NGI Weekly Gas Price Index | Markets | NGI All News Access | NGI Data

Cash Notches Weekly Gains, But NatGas Futures Not Impressed By Cold

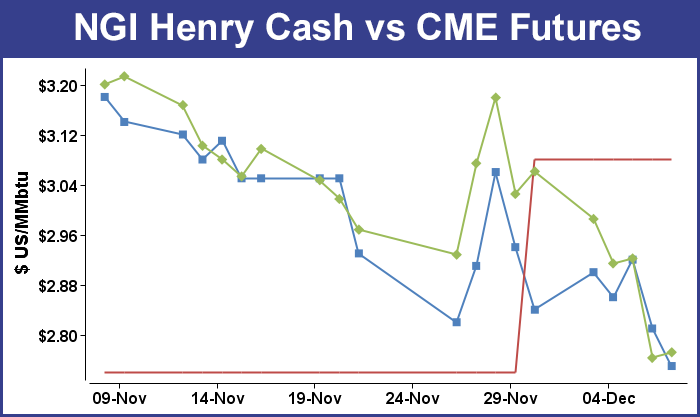

The arrival of winter cold following a period of mild temperatures helped lift natural gas spot prices in some regions this week, but a sell-off in futures showed it wasn’t cold enough to send the bears into hibernation. The NGI Weekly Spot Gas Average gained 18 cents to $2.89.

Chilly temperatures swept into the Midwest mid-week before reaching the East Coast by Friday, creating wintry conditions in parts of the South and Texas along the way.

But weekly spot gas averages showed the Midwest shrugging off the cold. Chicago Citygate traded as high as $2.96 last Wednesday but never cracked $3.00, adding 5 cents for the week to average $2.80. Joliet tacked on 4 cents to average $2.79, while Dawn ratcheted a couple pennies to $2.90.

Prices along the East Coast saw much more pronounced weather-driven gains thanks to a late-week surge. Algonquin Citygate gained $1.38 to $4.25, while Tennessee Zone 5 200L added 50 cents to $3.40. Tennessee Zone 6 200L jumped $1.98 week/week to $5.24. Transco Zone 6 NY gained 74 cents to $3.44.

Further south, Transco Zone 5 recorded big increases late in the week thanks to some wintry conditions in the forecast for the Mid-Atlantic. Transco Zone 5 added 51 cents to average $3.41.

Out West, restrictions at SoCal Citygate continued, and some day/day increases in demand on Southern California Gas Co.’s system prompted trades as high as $7.75 during the week. Even after a steep drop in Friday’s trading, SoCal Citygate finished 90 cents higher for the week, averaging $5.98.

Meanwhile, SoCal Border Average added 17 cents to $3.03, while El Paso S. Mainline/N. Baja tacked on 19 cents to $3.18 and Kern Delivery added 11 cents to $2.92.

In the futures market, the bears were firmly in control for most of the week, with a loose supply/demand balance — confirmed by a very bearish government storage report — informing the move lower. January settled at $2.772 Friday, down sharply after settling at $3.061 the Friday before.

The Energy Information Administration (EIA) reported a net injection into U.S. gas stocks for the week ended Dec. 1, a slight bearish miss on what was already a bearish consensus leading up to the report.

EIA said in its weekly report that U.S. working gas in underground storage showed an implied 2 Bcf build for the period, an unseasonable number that’s far looser than the 43 Bcf withdrawn a year ago and a five-year average 69 Bcf withdrawal.

The market would have to go back five years to find the last time EIA reported a net injection during the month of December — a 2 Bcf build recorded for the week ended Dec. 7, 2012.

Word of a potential injection had spread earlier in the week, and the futures market seemed to have baked in the news. January recorded a small bounce from pre-report levels in the minutes immediately following EIA’s 10:30 a.m. EDT release.

With some overnight warm changes in the weather outlook, January fell sharply from Wednesday’s $2.922 settle, pushing down into the $2.775-2.790 area in the lead-up to the report. By 11 a.m. EDT, January was trading around $2.790-2.800.

The market came into Thursday bracing for an unusually light withdrawal, though a net injection wasn’t out of the question, according to some analysts.

A weekly Reuters survey had revealed on average a 7 Bcf net withdrawal. Responses ranged from -66 Bcf to an injection of 3 Bcf. The -66 Bcf prediction was an outlier, with the next most-bullish survey response coming in at -25 Bcf. Responses to a Bloomberg survey ranged from -14 Bcf to +4 Bcf, with a median of -3 Bcf.

IAF Advisors analyst Kyle Cooper had been calling for a 1 Bcf build for the week, echoing Price Futures Group analyst Phil Flynn, who had also called for an injection. Stephen Smith Energy Associates had been looking for a 7 Bcf withdrawal, as had PointLogic Energy.

“The print missed slightly bearish to our estimates and confirms significant week-over-week loosening that the market has priced in recently,” said Bespoke Weather Services in a note issued shortly after the EIA release.

“Elevated production and very warm weather last week clearly allowed for such a print, which has moved us back far closer to the five-year average. However, it appears the surprise bearish print was not much of a surprise at all; prices moved little off the number, lending support to the idea that this may be a ”buy the rumor, sell the fact’ report. We still see $2.75 support as likely firm, though this print limits short-term upside too.”

The net injection for the week shrank the year-on-five-year deficit to -36 Bcf, versus -107 Bcf last week. Total U.S. gas stocks ended the week at 3,695 Bcf, versus a five-year average of 3,731 Bcf and year-ago stocks of 3,959 Bcf.

The East and Midwest regions recorded weekly withdrawals of 8 Bcf and 10 Bcf, respectively. The Pacific region saw a 1 Bcf withdrawal. The South Central region injected 21 Bcf for the week, according to EIA, including 12 Bcf injected into salt and 9 Bcf into nonsalt.

Natural gas futures traded in a holding pattern Friday, adding less than a penny to the prompt-month contract to cap off a rough week for the bulls. Outside of strong weather-driven gains along the East Coast, the spot market softened also, with prices in some regions barely registering a reaction to the arrival of cold weather. The NGI National Spot Gas Average gained 8 cents to $2.94/MMBtu.

The January contract couldn’t muster a convincing move off support in the $2.750 area Friday, trading as high as $2.820 and as low as $2.757 before settling 0.9 cents higher at $2.772. February settled 1.0 cent lower at $2.792.

The 2 Bcf injection reported by the Energy Information Administration on Thursday vindicated the bears, that were eyeing looseness in the supply/demand balance all week.

“Warmer temperatures coupled with leftover Thanksgiving noise were driving the injection, as weather-adjusted data implies the market is about 1 Bcf/d oversupplied,” analysts with Tudor, Pickering, Holt & Co. (TPH) said in a note to clients Friday. “We’re looking to next week’s report (free of holiday disruption) for more context with expected return to normal weather.”

The TPH analysts noted some “offsetting supply-demand drivers on the horizon, with the anticipated start-up of Rover Pipeline LLC’s Phase 1B, likely accompanied by a production uptick given gas behind pipe” versus “near-term commercial service” of the liquefied natural gas (LNG) export terminal about to start up, Dominion Cove Point in Maryland, which should add to the “export relief valve.”

Meanwhile, “inventories are beginning to push back to five-year norms, likely kicking the legs out from under the winter gas trade stool,” analysts said.

In its latest Monthly Energy Outlook issued Friday, Stephen Smith Energy Associates said the an important factor “is that U.S. gas production has increased by about 2.8 Bcf/d over the last six months. More important, this pace of production growth appears likely to continue or possibly even increase.

“The National Weather Service outlook for 1Q2018 is for near or slightly below normal heating degree days, and we would expect this to lead to about a 300 Bcf decline in the storage surplus by the end of 1Q2018,” the firm said. “But annual production growth for 2018 and 2019 appears likely to be near 5 Bcf/d per year.”

Continued growth in LNG exports and exports to Mexico should help to offset the supply growth, according to the Smith analysts.

From a technical perspective, the prompt month “is extending the down move after breaking below the lower bound of the down sloping channel ($2.87-$2.91) within which the correction since January evolved,” said Societe Generale analysts in a note Friday. “Natural gas is likely headed next towards February 2016 lows of $2.72.

“Daily Stochastic is near a multi-month floor, however reversal signs still lack. In case the support at $2.72 gives way, gas will deepen its slide towards the next projection at $2.63 and $2.52” with $2.87-2.91 being “immediate resistance.”

As for the latest forecast guidance, Bespoke Weather Services said its “sentiment heading into the weekend continues to remain between slightly bullish and neutral, as it has for much of this primarily balance-driven selling.

“We still expect gas-weighted degree days above seasonal averages through the next 15 days, though have noted large medium-term losses. Additionally, we continue to note significant long-range cold risks,” Bespoke said, adding that this “has us still seeing more bullish than bearish risks for the final third of December, and model guidance over the weekend should pick up on this.”

In the spot market Friday, most regional averages finished in the red. The lone exception was the Northeast, where AccuWeather was forecasting snow showers and lows in the 20s and 30s in places like Boston and New York over the weekend.

Algonquin Citygate jumped $2.80 to average $6.79. As of Friday, an operational flow order was in effect on Algonquin Gas Transmission’s system. Tennessee Zone 5 200L added 83 cents to $4.21, while Tennessee Zone 6 200L jumped $2.18 to $7.12. Transco Zone 6 New York tacked on 22 cents to $4.17.

Genscape Inc. reported that the 1,030 MW Indian Point nuclear plant in New York was ramping down for maintenance Friday. “If this generation capacity is replaced one-to-one with gas-fired generation, it has the potential to add 189 MMcf/d of gas demand when the unit is completely offline.” Along with the expected colder weather moving into the region, “this increased gas demand will increase the likelihood of price volatility on Tetco M3, Tennessee Gas Pipeline and Transco Zone 6.”

In Appalachia, Tetco M3 Delivery rose 25 cents to $2.91, while other regional points fell. Columbia Gas dropped 4 cents to $2.63. Dominion South tumbled 22 cents to $2.18.

Rover, planning to bring its Phase 1B online by the end of the year, came a step closer Friday to ramping up its east-to-west capacity out of the Appalachian Basin after FERC approved a request to start up the remaining units at the pipeline’s Compressor Station 1 in Carroll County, OH.

Rover, designed to eventually transport up to 3.25 Bcf/d from the Marcellus and Utica shales to the Midwest, Gulf Coast and Canada, flowed a little over 500,000 MMcf/d Friday from Cadiz, OH, to interconnects with Panhandle Eastern and ANR, according toNGI‘s Rover Tracker.

In the Southeast, Transco Zone 5 also saw a lift from the chilly weather hitting the East Coast, adding 11 cents to average $4.09. Genscape was forecasting Southeast and Mid-Atlantic demand to exceed 19 Bcf/d over the weekend after totaling just over 15 Bcf/d earlier in the week.

In the Midwest, where Genscape was calling for demand to ease over the weekend after peaking at 16.92 Bcf/d Thursday, prices fell. Chicago Citygate dropped 7 cents to $2.63, and Joliet dropped 4 cents to $2.65.

Out West, true to its volatile form as of late, SoCal Citygate took a nosedive, plummeting $2.09 to average $5.39. Southern California Gas (SoCalGas), which remained without the use of key import lines through Topock, AZ, and Needles, CA, Friday, was forecasting system sendout to decrease to just above 2.4 million Dth/d through the weekend after totaling 2.873 million Dth on Thursday. Receipts were expected to total around 2.6 million Dth/d through the weekend after totaling 2.604 million Dth on Thursday, according to the utility.

Other regional points fell also. SoCal Border Average gave up 21 cents to $2.69, and Malin dropped 7 cents to $2.56. In Arizona/Nevada, El Paso S. Mainline/N. Baja dropped 27 cents to $2.81, while Kern Delivery fell 14 cents to $2.67.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |