NGI Data | Markets | NGI All News Access

Despite Chilly Forecast, Bears Not Sleeping on NatGas Futures; Cash Firms as SoCal Spikes (Again)

Natural gas futures continued lower Tuesday, with a wintry forecast unable to persuade a skeptical market seeing signs of looseness in the fundamentals. A cold blast set to move through this week helped lead prices higher in the cash market, though increases were modest in many regions; the NGI National Spot Gas Average climbed 7 cents to $2.86/MMBtu.

After a big sell-off dropped the January contract below $3.00 Monday, the prompt month fell again Tuesday, settling 7.1 cents lower at $2.914. February settled 6.8 cents lower at $2.920.

Despite the imminent arrival of winter weather, the bears don’t seem willing to go into hibernation.

“We’re going to get this blast of cold,” Powerhouse’s Elaine Levin, president of the Washington, DC-based risk management firm, told NGI. “The question is will it stay? And that’s in the face of rising production. The concerns are that if you do see a warmer winter with higher production, that would be the combination to push us down.”

That long-standing prompt-month trading range — roughly $2.750-3.200 — continues to hold, Levin noted. The shorts could be waiting for prices to move lower in the range, likely below $2.900, she said.

“I think you can expect good support as you move below $2.90 and into the $2.80s. It’s held there before. There’s a good history of buying at that level.”

Meanwhile, early predictions point to another bearish inventory report Thursday from the Energy Information Administration. After last week’s 33 Bcf withdrawal fell short versus the year-ago and year-on-five-year figures, the upcoming report could feature an even lighter pull.

Stephen Smith Energy Associates revised its estimate Tuesday from 10 Bcf net withdrawal to a 7 Bcf withdrawal for the week ending Dec. 1, based on total degree days for the period coming in 43 below normal. The 7 Bcf draw “compares with a seasonally normal weekly draw of 160 Bcf” based on 2006-2010 norms, the firm said.

PointLogic Energy was also calling for a 7 Bcf net withdrawal for the period. “This significant decrease in week-on-week withdrawals comes amid demand falling by nearly 5 Bcf/d week-on-week,” the firm’s analysts said, pointing to a decline in Midwest residential/commercial demand as a key driver.

“…On the supply side, total production for the week increased by 0.8 Bcf/d, with the majority of the increase coming from the Northeast’s Marcellus Shale,” the analysts said.

Bespoke Weather Services said it is maintaining a neutral to “slightly bullish” outlook “as the weather remains supportive for the market, but the recent loosening has crushed the natural gas strip.”

After gas-weighted degree day (GWDD) declines in the overnight data, “we saw afternoon guidance Tuesday come in more mixed, with medium-term GWDD additions confirming our colder forecasts despite varied long-range output…We noticed prices bounce a bit off a colder run” in the European model Tuesday, “indicating the market is beginning to focus a bit more on weather…after having priced in looser balances.”

The cash market’s response to the arrival of chilly temperatures could play a role in determining the direction of futures, and could potentially serve “as an upward catalyst to pull us off $2.88 support,” Bespoke said.

Near-term forecasts had the spot market prepping for wintry weather Tuesday.

Natural gas analytics firm Genscape Inc. said Tuesday that its previous seven-day average of 76.2 Bcf/d Lower 48 demand is expected to increase to 96.1 Bcf/d over the next seven days as a cold system should hit the Midwest before sweeping eastward.

Day-ahead prices generally firmed, though gains were more muted outside the Northeast.

With a Nor’Easter in the cards, prices in New York and New England gained, with some Appalachian points following suit. Algonquin Citygate added 52 cents Tuesday to $3.43, while Tennessee Zone 6 200L gained 62 cents to average $4.37. Transco Zone 6 New York tacked on 11 cents to $2.97.

In Appalachia, prices were mixed. Tetco M3 Delivery added 21 cents to $2.62, while Tetco M2-30 Receipt added 3 cents to $2.28. But Columbia Gas gave up 3 cents to $2.71, and Dominion South traded down a penny, ending the day at $2.33.

Producers have less capacity to move gas westward out of the Appalachian Basin this week. East-to-west flows on the Rover Pipeline were reduced to 0 MMcf/d for Tuesday’s gas day, according to NGI‘s dailyRover Tracker.

Genscape said in a note to clients Monday that Rover planned to cut operational capacity on its Cadiz Lateral — affecting the Cadiz-MW and Cadiz-ORS receipt points — to 0 MMcf/d for the Tuesday and Wednesday gas days to accommodate installation of the Cadiz Compressor Station.

With Rover currently only providing service from Cadiz to Defiance, OH, this maintenance effectively reduces flows on the pipe to zero, Genscape noted.

“Since Oct. 10, when partial service through Rover’s Compressor Station 1 was approved, through early November, total receipts averaged 1,020 MMcf/d — hitting a max of 1,150 MMcf/d Nov. 4-6,” Genscape said. “Volumes dropped off starting Nov. 7 as winter demand ramped in Appalachia; average total receipts from Nov. 7 to the end of the month decreased to 878 MMcf/d.”

More recently, Rover flows have decreased further, with the Cadiz-MW point cut to 0 MMcf/d since Dec. 1 and overall volumes averaging 515 MMcf/d during that time, according to Genscape.

“The December decline can likely be attributed to increased demand in Appalachia, in conjunction with pre-maintenance flow decline,” the firm said. “With the cuts to Rover, receipts to both Tetco and REX from the Ohio River System, and Dominion East Ohio from MarkWest, have increased correspondingly.”

In most other regions, points traded within a nickel of even. Henry Hub gave up 4 cents to $2.86. Chicago Citygate added 3 cents to $2.89, while Northern Natural Demarcation picked up 3 cents to end at $2.84.

Out West, prices surged in Southern California, where high winds stoking wildfires in the Los Angeles area had Southern California Gas Co. (SoCalGas) working with officials to keep the public safe and minimize service interruptions.

SoCal Citygate, still dealing with critical import restrictions, jumped $1.02 to $6.01. SoCal Border Average also spiked, adding 46 cents to $3.44, which includes SoCalGas imports through an interconnect with El Paso Natural Gas at Ehrenburg, AZ.

SoCalGas was scheduled to begin maintenance Tuesday that would reduce imports from El Paso Natural Gas (EPNG) through the Ehrenberg interconnect by about 150 MMcf/d, Genscape said Monday.

As of Tuesday, SoCalGas was forecasting receipts through El Paso-Ehrenberg to total 734,826 Dth Tuesday through Friday, down from 1,039,000 Dth scheduled on Monday.

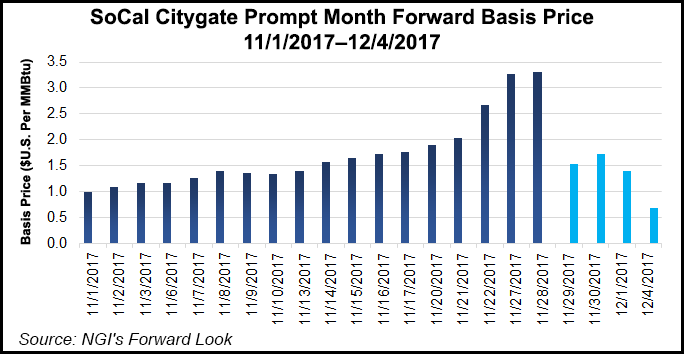

But some price relief could soon be on the way after months of inflated basis at SoCal Citygate. Recent forwards trading activity shows the market expecting the supply constraints into Southern California to ease somewhat by January.

SoCal Citygate prompt-month forwards decreased sharply with the roll-over from December to January; fixed price trades averaging $6.374 for the December contract on Nov. 28 gave way to a January average of $4.719 for the Nov. 29 trade date, Forward Look data show.

Fixed prices for January have dropped even further since that point, falling nearly 18% day/day to average $3.665 in trading Monday, according to Forward Look.

Genscape analyst Joseph Bernardi told NGI the restoration of flows through SoCalGas’s TGN-Otay Mesa receipt across the Mexico border is “definitely” a potential factor in the recent easing of SoCal Citygate forwards.

“SoCalGas also changed the end date of the Line 4000 remediation from Dec. 30 to Dec. 25. It’s not a major change, but it’s in contrast to SoCalGas’s past pattern of pushing back the end date of maintenance events such as this,” Bernardi said. “The return of Line 4000 would add an additional 200 MMcf/d of receipt capacity in the Northern Zone, including the return of some capacity at the Needles receipt points.

“This change would give SoCal the ability to receive gas in this zone from Transwestern and Questar Southern Trails, instead of relying solely on the Kern-Kramer Junction point.”

The TGN-Otay Mesa receipts were scheduled to total 229,600 Dth/d Tuesday to Friday, up from 130,000 Dth on Monday, according to SoCalGas.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |