NGI Data | Markets | NGI All News Access

EIA Reports Slightly Bullish Withdrawal, but Bears Undeterred

The Energy Information Administration (EIA) reported a net withdrawal from natural gas storage Thursday that was slightly bullish to market expectations but not enough to break the bear’s grip on the market.

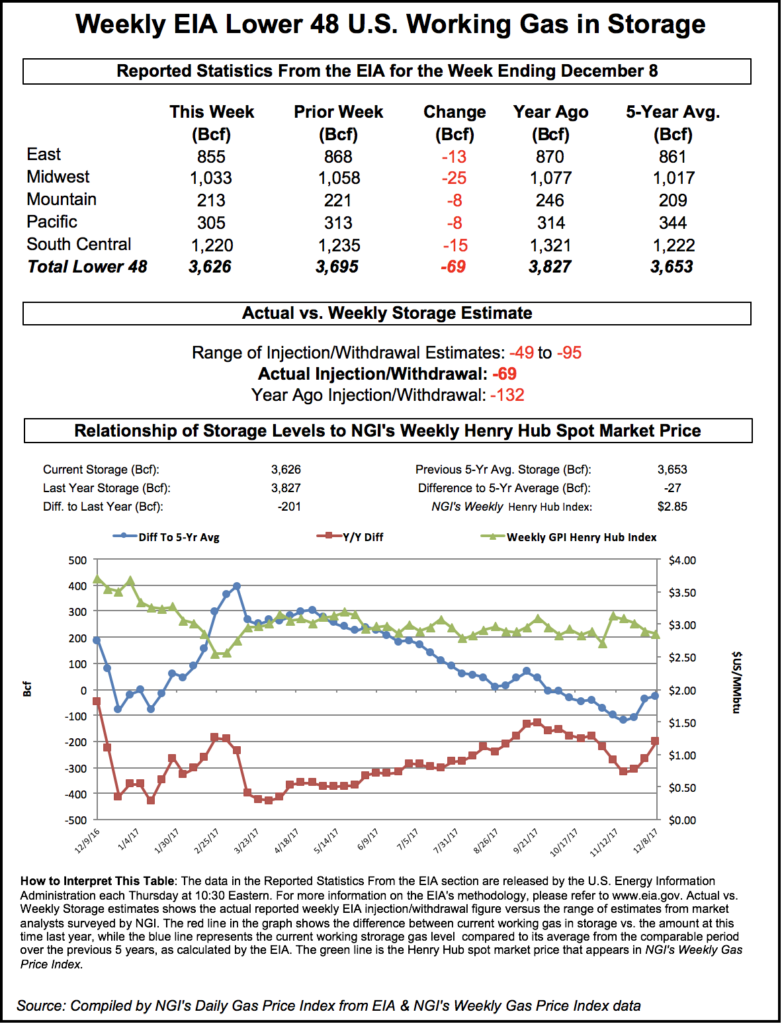

After reporting a rare net injection last week, EIA reported a 69 Bcf withdrawal from U.S. gas stocks for the week ended Dec. 8, a slightly larger pull than what the market had been expecting.

In the minutes immediately following EIA’s 10:30 a.m. EDT report, the January contract dipped lower, trading as low $2.656 at 10:40 a.m. By 11 a.m. EDT, January was trading around $2.670-2.680, down from Wednesday’s settlement of $2.715.

Traders and analysts had been looking for a withdrawal slightly smaller than the actual figure.

A Reuters survey was on average calling for EIA to report a 60 Bcf net withdrawal from U.S. gas stocks for the week ended Dec. 8. Responses ranged from -49 Bcf to -95 Bcf. Last year, 132 Bcf was withdrawn, and the five-year average is a withdrawal of 78 Bcf.

Stephen Smith Energy Associates revised its estimate Tuesday to a 64 Bcf withdrawal for the week ended Dec. 7 after earlier calling for a 60 Bcf withdrawal. Kyle Cooper of ION Energy predicted a 61 Bcf withdrawal. PointLogic Energy was calling for a 57 Bcf withdrawal.

Total working gas in underground storage as of Dec. 8 was 3,626 Bcf, versus 3,827 Bcf a year ago and a five-year average 3,653 Bcf. This week, the deficit to the five-year average narrowed by 9 Bcf to -27 Bcf. The deficit to year-ago stocks decreased week/week from -264 Bcf to -201 Bcf, EIA historical data show.

Bespoke Weather Services said the number “shows a gradual tightening in the natural gas market at these lower price levels. Yet the reaction is not especially bullish” since “the number fell generally within expectations.

“We see it as confirming gradual tightening within the market and marginally decreasing downside,” the firm said. “It may increase support around the $2.65 level, but weather must improve again if prices are going to break back above the $2.75 level.”

By region, the largest week/week withdrawal came from the Midwest, which posted a net 25 Bcf decline. The East saw a 13 Bcf withdrawal, while the Mountain and Pacific regions each posted an 8 Bcf pull.

The South Central region, after recording a 21 Bcf injection the previous week, finished at -15 Bcf for the current report week, all from nonsalt.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |