NGI The Weekly Gas Market Report | Infrastructure | LNG | NGI All News Access

U.S. Targets Middle East for LNG Sales; Russia’s Newest Exports Targeting China

Secretary of Energy Rick Perry in the last few days was making a pitch to export natural gas to the Middle East, opening up U.S. markets, while Russia is prowling for more customers in Asia and elsewhere with the startup of a massive project in the coldest part of the world.

Perry met last Monday with top Saudi officials, including Energy Minister Khalid al-Falih, to make the case for exporting U.S. liquefied natural gas (LNG) to the oil-rich region. At a conference in the United Arab Emirates (UAE), Perry’s delegation also discussed U.S. LNG exports.

Perry and al-Falih signed a memorandum of understanding (MOU) to establish “a framework for mutually beneficial cooperation in the area of clean fossil fuels and carbon management.”

“After a productive and informative visit to the Kingdom…the United States and our friend Saudi Arabia enter an exciting new phase in our energy partnership, building on our collective success with an eye to the future,” said Perry.

“This MOU outlines a future alliance not only in supercritical carbon dioxide, but also in a range of clean fossil fuels and carbon management opportunities. Together through the development of clean energy technologies our two countries can lead the world in promoting economic growth and energy production in an environmentally responsible way.”

Al Falih said the “potential of this cooperation has no limits and its positive impact on the global economy, environment, and energy supplies is so great. The signing of this MOU reflects one of the valuable opportunities this cooperation can avail.”

The outlined objective outlined in the MOU is for the countries to exchange experts, engineers and scientists, along with transferring technology.

Finding a home for the abundant natural gas now flowing from onshore basins in the United States is paramount to the energy industry.

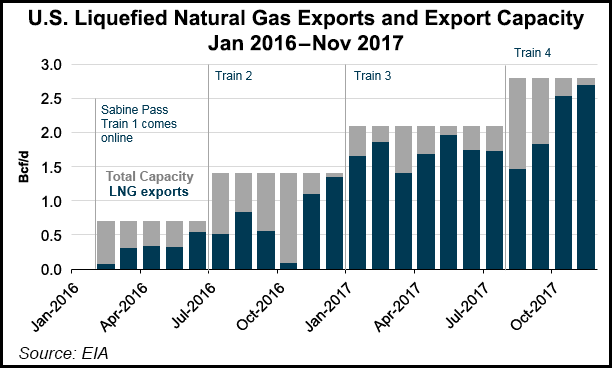

The Energy Information Administration (EIA) in a note published Thursday said total U.S. gas liquefaction capacity in the Lower 48 states increased during August to 2.8 Bcf/d following the completion of the fourth liquefaction unit at the Sabine Pass LNG terminal in Louisiana.

“With increasing liquefaction capacity and utilization, U.S. LNG exports averaged 1.9 Bcf/d, and capacity utilization averaged 80% this year, based on data through November,” EIA experts said.

When all five trains are completed, Sabine Pass is slated to have a total liquefaction capacity of 3.5 Bcf/d.

Five More Coming

Five additional LNG projects are under construction in the United States, and they are expected to increase total domestic liquefaction capacity to 9.6 Bcf/d by the end of 2019, EIA noted, citing:

â— Dominion Energy Cove Point LNG LP, which has begun introducing feed gas to the Maryland facility, has one train with 0.75 Bcf/d capacity and is set to go into service before the end of this month.

â— Kinder Morgan Inc.’s Elba Island LNG project in Georgia, which has six trains scheduled to come online next summer and four more in May 2019, each with 0.03 Bcf/d of capacity.

â— The Freeport LNG project in Texas, designed with three trains each able to provide 0.7 Bcf/d capacity, is being developed by Freeport LNG Development, LP, with the first train citing a ramp up for next November. The other two trains would follow in six-month intervals.

â— Corpus Christi LNG in South Texas, under development by Cheniere Energy Inc., is scheduled to come online in 2019 with two trains, each with 0.6 Bcf/d. And Cameron LNG in Louisiana, with three trains, 0.6 Bcf/d capacity each, is under development by Sempra Energy Inc. with a tentative start-up date of 2019.

According to data by the U.S. Department of Energy, between February 2016, when the United States started exporting LNG, and last September, a total of 26 countries received U.S. LNG, including eight cargos to Kuwait and five cargos to the UAE, EIA noted.

The International Energy Agency (IEA) in November said the United States would become the largest LNG exporter by 2022, accounting for 40% of gas produced globally.

“More than half of the gas production growth in the U.S. will be destined for LNG exports,” said EIA. “According to the IEA, the United States may be on course to challenge Qatar and Australia for global leadership in LNG exports by 2022.”

Russia Not Ready To Cede Ground

Russia, however, is looking to make a challenge.

On Friday, Russian President Vladimir Putin oversaw the launch of the first shipment from the Yamal LNG plant in Sabetta, one of the biggest LNG projects in the world. The Yamal region may contain more gas than the Persian Gulf.

The coldest LNG facility, sited in a corner of the Yamal Peninsula, is a three-train LNG facility able to supply 16.5 million metric tons/year.

Like its U.S. counterparts, Yamal’s reserves are eyeing customers in Asia and Europe. Russia’s Novatek PJSC operates the facility with partners Total SA, China National Petroleum Corp. and China’s Silk Road Fund.

“This first LNG cargo is a testament to the tremendous efforts of the project partners, contractors and all parties who managed to deliver Yamal LNG on time and on budget,” Total CEO Patrick Pouyanne said. “Together we managed to build from scratch a world-class LNG project in extreme conditions to exploit the vast gas resources of the Yamal peninsula…With remarkably low upstream costs, Yamal LNG is one of the world’s most competitive LNG projects and it will contribute to the Group’s gas production for many years.”

At the ceremony, Putin said further expansion of the mega project would be ahead of schedule.

“This is sure a complicated project,” Putin reportedly said. “But those who started this project took a risk, and the risk was justified, and they succeeded.”

Russia has designs on LNG plants extending from the Baltic region to its Pacific coast, armed to take on not only the United States, but Australia and Qatar.

The first Yamal cargo is destined for China in recognition of its financial support — and its thirst for gas. Chinese sponsors provided the lion’s share of Yamal financing at $12 billion as it the country appears ready to jump over South Korea to become the world’s second largest LNG consumer after Japan.

In a note Friday, analysts with Barclays Capital said on a year/year basis, China’s energy commodities imports remained strong, with gas imports up 42% and oil rising 15%.

The latest customs data for November, said Barclays, indicate total gas imports reached 6.9 billion cubic meters (bcm), “an increase of 42% from last year and up almost 13% month-on-month. Total year-to-date import levels have amounted to 64 bcm, up 27% from the 51 ccm imported during the same period last year.”

The Chinese government has made a push to encourage more gas use, and higher incremental demand levels “will now meet peak winter demand levels,” according to Barclays. However, this “could put China in a precarious gas supply situation, depending on how winter weather unfolds. Chinese production levels have remained relatively static at about 12 bcm over the course of the year, failing to keep up with demand increases and leaving China more dependent on higher levels of imports.”

The analyst team at BofA Merrill Lynch Commodity Research also on Friday said China was “gobbling up” gas imports, boosting purchases by 60% in the first 10 months of this year.

Asian spot LNG prices have reached almost $10/MMBtu, the highest since January.

“All in, Asian demand turned out unexpectedly healthy, with repercussions for gas pricing across the world,” said analysts. “But that is not all. Spot LNG prices also moved up due to delays of new projects, as well as production problems in Australia and Indonesia at the start of the Northern Hemisphere winter. In addition, the surge in oil prices provided support to LNG as it lifted the breakeven price for long-term contracts.”

The United States has yet to have issues in placing more LNG volumes in Latin America and Asia, but Europe has taken less LNG than expected, analysts noted.

“In our view, this is unlikely to be sustained in 2018-19 when more LNG supply hits the market. The lumpiness of supply could also introduce more volatility to global LNG prices, especially in 2019 when we expect more significant downward pressure to emerge.”

Meanwhile, Cheniere continues to rack up contracts for more gas exports from its U.S. projects.

Cheniere Marketing International LLP has signed a multi-year sales agreement with the trading arm of Austria’s OMV Group. Per the deal, Cheniere agreed to deliver LNG from the Sabine Pass terminal to Europe. Details were undisclosed regarding the pricing and duration.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |