Shale Daily | E&P | NGI All News Access | NGI The Weekly Gas Market Report

Schlumberger Scuttles OneStim Plan, Buys Out Weatherford’s U.S. Fracture Business Instead

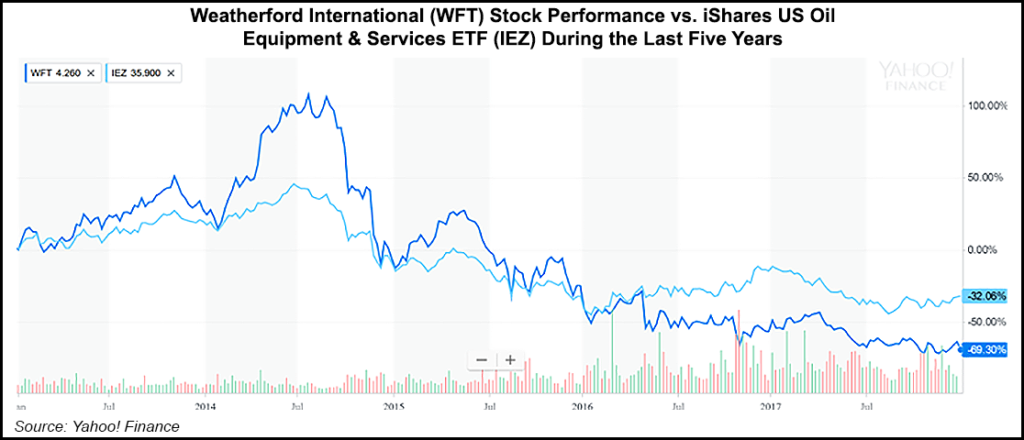

Weatherford International plc has sold its U.S. pressure pumping and pump-down perforating assets to a subsidiary of Schlumberger Ltd. for $430 million, scrapping a plan initiated in early 2017 to partner in the domestic arena.

The parties agreed to revised deal terms to reflect the asset sale, versus the previously announced OneStim joint venture announced last March.

Schlumberger was to have been 70% owner of the partnership, combining its 2 million hydraulic hp (hhp) with Weatherford’s 1 million hhp to control the second largest fracture fleet in North America after Halliburton Co. Instead, the world’s largest oilfield services company is taking ownership of Weatherford’s U.S. assets, as well as supplier and customer contracts.

“Although not as originally anticipated, this transaction delivers cash proceeds that enable our company to begin the deleveraging process and, coupled with our transformation plans, will lead to a leaner organization with lower debt and significantly higher profit margins,” said Weatherford CEO Mark A. McCollum. Proceeds from the sale are being used to reduce debt.

About 100 Weatherford employees associated with the pressure pumping and pump-down perforating businesses are moving to Schlumberger.

Weatherford also is retaining all of its multistage completions portfolio, manufacturing capability and supply chain and would continue to participate in the growing completions markets in North America and globally.

“Retaining 100% of our leading land-based multistage completions business allows for significant upside potential for Weatherford,” McCollum said. “The closing of this transaction represents another step on our path toward building a solid and strong company and unlocking the potential that exists within Weatherford.”

Analysts with Tudor, Pickering, Holt & Co. (TPH) had liked the strategic rationale of the OneStim partnership and in December had still expected the venture to be completed.

“Master poker players we’ll never be, and we’ll never know the details of which key factors led to the change in deal structure from joint venture to an asset sale, but we do sense that both parties were committed to moving the ball forward as recent as a month ago, so it feels like this really was a situation in which talks/negotiations got bogged down in the 11th hour,” analysts said.

The asset sale may be a better outcome for Weatherford than Schlumberger, the TPH team said, as some in the industry and investment community viewed Weatherford’s U.S. fracture fleet as in “an extreme state of disrepair…” By selling the portfolio and still maintaining full ownership of its completions business, Weatherford may end up in the “sweet spot of products/services” to help North American producers optimize their horizontal completions.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |