NGI The Weekly Gas Market Report | Markets

Snow in Texas Not Enough to Convince NatGas Market of Cold; January Plunges 30 Cents

The U.S. energy capital of Houston woke up to snow and chilly temperatures on Friday, but it wasn’t enough to convince the natural gas market that wintry weather was here to stay, despite long-range weather outlooks indicating frigid temperatures ahead. January forward prices plunged an average 35 cents from Dec. 1 to 7, according to NGI’s Forward Look.

“We entered December with calls for very impressive mid-month cold, and while the cold did verify, the potential for severe cold was only potentially realized,” said Bespoke Weather Services chief meteorologist Jacob Meisel. “The market may feel burned by these colder forecasts accordingly, having priced in very impressive heating demand and only seen modest heating demand increases verify.”

With the risk of a significant cold shot in the final third of December back on the table, the market appears to be shaking that off and taking more of a “show me” attitude, expecting forecasts to moderate as it approaches too, he said.

Weather guidance overnight Thursday remained rather consistent with some gas-weighted degree days (GWDD) lost in the medium range, but also some added in the long range, Bespoke said in a Friday note. There appears to be some consensus around a cold shot moving into the third week of December, resulting in a large burst of heating demand in the final third of the month. The consensus among modeling is also quite strong that a very intense cold pool will settle in across southern Canada.

“It is still unclear just how far south any cold will be able to spread and how far above-average heating demand will be able to get, but the amount of cold risk in the long-range forecast seems at least enough to cancel out most of the warmer trends in the medium-range forecast, offering this market some support heading into the weekend as we stopped shedding GWDDs,” Bespoke said.

Chief meteorologist Larry Cosgrove of WeatherAmerica said weather models for the next week or so show snowfall in the Great Lakes, Appalachia and into the Interstate 81 and 95 corridors. If enough snow accumulates in places like Worcester, MA, and Charles Town, WV, then the European weather model’s argument for a meaningful warm-up over the eastern United States after Dec. 16 may not verify, he said.

“Other ensemble groups seem to point to the colder air being more durable, especially across the Midwest/Northeast. I lean toward a round of cold and frozen precipitation to occur across the Corn Belt into the Mid-Atlantic and New England regions between Dec. 21-28,” Cosgrove said.

Cold weather may be looming, but natural gas markets remained unconvinced as the New York Mercantile Exchange’s January futures contract traded mostly sideways on Friday after tumbling about 30 cents from Dec. 1 to 6. The Nymex January futures contract settled Friday at $2.772, up nine-tenths of one cent on the day.

Bespoke’s Meisel said he sees the market as potentially over-discounting frigid weather risks to close out December, with warmer-than-average weather apparently priced in for January and February as well, at least at current price levels. The Nymex February contract was down 28 cents on the week and settled Friday at $2.79, up 1 cent from Thursday.

“We see significantly more cold risks for the center of the country this January over last January, and even though the focus of the cold may shift from the East into the Midwest, we still see enough heating demand to allow this market to recover some of its losses from the past week and a half,” he said.

It should come as no surprise, however, that traders are leary of recent weather models. It’s been common in recent weeks that weather models show significant cold blasts one day, then warmer trends the next.

There are a couple of different explanations for the volatility in the weather data, Cosgrove said. For one, the construction of the models change over time to either fit a different grid or acknowledge new data sources such as satellite imagery. “Sometimes, the ‘new’ does worse than the ‘old’,” he said.

Another reason for volatility is the fact that it is warmer today than it has been historically, both in terms of the atmosphere and bodies of water. “There’s less snow than what was seen since data processing began in 1948. Some of the analogs I construct show this, as I have to account for the colder history against the new warm reality,” Cosgrove said.

While future weather is always front and center in the gas market, traders also had to contend with a rare storage injection in December. The U.S. Energy Information Administration reported a 2 Bcf injection into storage inventories for the week ending Dec. 1, far below the 43 Bcf withdrawn a year ago and the 69 Bcf five-year average withdrawal.

Estimates ahead of the storage report’s release were wide ranging, and the injection didn’t come as too much of a surprise to the market. But the storage report for the week ending Dec. 8 should also have a notably bearish year/year comparison as it will go up against a -132 Bcf withdrawal, analysts at Mobius Risk Group said.

The Houston-based company said year/year weekly storage changes may prove to be a headwind for the month of December, but “the script could be turned on its head just after the Christmas holiday and heading into the new year.”

Indeed, the market is ripe for a rebound. Technical analysis shows the Nymex January contract is “deeply oversold” and is nearing its all-time low closing price of $2.753 from December 2016, according to NGI’s Patrick Rau, director of strategy and commodity research.

Aside from inconsistent weather, healthy storage inventories and near-record production in the Lower 48, Rau said early indications point to rising capital expenditures (capex) from exploration and production companies in 2018, by as much as 15% year/year.

Much of the increased capex may be focused on oil-heavy areas like the Permian, the South Central Oklahoma Oil Province/Sooner Trend Anadarko Basin Canadian and Kingfisher Counties plays, the Bakken and Eagle Ford, which means more associated natural gas production, Rau said.

In fact, Chevron Corp. has reduced its 2018 total capex plans, but it is set to increase Permian spend in 2018, it said Wednesday.

Meanwhile, Appalachia-based production should also increase significantly next year, based on most regional producers being well hedged into next year, and drilling to help fill new pipeline capacity.

And with LNG exports and pipeline exports to Mexico likely not having much of an incremental impact this winter, “that puts all the more pressure on weather to carry the day, and a 2 Bcf injection to start December is not the start bulls were looking for,” Rau said.

Northeast Markets Getting Hammered

Northeast markets sold off heavily during the week, even as cold weather was expected to drive up demand significantly in the days ahead. AccuWeather reported temperatures in Boston reaching a high of only 30 F last Wednesday, while overnight lows fell into the teens. Temperatures were forecast to remain in the 30s through Dec. 21, with lows expected in the 20s.

Colder-than-normal weather is expected to drive up demand in the region. Data and analytics company Genscape Inc. showed demand in the entire New England region peaking at 3.66 Bcf/d by last Wednesday, up from the recent seven-day average of 3.17 Bcf/d. In the next week, demand is projected to average 3.374 Bcf/d, while softer demand of around 3.194 Bcf/d is expected for Dec. 18-22.

Regional markets responded swiftly to the changing seasons. Algonquin Gas Transmission city-gates January forward prices plunged 47 cents from Dec. 1-7 to reach $8.623, according to Forward Look. February also was down, falling to $8.649, while the balance of winter (February-March) tumbled 41 cents to $6.88. Even the 2018 calendar strip dropped an impressive 21 cents, averaging $4.27.

Forward curves at Tennessee zone 6 200 leg posted similar declines.

In New York, similarly cold weather was on tap for the weeks ahead. After reaching a high of 61 on Dec. 5, New York temperatures were forecast to peak at 28 by Wednesday (Dec. 13), while overnight lows may hit the upper teens, according to AccuWeather. Thereafter, temperatures are expected to return to the 30s and 40s for highs and the 20s and 30s for lows.

Genscape, meanwhile, shows demand peaking at 16.68 Bcf/d on Wednesday (Dec. 13) but then averaging around 17 Bcf/d for the full work week. Demand is then expected to drop to an average 15.376 Bcf/d for the Dec. 18-22 work week.

Transco zone 6-New York January forward prices plummeted som 69 cents from Dec. 1-7 to reach $6.482, February dropped 56 cents to $4.454 and the balance of winter (February-March) slid 45 cents to $3.66, according to Forward Look.

In an unusual twist, the back of the Transco zone 6-New York forward curve saw some action late in the week as the November packages in both 2021 and 2022 jumped more than 15% Thursday alone. November 2021 shot up 41.1 cents to $2.87, while November 2022 jumped 43.4 cents to $2.90.

SoCal Eases As Restrictions Lifted

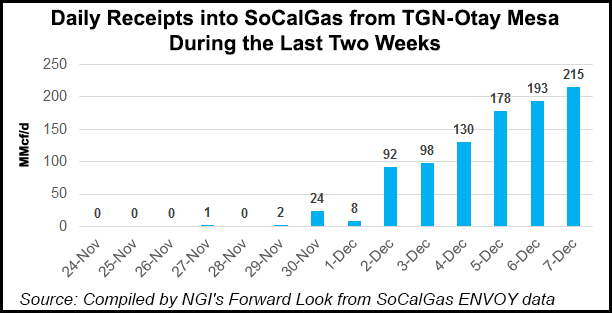

Southern California forward prices finally caught a break after restrictions were lifted at a key import point. After averaging 143 MMcf/d during the two weeks before the restrictions were imposed and reaching a high of 198 MMcf/d in the past two months, Otay Mesa was expected to contribute about 98,000 Dth/d to imports for the week ending Dec. 8, according to Southern California Gas (SoCal Gas).

SoCal City-gate January forward prices dropped 75 cents from Dec. 1 to 7 to reach $3.696, while February slid 62 cents to $3.08, Forward Look data show. The balance of winter (February-March) was down 48 cents to $2.89. The steep drop comes even as several other restrictions, including ones that were imposed as recently as Dec. 1, remain in place. Genscape’s Joseph Bernardi attributed the recent sell-off to a combination of factors, including the renewed flows through Otay Mesa.

One of those additional factors is the revision of the Line 4000 remediation’s end date, which moved to Dec. 25 from Dec. 30. “It’s not a major change, but it’s in contrast to SoCal Gas’ past pattern of pushing back the end date of maintenance events such as this,” Bernardi told NGI a few days ago. “The return of Line 4000 would add an additional 200 MMcf/d of receipt capacity in the Northern Zone, including the return of some capacity at the Needles receipt points.

“This change would give SoCal [Gas] the ability to receive gas in this zone from Transwestern and Questar Southern Trails, instead of relying solely on the Kern-Kramer Junction point,” he said.

It’s also been a relatively mild winter thus far, with only one day of system-wide demand for the utility in excess of 3 Bcf, Bernardi told NGI on Friday. In comparison, there were 11 such days by this point last winter, and seven in the prior year.

“This has allowed SoCal [Gas] to continue building up their storage inventory slowly but surely. Normally by this point in the winter — especially before the Aliso Canyon leak — they would have switched to net withdrawals in earnest, but that hasn’t happened this year,” Bernardi said.

SoCal Gas’ system-wide storage inventory was actually higher on Friday (Dec. 8) than it was on Nov. 1, which is the first time that’s been true since 2012 (and only the third time in the last 15 years), he said.

“There’s still potential for volatility because of the continued import and storage restrictions, but the way the winter has started has certainly led to some bearishness for the next couple months,” Bernardi said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 1532-1266 |