Shale Daily | E&P | Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report

Midstream Operators Seen to Benefit with Added Frack Crews Increasing Completions

U.S. midstreamers working in onshore basins should get a “substantial uplift” in 2018 as oil and natural gas producers complete more wells and tie in to expanding infrastructure.

Centennial, CO-based East Daley Capital Advisors Inc. (EDC) identified factors that may give a much needed boost to the domestic midstream sector in the report, “2018 Guidance Outlook: Opportunities Abound for Midstream Investors.”

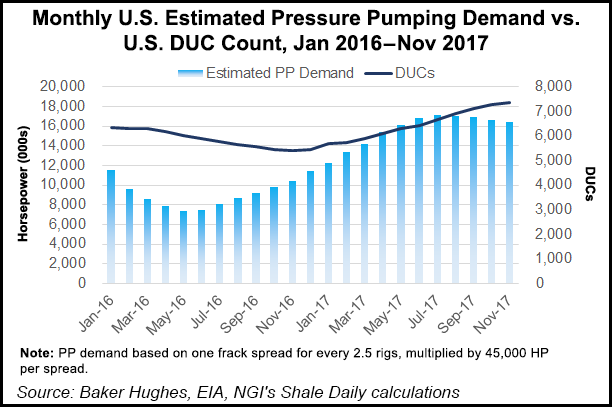

Most of the gains anticipated in 2018 are expected to come as pipeline infrastructure is completed and drilled-but-uncompleted wells are tied to sales. The signs are clear as more fracture (frack) crews are going back to work, said EDC Vice President Justin Carlson.

“The most influential midstream theme in 2018 is our forecast for significant oil and gas production growth,” he said. “The main lag with production in 2017 has been the long lead time for contracting frack crews needed to complete the newly drilled wells.

“We see that changing dramatically in 2018. We do not anticipate that being an issue next year as field service providers are really ramping up their frack fleets. Completions will increase significantly in 2018.”

Bakken Shale completions, primarily in North Dakota, are expected to rebound from 2017 levels, because rig activity rose steadily on stable prices.

Given current prices, guidance from producers and oilfield service providers and the stable forward curve, EDC is forecasting Bakken completions will continue to grow, leading to robust basin growth in 2018.

Also expected to boost the midstream sector is the Marcellus Shale

“The Marcellus will continue to be the best location for midstream companies exposed to natural gas,” said Carlson. “Production in the Northeast is poised to ramp up significantly in 2018 as new pipeline projects debottleneck the region.”

EDC’s team cited three themes for 2018 that should impact the midstream sector. The market is being “overly pessimistic” on midstreamers as East Daley’s adjusted earnings forecasts are skewed positive versus consensus estimates. Second, increasing oil and gas output in 2018 may lag 2017, but it should provide an earnings gain to midstream companies in most of the major onshore basins.

In its third bullet point, however, EDC said some midstreamers could be impacted negatively by “large amounts of long-haul natural gas pipeline capacity contracts that will either be terminated or renewed at a lower-rate, putting downward pressure on earnings in some cases.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |