Shale Daily | E&P | Eagle Ford Shale | Marcellus | NGI All News Access | NGI The Weekly Gas Market Report

Cabot Dumps Eagle Ford Assets for $765M, Citing Low Oil Prices

Lower oil prices and the company’s ongoing push to cut costs find Cabot Oil & Gas Corp. exiting the Eagle Ford Shale in two separate deals that are expected to close next year, leaving the company with its core Marcellus Shale properties and exploratory prospects.

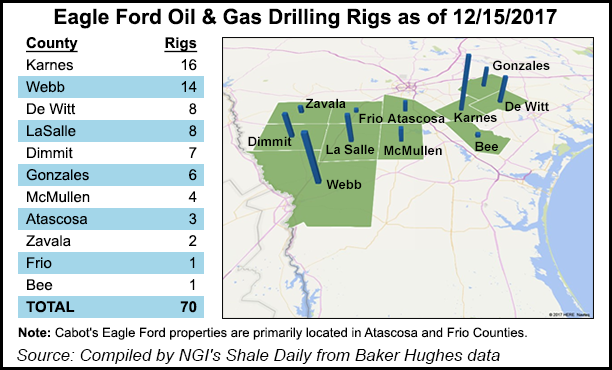

Cabot said it would sell 74,500 net acres in South Texas’ Frio, Atascosa and La Salle counties, including 61,500 that are operated and 9,400 that are nonoperated, to privately-held Venado Oil & Gas LLC for $765 million. Production from the properties was 15,656 boe/d in 3Q2017. The deal is expected to close in the first quarter.

In all, Cabot has 84,000 net acres in the Eagle Ford, according to its website. Its remaining assets in East Texas are being sold to an undisclosed buyer for an unknown price in a separate transaction expected to close in July 2018.

“In a higher oil price environment, the Eagle Ford Shale assets were a nice complement to our Marcellus Shale position and provided capital allocation optionality,” said Cabot CEO Dan Dinges. “However, based on our current outlook for the oil markets and the resulting rates of return from these assets relative to our Marcellus Shale returns, we did not plan to allocate any incremental capital to the Eagle Ford Shale above the current maintenance capital levels.”

Year-to-date, the Eagle Ford assets accounted for just 5% of the company’s production. The company had previously allocated $125-150 for maintenance expenses in the play next year.

Cabot produced 169.5 Bcfe, with the majority of that — or 1.706 Bcf/d — coming from the Marcellus, where the company has long said it could easily produce 2 Bcf/d-plus with more takeaway capacity. Several infrastructure projects are coming online next year that will find the company ramping both production and spending in northeast Pennsylvania to meet the new demand.

While Cabot has long emphasized a clean balance sheet, it plans to fall in line with other exploration and companies heading into the new year. Management teams across the onshore have pledged to focus more heavily on capital discipline, with plans that call for less outspending and a sharper focus on investor returns rather than production growth.

Proceeds from the sale would go toward strengthening the balance sheet and funding potential spending increases for the company’s exploratory programs, among other things. Earlier this year, Cabot identified two new exploration areas in unspecified locations, where it’s targeting oil. The company also recently confirmed that it’s prospecting in Ashland County, OH, at the western fringes of the Utica Shale in an area where Devon Energy Corp. once struck out. It’s considering drilling an exploratory well in a deeper formation there, according to news media reports. It currently plans to spend up $75 million next year on exploration efforts.

In any event, the Eagle Ford sale was not necessarily in the offing. The company recently sold legacy assets in West Virginia for more than $40 million, and it’s been marketing its remaining Haynesville Shale assets.

Cabot said it would record a non-cash impairment on the Eagle Ford assets of $270-280 million in 4Q2017. The company is now guiding for 10-15% production growth next year (18-23% pro forma for the latest divestitures). It had previously guided for 15-20% production growth.

Its 2018 capital budget has also been revised lower to $900 million-$1.0 billion from the previous range of $1.025-1.150 billion. Spending would still be up from this year’s budget of $720 million, and the company’s forecasted capital expenditures in the Marcellus remain unchanged at up to $850 million.

While they questioned the Eagle Ford valuation, financial analysts generally welcomed the sale, noting that the divestiture leaves Cabot with $1.5 billion of debt and $1.3 billion of cash on hand. Liquidity stands at $3 billion, including the cash and an undrawn $1.7 billion borrowing base.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |