U.S. Rig Count Trimmed to 924; Canada Bounces Back to 174

Five oil-directed rigs were lost in the United States for the week ended Jan. 5, likely due to a typical end of year slowdown, according to data released Friday by Baker Hughes Inc. (BHI).

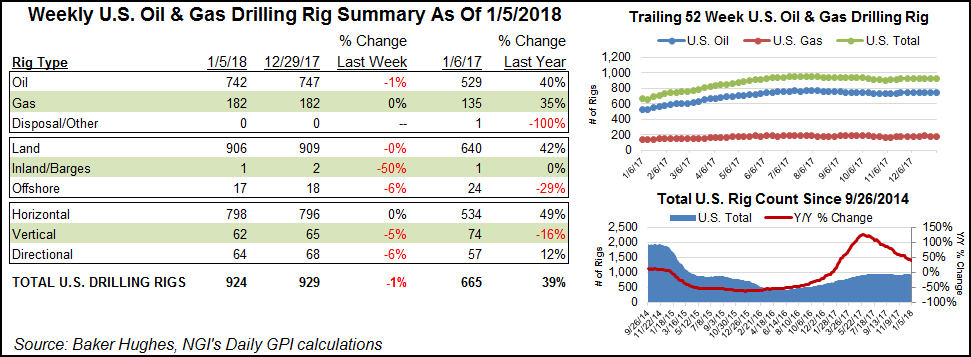

With natural gas-directed drilling flat week/week, the U.S. rig count was 924, down five from a week before, but still up 39% compared with 665 rigs running a year ago. Two horizontal units returned to the patch, but that was more than matched by declines of three vertical units and four directional units, according to BHI. There were three fewer land units, one less inland/barge unit, and one less offshore unit than a week earlier.

Canada, which had dropped 102 rigs over the previous two weeks, recouped some of those losses, adding 38 rigs week/week to finish at 174 rigs.

The combined North American rig count finished at 1,098 rigs, up 33 week/week and up 228 from 870 rigs running a year ago.

NGI‘s detailed breakdown of plays shows a gain of three rigs in the Sooner Trend of the Anadarko Basin, mostly in Canadian and Kingfisher counties (aka, the STACK), but a decline of three in the South Central Oklahoma Oil Province (aka, the SCOOP) left the Cana Woodford total unchanged at 73.

The Permian Basin had 400 rigs, an increase of two from the previous week, achieved by the addition of one rig each in the Delaware and Midland sub-basins.

The Haynesville Shale was down one rig to 45, and the Williston also lost one rig, ending the week at 46 rigs.

Three states added rigs for the week, with two coming aboard in Wyoming and one each in New Mexico and Texas. Those gains were more than matched by the subtraction of six rigs in Louisiana, two in Oklahoma and one in North Dakota.

Putting the week’s overall decline in the rearview mirror, recent economic reports from various officials at the state level point to a possible resurgence within the oil and gas exploration and production (E&P) segment.

At the end of December Wyoming officials reported that revenues from federal and state oil/natural gas lease sales in the state during 2017 shot up dramatically compared to their anemic levels a year earlier, prompting industry and government officials to conjure up visions of a return to more boom-like times ahead in the state oil/gas fields.

Further south, the Federal Reserve Bank’s Dallas arm said in late December oil and natural gas activity across Texas, northern Louisiana and southeastern New Mexico gained momentum during the 4Q2017. The business activity index is measured quarterly in the Dallas Fed Energy Survey, offering the broadest measure of conditions facing Eleventh District energy firms. The index climbed to 38.1 from 27.3 in 3Q2017, driven by a surging exploration and production (E&P) sector.

Said one E&P executive, “The oil industry in the Lower 48 states appears to be in the ‘Goldilocks stage’ — not too strong, not too soft, just right — which incents everyone to be efficient.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 |