NGI Weekly Gas Price Index | Markets | NGI All News Access

NatGas Spot Market Sees Polar Vortex-Like Spikes in Bullish Week, But Futures Not Convinced

After a mostly lackluster December, the legitimate heating demand the natural gas market had been waiting for finally arrived just in time to close out 2017. Brutal below average temperatures drove up heating demand across the country, and the NGI Weekly Spot Gas Average for the three-day trading week ended Thursday surged $2.44 to average $5.35/MMBtu.

Major demand markets across the Midwest and East Coast saw some of the “coldest winter temperatures in years” during the week, according to Genscape Inc.

After “grossly mild temperatures” and weak demand earlier in the winter heating season, “time was running out to sufficiently draw down inventories, especially given the strong production numbers we’ve been seeing,” according to Genscape. “…That all changed around Christmas. From Nov. 1-Dec. 24 there were no plus-100 Bcf/d demand days…and just 10 days where demand exceeded 90 Bcf/d.” But on Dec. 25 “demand jumped to 97 Bcf/d and has run well above 100 Bcf/d every day since.”

Prices at some points spiked to levels that hearkened back to the polar vortex winter of 2013/14.

Algonquin Citygate spiked $16.48 to average $25.14, while Transco Zone 6 NY jumped $14.55 to $17.71.

Midwest markets saw some of the coldest temperatures, and prices at Chicago Citygate climbed 71 cents week/week to average $3.35.

Elevated heating demand and underperforming receipt points contributed to a record-breaking spike in the Midcontinent. Northern Natural Ventura saw trades as high as $100 during a one-day price blowout, and that drove its average up $21.23 week/week to $23.85. It was a similar story at Northern Border Ventura, which rose $13.85 to average $16.47 for the week.

Out west, after weeks of volatility, prices settled to more moderate levels at SoCal Citygate during the week. This came after utility Southern California Gas announced Dec. 22 that it completed maintenance on its Line 4000, restoring receipts through Needles, CA, in its Northern Zone. SoCal Citygate gave up $1.68 on the week to average $3.32.

The forecasts finally showed enough heating demand during the week to impress the futures market, though questions remained for the bulls after a ho-hum performance Friday. The February contract settled at $2.953 to close out the week, up 3.9 cents on the day. That’s a big increase from February’s $2.658 settlement the week before, but perhaps less-than-convincing given how far the mercury was dropping in key Midwest and East Coast markets Friday.

“Despite the solid last couple days we’ve seen in natural gas, that really has only gotten us back into the bottom of the extended trading range the market has been in the last several months,” Powerhouse’s David Thompson, executive vice president, told NGI Friday. “The coldest blast of the year so far has only gotten us back in the range. That’s something the bulls, I think, have to be a little worried about. Is this all they can get?”

Thompson noted the contrast between natural gas and heating oil markets in terms of how they reacted to the recent frigid conditions.

“The thing that needs to be resolved one way or the other is why is the heating oil market reacting as one would intuitively expect given the weather, while natural gas has run out of steam at this point? The only difference, I would say, between the two is the producer hedging action,” Thompson said, noting that when front-month prices climbed above $3 it seemed to yield attractive enough prices across the curve to incentivize producer hedging.

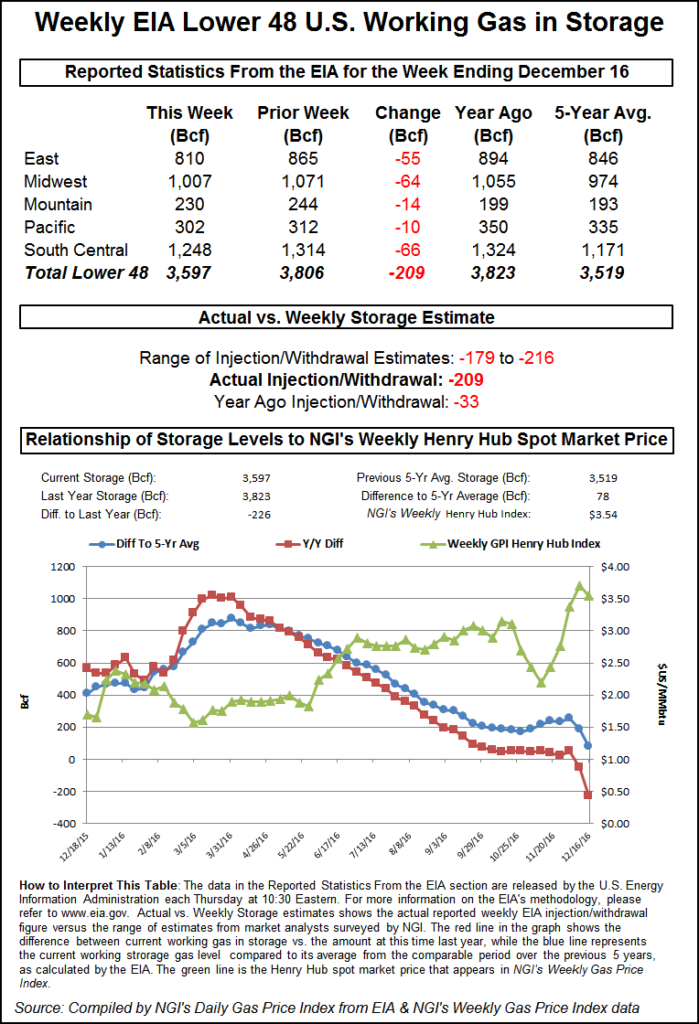

The Energy Information Administration (EIA) on Thursday reported a storage withdrawal in line with market expectations, and the already surging February contract continued unabated.

EIA reported a net 112 Bcf withdrawal for the week ending Dec. 22, versus 233 Bcf withdrawn a year ago, and a five-year average withdrawal of 111 Bcf. Last week, EIA reported a 182 Bcf withdrawal.

With forecasts showing frigid below-normal temperatures lingering across much of the eastern two-thirds of the country well into the new year, the bulls weren’t lacking for inspiration as the EIA data went live.

The February contract, taking over as the prompt-month Thursday, had already rallied roughly 15 cents from Wednesday’s settle to around $2.860-2.880 by the time the final number crossed trading desks at 10:30 a.m. EDT. February got a bump as the number came out and marched higher from there. By 11 a.m. EDT, February had climbed above $2.910.

The final figure from EIA fell right in line with consensus estimates.

A Reuters survey of traders and analysts had called for an average withdrawal of 113 Bcf, with responses ranging from -107 Bcf to -176 Bcf.

Stephen Smith Energy Associates, in a report issued over the holiday weekend, predicted a 107 Bcf withdrawal. The firm said this compares to a seasonally normal draw of 82 Bcf, based on 2006-2010 norms. PointLogic Energy on Tuesday predicted a withdrawal of 111 Bcf. ION Energy’s Kyle Cooper called for a 109 Bcf withdrawal.

“Initially it had appeared that the drawdown could be even larger, but a bit warmer weather and elevated production brought the number right in line with our revised estimate,” Bespoke Weather Services said of the 112 Bcf figure.

“We see this print as a bit looser week-over-week but still relatively tight given the widespread warmth last week…We see room to test resistance at $2.98-3.02 into week end, but worry we struggle to move higher with mid-January warm risks and continually growing production.”

Given the cold blast that moved into the Lower 48 this week, the market will now look with great interest to the next few storage reports. Analytics firm Genscape Inc. told clients earlier this week that its preliminary estimate based on pipeline supply/demand balance pointed to a storage draw of around 191 Bcf for the week ending Dec. 29, with the estimate for the week ending Jan. 5 increasing from a draw of 240 Bcf to a draw of 255 Bcf.

Total working gas in underground storage stood at 3,332 Bcf as of Dec. 22, according to EIA. The year-on-five-year deficit increased by one to -85 Bcf for the period, while the deficit versus last year shrank from -183 Bcf to -62 Bcf, EIA data show.

By region, the largest weekly withdrawals came from the East (-29 Bcf) and Midwest (-39 Bcf). The Pacific region saw a 13 Bcf withdrawal for the period, while 9 Bcf was withdrawn in the Mountain region. In the South Central, 22 Bcf was withdrawn, including 6 Bcf from salt and 16 Bcf from nonsalt.

Thanks to bone-chilling temperatures across much of the Lower 48, Friday’s natural gas spot market for delivery the first two days of January proved a holiday treat for those craving winter volatility; Midcontinent prices fell back to earth after skyrocketing to record levels the day before, while most regional averages gained anywhere from 50 cents to $7 or more. The NGI National Spot Gas Average gained $1.27 to $7.05.

The futures market added to the prior day’s rally but showed some trepidation ahead of the long weekend. February settled 3.9 cents higher at $2.953, after trading as high as $3.008. March added 2.8 cents to settle at $2.906.

As futures struggled to break above $3, the big moves occurred in the spot market Friday.

MDA Weather Services was calling for significantly below-normal temperatures to hit major cities across the Midwest, South and East Coast over the holiday weekend. Temperatures in Boston, New York, Philadelphia and Washington, DC, were expected to fall to around 15-25 degrees below normal Sunday to Tuesday.

MDA forecast lows in the single digits in Chicago Saturday and Sunday to dip below zero by Monday and Tuesday. Minneapolis was expected to see highs in the negatives over the weekend, with lows in the negative teens — around 25 degrees below normal, according to MDA.

“Intense cold across nearly two-thirds of the Lower 48” over the holiday weekend was shaping up to be “nothing short of spectacular,” PointLogic Energy analyst Alan Lammey said Friday. “In fact, records may be broken on New Year’s Day in many parts of the central U.S. as repetitive shots of super frigid polar-charged air will continue to dominate most areas of the nation east of the Rockies all the way to the Eastern Seaboard through the first full week or more of 2018.”

Northeast prices for Monday and Tuesday delivery lurched higher to cap off a volatile week. Algonquin Citygate gained $5.14 to average $24.23, while Transco Zone 6 Non-New York added $23.05 to $37.12. In Appalachia, Tetco M3 Delivery jumped $13.44 to $28.67, while most other points added around 50 cents on the day.

Prices in Chicago surged as well, with Chicago Citygate adding 70 cents to average $4.68.

Pipeline operators were continuing to take steps Friday to maintain system integrity in the face of heightened demand.

The cold had both Columbia Gas Transmission (TCO) and Dominion Energy Transmission (DETI) paying close attention to their operations. Based on weather forecasts and market conditions, both interstate systems had capacity constraint notices posted that were in effect until further notice on Friday. TCO called for transportation critical days for operating areas 1,4 and 10 on Wednesday and later revised the notice to include all its operating areas through the New Year’s holiday.

DETI, meanwhile, issued its critical notice in response to increased demand in its central region, requiring shippers making deliveries west of the Gilmore station to source them only from primary receipt points. “Dominion Energy Transmission Inc. is expecting continued record cold temperatures across our service area for the next several days,” spokesperson Jen Kostyniuk said. She added that the system’s customers are being served both through flowing supply and storage and said all firm commitments are currently being met.

A Williams’ spokesman told NGI Friday that the Transco system was doing well, had no issues to report and had experienced no freeze-offs in its supply lines. A Kinder Morgan spokesman said NGPL was experiencing no operational issues.

The cold was also affecting utilities. For example, operational flow orders (OFO) on interstate systems found Southern Co. affiliate Virginia Natural Gas (VNG) on Thursday asking its larger customers to curtail volumes whenever possible. The utility serves 293,000 customers in southeast Virginia. A VNG spokesperson told NGI Friday that the curtailment requests had been lifted and the system was again operating normally.

With AccuWeather calling for lows into the teens and 20s over the long weekend even in southern cities like Atlanta, prices in the Southeast also ratcheted higher.

In what has become a running theme for cash prices during the recent arctic blast, Transco Zone 5 saw trades reach polar vortex proportions Friday, averaging $34.04 after trading as high as $50. Friday’s high marked the most expensive trade at Transco Zone 5 since Jan. 21, 2014, when cash prices went as high as $136, Daily GPI historical data show. Transco Zone 5 prices peaked at $49 in February 2015.

Also in the Southeast Friday, Transco Zone 4 gained 60 cents to average $3.55, while Florida Gas Zone 3 jumped 59 cents to $3.54.

Even after recent weather-driven price blowouts, more volatility could be in store, according to Genscape.

“With many regions forecast to get even colder” in the week ahead, and with Friday’s trading covering the extended weekend, Tuesday’s trading could bring “heightened volatility.”

The firm said its supply and demand storage forecast points to a withdrawal of 193 Bcf for next week’s storage report, with estimates for the following two weeks solidly above 200 Bcf.

Perhaps feeling a little left out after big gains at demand centers in the Midwest and Northeast this week, Texas also got in on the price action in Friday’s trading. All three Texas regional averages covered by NGI flirted with $4.

In East Texas, Katy jumped $1.31 to $4.30, while in South Texas, NGPL S. Texas climbed $1.20 to average $4.10 as Agua Dulce notched a $1.09 increase to $4.09. In West Texas, the Waha Hub — sitting overtop the prolific Permian Basin — surged $1.12 to average $4.14, the highest daily spot price average there in more than three years, according toDaily GPI historical data.

The bone-chilling temperatures this week have led to freeze-offs, according to Genscape.

Genscape’s production data affiliate Spring Rock “estimates there’s about 1.12 Bcf/d of Lower 48 production currently shut-in due to freeze-offs, primarily in the Bakken, Pennsylvania and Oklahoma,” Genscape said in a note to clients Friday. “Western Canada appears to be dealing with freeze-offs too. We estimate there is about 0.7 Bcf/d of Alberta production shut-ins as daytime highs across the province plummeted from the mid-30s last week to negative single digits starting Christmas Day.

“Alberta producers are equipped to deal with such cold, but freeze-offs there do occur early in the winter when there are radical temperature swings like this,” the firm said. “So far, we believe there has been a cumulative 2.4 Bcf of Alberta production shut in over the past five days. It may be a bit before volumes recover” given recent forecasts.

The freeze-offs come as spot prices at Ventura, IA, spiked to record levels in Thursday’s trading, prompting Northern Natural Gas to declare a critical day and impose penalties for shippers taking volumes in excess of scheduled quantities.

Northern cited system-weighted average temperatures well below normal and said it was “at risk of experiencing reduced receipts at pipeline interconnects in its Market Area.”

Prices at Northern Natural Ventura traded as high as $10 Friday but fell well below the prior day’s outsized spikes. Prices there averaged $5.23 Friday after trading as high as $100 the day before.

Northern Border Ventura also spiked Thursday. Northern Border, which travels through Ventura on its way from Western Canada, had an OFO watch in effect at multiple locations on its system Friday “due to cumulative operational imbalance issues.”

Northern Border Ventura averaged $5.25 Friday, down $37.22 from the day before.

Northern Border Ventura and Northern Natural Ventura also led a slew of forwards increases Thursday, according to Friday’s edition of Forward Look.

Points across the Midwest and Northeast, including Chicago Citygate, ANR SW, Texas Eastern M3, Transco Zone 5 South, Dawn and others, gained 10% or more day/day in Thursday’s trading, Forward Look data show.

The February contract at Northern Border Ventura was up 16.3% day/day to $3.368 in Friday’s Forward Look, and the same contract on Northern Natural Ventura jumped 15.2% to $3.336.

“Looks like traders in the Northeast and Midwest are starting to price in some cold weather after our first real taste of it this past week,” NGI Markets Analyst Nate Harrison said. “Prices are rising across the board.”

With the outlook decidedly frigid through the first week of January, forecasters were also watching a potential warm pattern developing later in the month.

Midday data Friday continued “to advertise two dangerously cold arctic blasts in the week ahead, with the first arriving” over the weekend “to cover much of the country east of the Rockies” and the second a “colder trending outbreak Jan. 3-7 across the MIdwest and East,” NatGasWeather.com said.

“Both Arctic blasts are expected to drop temperatures well below normal with lows of -25 to single digits over the northern U.S., and teens to 30s over the southern U.S…While the data is colder trending overall through Jan. 10” milder trends were showing up “over the East Jan. 11-14.”

NatGasWeather said the Jan. 11-15 period could hold the market’s attention over the long holiday weekend “with prices likely to gap in the direction of warmer or colder trends across the North and East.”

PointLogic’s Lammey said the firm’s 11-15 day outlook was showing “some moderation in the extreme winter temperatures will be in order” during the period. “With that said, the overall temperature profile for the Lower 48, as shown by the Global Forecast System model, still has more than half of the country covered in notably cold conditions.”

Parts of the northern Plains, the upper Midwest and the Northeast could see “temperature departures from normal on the magnitude of 10-15 degrees below average,” he said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |