underground storage infrastructure, further increasing its exposure to imports. Last month the energy ministry published a draft of its natural gas storage policy, which would require Cenagas to hold strategic inventories of 45 Bcf by 2025 at the latest.

“This is another tool that will allow the market to protect itself from substantial price swings and operate with a more robust system,” Patterson said.

Working gas in storage in the U.S. south-central region, which is the closest source of domestic storage to Mexico, currently sits at 1,060 Bcf, 109 Bcf lower than last year, and 83 Bcf lower than its previous five-year average.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |