NGI Data | Markets | NGI All News Access

Supportive Storage Stats No Match For NatGas Bears; January New Low

A cold forecast and a bullish government storage report couldn’t rescue slumping natural gas futures Thursday, as January took out last week’s all-time contract low. Meanwhile, spot market bulls were stuck waiting on cold temperatures expected to move into most of the country by next week, and the NGI National Spot Gas Average slipped 22 cents to $2.77.

January settled 3.9 cents lower at $2.598 Thursday after trading as low as $2.568, setting new all-time contract lows for intra-day and settlement prices. The previous lows were set last Friday, when January settled at $2.612 after trading as low as $2.581.

The February contract settled at $2.592 Thursday, down 4.4 cents.

“We’ve established that we’re no longer in the range” of $2.75-3.20 “and the market’s behaving as such,” Powerhouse President Elaine Levin told NGI. “I think that’s really the big story. You have a resolution of a trading range to the downside, and really other than testing old support as new resistance, this has been textbook.”

That prices moved lower despite a supportive storage report from the Energy Information Administration (EIA) serves as “an even more bearish confirmation of the technical break, if a fundamental news story couldn’t push it through an important technical number.”

EIA on Thursday reported a larger-than-average storage withdrawal that exceeded consensus estimates, and prices got a bounce after some overnight selling. But even with the bullish miss, the market failed to sustain any kind of rally, and the bears ultimately won the day.

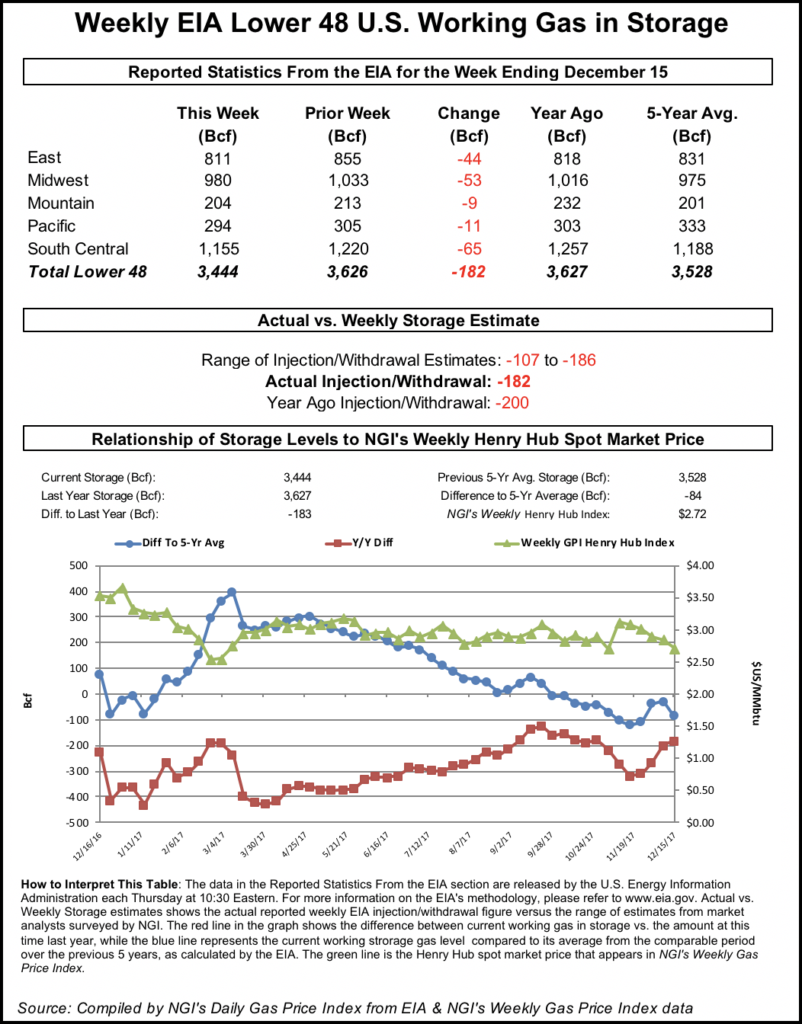

EIA reported a net withdrawal of 182 Bcf from U.S. gas stocks for the week ended Dec. 15, about 10 Bcf to the bullish side of the average of predictions leading up to the report. That’s versus a 200 Bcf draw in the year-ago period and a five-year average pull of 125 Bcf.

The -182 Bcf reported for the week ranks as the fifth largest weekly withdrawal for the month of December since 2010. The largest was -285 Bcf reported for the week ended Dec. 13, 2013, an NGI analysis of EIA historical data shows.

After selling off into the $2.580 area prior to the open, the January contract gained steadily through the morning before seeing a noticeable uptick when the final storage figure crossed trading desks at 10:30 a.m. EDT. The prompt month traded as high as $2.669 in the minutes immediately following the report.

But shortly after 11 a.m. EDT, January — set to expire next week — was trading back around $2.623, down about a penny from Wednesday’s settle.

Prior to the report, traders and analysts had been looking for a large withdrawal, but not as large as the actual figure.

A Reuters survey of traders and analysts on average predicted a 170 Bcf draw for the period. Responses ranged from -107 Bcf to -186 Bcf.

Stephen Smith Energy Associates was calling for a 175 Bcf draw from U.S. gas stocks for the week ended Dec. 15, based on 16 total degree days more than normal for the period. That’s versus a seasonally normal draw of 145 Bcf (based on 2006-2010 norms), the firm said.

PointLogic Energy estimated that EIA would report a 172 Bcf draw for the period. “The significant increase in week-on-week withdrawals comes amid demand gaining nearly 18.5 Bcf/d week-on-week,” analysts said in a note to clients.

Kyle Cooper of IAF Advisors was looking for a withdrawal of 176 Bcf, while Price Futures Group was calling for a pull of 155 Bcf.

Bespoke Weather Services said the bullish miss “seems to indicate more significant demand from the first cold shot of December than the market had priced in thus far.

“Though production has been the central focus, the market has yet to see how truly cold weather would flex demand; this impressive print would seem to present further upside for prices, and is seen as very tight along all historical metrics,” the firm said. “Should weather forecasts hold it would seem to put a $2.75 re-test back in play.”

Total working gas in underground storage ended the week at 3,444 Bcf, according to EIA. That’s versus 3,627 Bcf in the year-ago period and a five-year average of 3,528 Bcf. The year-on-five-year deficit increased for the week from -27 Bcf to -84 Bcf, while the deficit versus year-ago stocks narrowed from -201 Bcf to -183 Bcf, EIA data show.

All regions reported a net withdrawal for the period, led by the South Central at -65 Bcf, including 30 Bcf withdrawn from salt and 35 Bcf withdrawn from nonsalt. The Midwest saw a -53 Bcf net change to inventories, while the implied flow in the East was -44 Bcf for the week.

Asked whether a short-covering rally could be in play ahead of the holiday weekend, Levin said, “You don’t have the same geopolitical issues you do in oil — traders always hate going home short oil for a three day weekend — but still, people will square away a lot of positions” before the holiday break.

As for weather, in its six- to 10-day outlook Thursday, MDA Weather Services said, “The large-scale national pattern remains a colder one, with Alaska and Arctic ridging setting up a pathway for polar air diving southward and into the Lower 48. The result is strongly below normal temperatures over a large part of Canada and the Upper Midwest, with still colder risks for strong belows into the Northeast associated with the passage of a polar vortex near the region in the mid-period.”

Thursday’s 11-15 day outlook also trended colder, MDA said.

“This feature has Arctic connection, and continued cross polar flow leaves this period with much below normal temperatures from the Midwest to the East,” the firm said. “However, confidence is decreasing with the durability of the more intense cold anomalies.”

In the spot market Thursday, some warmer temperatures expected prior to next week’s cold pattern proved enough to sink day-ahead prices in most regions.

AccuWeather was calling for temperatures in Boston to warm up over the next few days, reaching into the 40s over the weekend, and Algonquin Citygate spot prices fell hard Thursday, dropping $4.24 to average $6.63. Tennessee Zone 6 200L dropped $2.79 to average $7.24.

In New York, AccuWeather expected temperatures to rise into the 50s over the weekend, and Transco Zone 6 New York dropped 88 cents to $2.56.

Appalachian prices weakened as well. Columbia Gas fell 8 cents to $2.46, while Dominion South gave up 19 cents to $2.07. Tetco M3 Delivery tumbled 53 cents to $2.25.

MDA was calling for temperatures with highs in the 40s in Chicago Friday, 11.5 degrees above normal, with temperatures expected to flip to below-normal by Sunday.

Chicago Citygate dropped 10 cents to $2.54, while elsewhere in the Midwest, Joliet fell 10 cents to $2.55. In the Midcontinent, Northern Natural Demarcation fell 11 cents to $2.51.

Elsewhere, in the Southeast, Transco Zone 4 fell 13 cents to $2.55, while in Louisiana, day-ahead prices at Henry Hub fell 10 cents to $2.60.

In the Rockies, higher regional demand couldn’t lift spot prices, with most points pulling back from gains the day before. Genscape Inc. was calling for demand in the Rockies region to increase to 2.85 Bcf Friday versus 2.34 Bcf Thursday.

Kern River fell 18 cents to $2.47, and Opal dropped 17 cents to $2.48.

Meanwhile, prices in Arizona/Nevada and at SoCal Border Average recorded sharp increases for the second straight day.

El Paso. S. Mainline/N. Baja jumped 46 cents to $4.46 Thursday, while Kern Delivery added 41 cents to $4.06. SoCal Border Average jumped 83 cents to $4.33, building on a 43 cent gain in Wednesday’s trading.

Utility Southern California Gas (SoCalGas) — dealing with import and storage constraints the past few months — has been forecasting higher demand on its system this week, with sendout expected to peak at 3,585,000 Dth Friday. SoCal Citygate added 27 cents to $5.24.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |