NGI’s MidDay Alert Price Service: NY’s Transco Zone 6 Natural Gas Highs Shatter $50/MMBtu

A so-called winter bomb cyclone had day-ahead natural gas prices soaring along the East Coast Wednesday, with trades shooting as high as $60/MMBtu as forecasters were calling for blizzard-like conditions in the Northeast. Despite prices moderating in the Midwest and Texas, the NGI National Spot Gas Average added another $2.49 to $10.84/MMBtu.

Even with widespread weather-driven gains in the spot market, and despite expectations for the Energy Information Administration (EIA) to report a 200-plus Bcf storage withdrawal this week, the futures market could only shrug. With weather guidance showing a long-range warm-up, the February contract settled 4.8 cents lower at $3.008, while March settled 4.2 cents lower at $2.931.

Futures “were able to settle above the $3 level, but pulled back quickly as afternoon European guidance came out showing exactly the warm risks we were worried about in the long-range,” Bespoke Weather Services said in a note to clients Wednesday.

“Though EIA data Thursday looks to be supportive…and cash prices remained incredibly strong Wednesday, we are worried that long-range warmth will be able to overwhelm these short-term bullish catalysts and pull prices back down over the next couple of weeks, first to $2.92 and then potentially $2.75 (or lower).”

INTL FCStone Senior Vice President Tom Saal said speculators seem to view the recent weather-driven demand as unlikely to have a lasting impact.

“The perception in the industry is that we have an oversupply of gas,” Saal said. “So faced with this kind of severe weather, the only logical way they could stay short is to think that it’s a temporary phenomenon, and after this weather comes and goes, it’ll be like it was before.

“…They could be wrong, and they could turn on a dime and run this market back up,” he added.

The differential between Henry Hub spot prices and the futures creates opportunities for marketers, according to Saal. Day-ahead trades at Henry Hub averaged $6.88 Wednesday, up 25 cents — and more than double the prompt-month settlement.

“The market’s going to be backwardated for a while. It’s not going to instantaneously adjust, but it will adjust,” Saal said. “What that means is that other players could come in and…take that dominance away from the speculators. Stay tuned.”

In the spot market, the action was on the East Coast Wednesday. With a wicked nor’easter on the way, the Northeast Regional Average jumped $17.82 to $35.60, including a regional high of $60 recorded at Tennessee Zone 6 200L.

NGI’s MidDay Price Alert showed highs at Transco Zone 6 NY above $50. Transco Zone 6 NY averaged $48.34, up $38.85 on the day.

With parts of the Southeast and Mid-Atlantic also expected to see wintry precipitation Wednesday and Thursday, Transco Zone 5 spiked in Wednesday’s spot market, NGI’s MidDay Alert showed. Transco Zone 5 finished the day averaging $50.93 after jumping by $32.02.

The National Weather Service (NWS) issued an alert Wednesday warning of a winter storm bringing “the potential for a mix of freezing rain/sleet/snow from portions of northern Florida to North Carolina, and snowfall northward along portions of the Mid-Atlantic into northern New England. Blizzard conditions are possible across portions of eastern New England late Thursday.”

The amount of snow will depend on how close the storm gets to the coast as it moves northward, according to NWS, which also warned that the system could “produce strong, damaging winds, possibly resulting in downed trees and/or power outages.”

News outlets were calling it a “bomb cyclone” Wednesday, a rapidly strengthening weather system formed through a process called bombogenesis.

“In the Northeast, impact from snow and wind will increase dramatically from Wednesday night through Thursday night,” AccuWeather forecaster Alex Sosnowski said. “AccuWeather meteorologists believe the heaviest snow and strongest winds from the storm will occur in eastern New England and part of Atlantic Canada.

“…Blizzard conditions are likely from portions of Long Island, NY, through eastern Connecticut and Massachusetts to northeastern Maine, New Brunswick and western Nova Scotia,” Sosnowski said. “…There is the potential for 12-24 inches or more of snow to fall in Maine and New Brunswick. At the same time, the risk of hurricane-force gusts and frigid air will pound these areas.”

In New England, Algonquin Citygate surged $17.65 to average $38.22, while Iroquois Zone 2 added $27.94 to average $43.92.

Genscape Inc. earlier Wednesday told clients to expect volatility in New England due to near-record demand and limited supplies of fuel oil putting more pressure on gas-fired generation. The firm forecast New England demand to reach 4.556 Bcf/d by Friday, “just shy of the historic maximum of 4.567 Bcf/d in February 2015.”

Genscape said its forecast of 62 HDDs in the region Jan. 6 “breaches the maximum regional HDDs since 2009 by 0.3 HDDs.”

Meanwhile, competition between heating and power demand in New England “will intensify due to dwindling supplies of fuel oil. According to ISO New England, fuel oil supplies are low, and generators are reaching their emissions maximum, which would force more gas into the stack,” Genscape said.

The region has options for obtaining more gas using existing pipes and is also benefiting from the recent start-up of the Algonquin Incremental Market and Atlantic Bridge expansions, while additional supply is also waiting in the wings via the Everett and Canaport liquefied natural gas terminals, according to the firm.

Appalachian prices continued to move higher Wednesday amid the weather-driven demand, especially Tetco M3 Delivery, which jumped $28.87 to $45.20. Columbia Gas added 48 cents to $7.00.

In the Appalachia region, including New York and New Jersey, Genscape was forecasting demand to peak at 24.52 Bcf/d Friday, up from a recent seven-day average of 20.4 Bcf/d and well above the recent 30-day average of 16.91 Bcf/d.

Similarly, demand across the Southeast and Mid-Atlantic was expected to reach 24.21 Bcf/d Friday versus a recent seven-day average of 22.24 Bcf/d and a recent 30-day average 18.84 Bcf/d, according to Genscape.

This week’s bomb cyclone comes after a period of prolonged below-normal temperatures that drove up heating demand and led to production freeze-offs, putting pipeline operators under pressure to manage constraints and maintain system balance. With natural gas demand picking up sharply since Christmas, the market was looking for the EIA to report a withdrawal well above 200 Bcf Thursday.

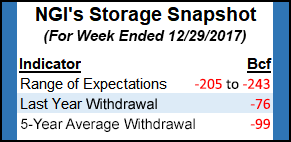

The average from a Reuters survey of traders and analysts had EIA reporting a 221 Bcf withdrawal from U.S. gas stocks for the week ended Dec. 29, a number that would blow away the year-ago withdrawal of 76 Bcf and the five-year average -99 Bcf. Responses ranged from -205 Bcf to -243 Bcf.

A Bloomberg Survey similarly showed an average -221 Bcf for the period, with a range of -205 Bcf to -235 Bcf.

PointLogic Energy was calling for EIA to report a 220 Bcf withdrawal based on “demand gaining just over 18.2 Bcf/d week-on-week. The increase in demand was spread across the entire country, with the largest gain coming from the Midcontinent region,” according to the firm.

Stephen Smith Energy Associates was calling for a withdrawal of 227 Bcf, while IAF Advisors analyst Kyle Cooper predicted a withdrawal of 211 Bcf.

Last week, EIA reported a 112 Bcf withdrawal for the period ending Dec. 22.

In the near-term, the extreme arctic chills should persist across “much of the country east of the Rockies” through the end of the week, according to NatGasWeather.com, “aided by a reinforcing Arctic blast arriving late Wednesday and Thursday, focused over the Great Lakes, Mid-Atlantic and Northeast.

“…With strong winds and lows reaching -25F to single digits over the northern U.S., and single digits to 20s deep into Texas and the South, national natural gas demand will be exceptionally strong through Saturday.”

Away from the East Coast, spot prices at a number of points eased off Wednesday, though the cash market generally held on to a good chunk of the sizeable gains reported across the Lower 48 the day before.

Day/day losses were greatest in the Midwest, where Joliet pulled back $2.25 to average $6.44.

Genscape was calling for Midwest demand to total around 17.5 Bcf/d Thursday and Friday before falling through the weekend. That’s versus demand above 22 Bcf/d since New Years Day, according to the firm.

Prices across East and South Texas averaged above $6 after giving up around $1 on the day.

Prices in the Rockies were mixed. Cheyenne Hub dropped 77 cents to $5.34, while Kern River gained 50 cents to $5.41.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |