NGI Data | Markets | NGI All News Access

EIA’s First Gauge of Recent Cold Blast a Bearish Miss as NatGas Futures Retreat

The Energy Information Administration’s (EIA) first storage inventory report covering the recent Arctic cold missed to the bearish side of consensus estimates Thursday, and prompt-month futures pulled back on the news.

EIA reported a net 206 Bcf withdrawal from U.S. gas stocks for the week ended Dec. 29, about 15 Bcf less than what the market had been expecting, and the bears, perhaps skeptical of the lasting impact of the recent cold, seemed to take it as validation.

The February contract had climbed above $3.030 Thursday but retreated sharply when the report hit trading desks at 10:30 a.m. EDT, trading around $2.985-3.005. By 11 a.m. EDT, February was hovering right around $3, near even with Wednesday’s settlement.

This week’s storage report was the first to gauge the impact of the extreme frigid temperatures that began moving in over the Christmas holiday, driving up heating demand and cash prices for most of the eastern two-thirds of the Lower 48 states.

Prior to the release of the final number, market predictions had been pointing to a withdrawal well above 200 Bcf. The average from a Reuters survey of traders and analysts had EIA reporting a 221 Bcf withdrawal from U.S. gas stocks, with responses ranging from -205 Bcf to -243 Bcf.

A Bloomberg Survey had similarly showed an average -221 Bcf for the period, with a range of -205 Bcf to -235 Bcf.

PointLogic Energy had been calling for EIA to report a 220 Bcf withdrawal, while Stephen Smith Energy Associates had called for a withdrawal of 227 Bcf. IAF Advisors analyst Kyle Cooper had predicted a withdrawal of 211 Bcf.

While below market expectations, the 206 Bcf withdrawal still comes in more than double the five-year average withdrawal of 99 Bcf and easily dwarfs the 76 Bcf withdrawal in the year-ago period.

“This was the first print with the recent cold snap featured prominently, yet the Christmas holiday clearly limited the demand aspect of this impressive cold,” Bespoke Weather Services said. “…With risks of a warmer second half of January on the horizon, we would need to see bullish EIA surprises to really keep prices bid up, and instead we saw further complacency justified with this slight miss.”

As for upcoming reports, analysts with Wells Fargo Securities LLC said they’re forecasting a cumulative 565 Bcf withdrawal over the next two weeks based on internal models and government forecasts.

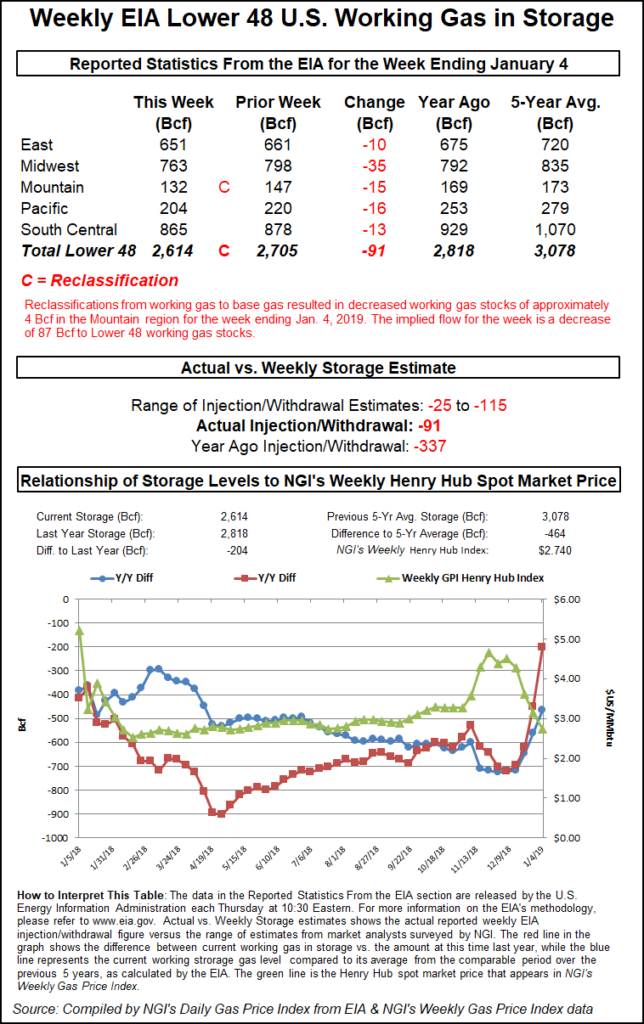

Total working gas in underground storage as of Dec. 29 stood at 3,126 Bcf.

According to EIA, both the year-ago and five-year average inventories stood at 3,318 Bcf. As a result, the year-on-year deficit increased week/week from -62 Bcf to -192 Bcf for the period, while the year-on-five-year deficit increased from -85 Bcf to -192 Bcf, EIA data show.

By region, EIA reported the largest net withdrawal in the South Central at -73 Bcf, including 22 Bcf withdrawn from salt and 50 Bcf withdrawn from nonsalt. The next largest withdrawals came from the Midwest (-66 Bcf) and East (-42 Bcf).

The Mountain region saw 12 Bcf withdrawn from inventories, while 13 Bcf was withdrawn in the Pacific, according to EIA.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |