NGI Data | Markets | NGI All News Access

EIA Storage Stats Hold No Surprises as February NatGas Continues Rally

The Energy Information Administration (EIA) on Thursday reported a storage withdrawal in line with market expectations, and the already surging February contract continued unabated.

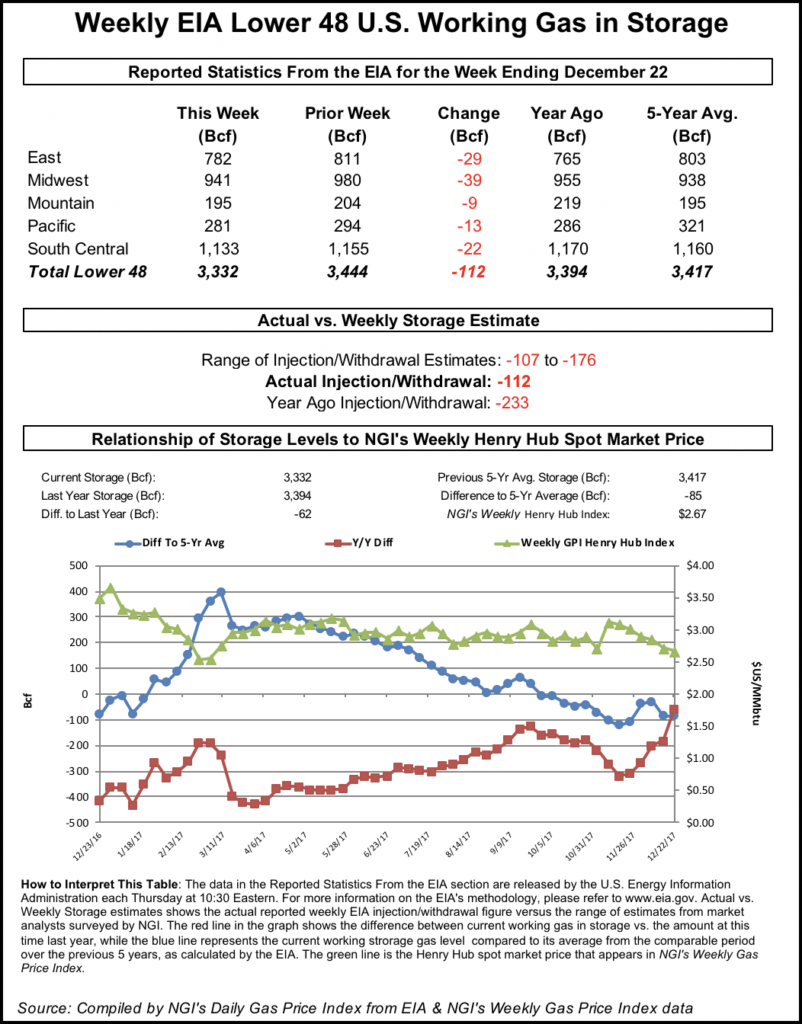

EIA reported a net 112 Bcf withdrawal for the week ending Dec. 22, versus 233 Bcf withdrawn a year ago, and a five-year average withdrawal of 111 Bcf. Last week, EIA reported a 182 Bcf withdrawal.

With forecasts showing frigid below-normal temperatures lingering across much of the eastern two-thirds of the country well into the new year, the bulls weren’t lacking for inspiration as the EIA data went live.

The February contract, taking over as the prompt-month Thursday, had already rallied roughly 15 cents from Wednesday’s settle to around $2.860-2.880 by the time the final number crossed trading desks at 10:30 a.m. EDT. February got a bump as the number came out and marched higher from there. By 11 a.m. EDT, February had climbed above $2.910.

The final figure from EIA fell right in line with consensus estimates.

A Reuters survey of traders and analysts had called for an average withdrawal of 113 Bcf, with responses ranging from -107 Bcf to -176 Bcf.

Stephen Smith Energy Associates, in a report issued over the holiday weekend, predicted a 107 Bcf withdrawal. The firm said this compares to a seasonally normal draw of 82 Bcf, based on 2006-2010 norms. PointLogic Energy on Tuesday predicted a withdrawal of 111 Bcf. ION Energy’s Kyle Cooper called for a 109 Bcf withdrawal.

“Initially it had appeared that the drawdown could be even larger, but a bit warmer weather and elevated production brought the number right in line with our revised estimate,” Bespoke Weather Services said of the 112 Bcf figure.

“We see this print as a bit looser week-over-week but still relatively tight given the widespread warmth last week…We see room to test resistance at $2.98-3.02 into week end, but worry we struggle to move higher with mid-January warm risks and continually growing production.”

Given the cold blast that moved into the Lower 48 this week, the market will now look with great interest to the next few storage reports. Analytics firm Genscape Inc. told clients earlier this week that its preliminary estimate based on pipeline supply/demand balance pointed to a storage draw of around 191 Bcf for the week ending Dec. 29, with the estimate for the week ending Jan. 5 increasing from a draw of 240 Bcf to a draw of 255 Bcf.

Total working gas in underground storage stood at 3,332 Bcf as of Dec. 22, according to EIA. The year-on-five-year deficit increased by one to -85 Bcf for the period, while the deficit versus last year shrank from -183 Bcf to -62 Bcf, EIA data show.

By region, the largest weekly withdrawals came from the East (-29 Bcf) and Midwest (-39 Bcf). The Pacific region saw a 13 Bcf withdrawal for the period, while 9 Bcf was withdrawn in the Mountain region. In the South Central, 22 Bcf was withdrawn, including 6 Bcf from salt and 16 Bcf from nonsalt.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |