NGI Mexico GPI | Markets | NGI All News Access

Mexico’s Natural Gas Industry Condemns U.S. Pipeline Export Delays

Natural gas industry leaders in Mexico are strongly criticizing “barriers to the nation’s social and economic development” led by community groups, which the industry claims are blocking new U.S. pipelines to help support gas demand.

The Asociación Mexicana de Gas Natural, aka the Mexican Natural Gas Association, on Monday condemned the use of legal injunctions “to postpone development, the creation of new jobs and the generation of electricity that is cleaner and more competitive in terms of costs.”

The association said it represents 67 companies, both Mexican and foreign operators, that represent about $10 billion in investment.

Delays of up to two years in Mexico have been caused by legal measures, such as injunctions, to halt at least five pipeline construction projects. Mexico’s 2013-2014 energy reform added consultations with indigenous groups to the regular permitting process for projects, along with those of the United States and other countries.

Some of the groups that are objecting to the pipelines, though not all, are from indigenous communities.

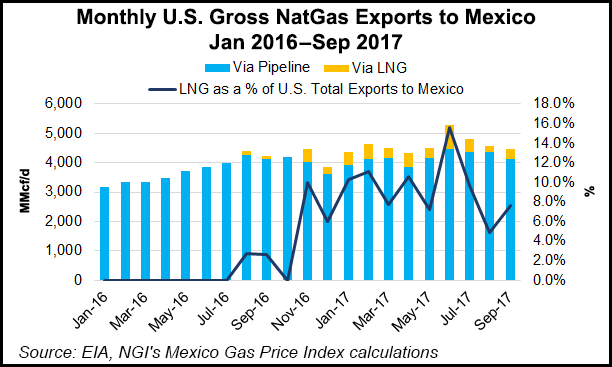

In order to remedy the expected shortages of gas because of the pipeline construction delays, two relatively long-term tenders are to be announced this week to allow for more imports of liquefied natural gas, including the use of a floating storage and regasification terminal.

The tenders are to be announced by CFEnergia, the marketing arm of the state power utility, the Comision Federal de Electricidad (CFE). The contracts are expected to run for up to five years, CFEnergia’s Guillermo Turrent, director-general, told NGI recently. The tenders are to meet requirements not only of the CFE, but of the state oil company, Petroleos Mexicanos, whose production of natural gas has dropped by almost 15% over the last year.

The pipelines facing delays run from the South Texas border to Tula, north of Mexico City, in the center of the country.

Gas infrastructure facing delays include projects by Sempra Energy’s Infraestructura Energética Nova SAB de CV, better known as IEnova; Carso Electric SA de CV, a unit of Grupo Carso, controlled by Carlos Slim, Latin America’s most powerful tycoon; Mexico City-based Fermaca Services SA de CV; and by TransCanada Corp.

The most costly project facing a delay is the $2.1 billion undersea pipeline that would run from South Texas to the Mexican port of Tuxpan on the Gulf Coast. The project was begun in May by a joint venture of Infraestructura Marina del Golfo, a joint venture of TransCanada and IEnova.

The 42-inch diameter Sur de Texas-Tuxpan pipeline is to have a capacity of 2.6 Bcf/d and provide gas to Mexico’s leading center of the private-sector petrochemicals industry in Altamira in the state of Tamaulipas, and then move onward to Tuxpan in Veracruz.

A connection from Tuxpan to Tula in Central Mexico is already delayed by an injunction. And now the Tuxpan pipeline has been delayed by an injunction presented by a fisherman, presumably a member of a fishing cooperative that previously complained about the project.

Both Texas-Tuxpan and Tuxpan-Tula are slated to be operational by the end of next year.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |