Shale Daily | E&P | NGI All News Access | NGI The Weekly Gas Market Report

Duvernay Ramp Up Only Needs Modest NatGas, Oil Price Increases, Say Experts

Canadians can make a strong start on tapping Alberta’s Duvernay Shale, even if natural gas and oil prices stay flat, according to an economic geology forecast by government earth scientists.

At 2017 averages of C$60/bbl ($48/bbl) for oil and C$2.50 per gigajoule (GJ) ($2.10/MMBtu) for natural gas, the forecast for profitable Duvernay production is 12 Tcf of natural gas, 1.4 billion bbl of natural gas liquids (NGL) and one billion bbl of oil.

Prices only have to rise modestly to drive swift output growth from the 130,000-square-kilometer (52,000-square-mile) formation, according to the economic review of a resource endowment study by the Alberta Geological Survey and National Energy Board (NEB).

At C$70/bbl ($56/bbl) for oil and C$3/GJ ($2.52/MMBtu) for natural gas — annual average prices rated as conceivable in 2018 by the Alberta Energy Regulator — forecast Duvernay production jumps to 32.9 Tcf of natural gas, 3.4 billion bbl of NGL and 2.2 billion bbl of oil.

High NGL and oil yields from formation sweet spots drive the production expectations.

“Some areas of the Duvernay natural gas resource are economic at negative gas prices,” the NEB study said. “In those areas, companies earn enough revenue from the oil and NGL production from a well that they can lose money on the natural gas production and still make a profit.”

The total Duvernay endowment of recoverable reserves is estimated at 77 Tcf of gas, 6.3 billion bbl of NGL and 3.4 billion bbl of oil.

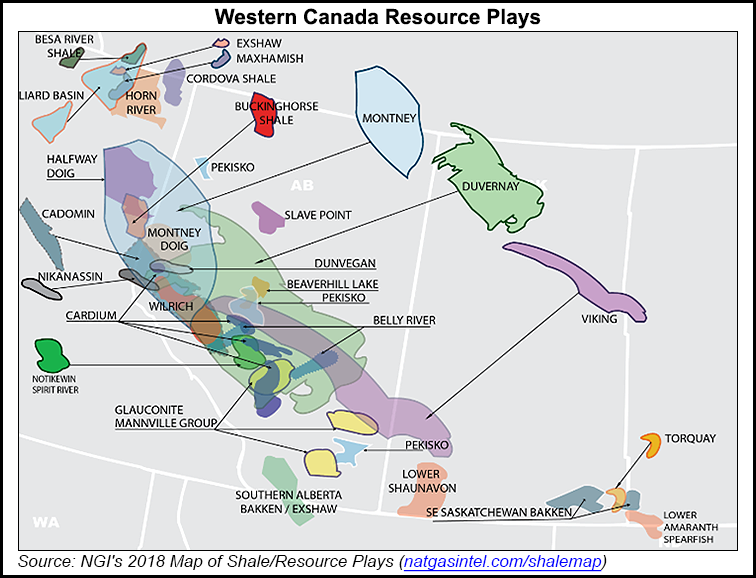

The Duvernay rates as Canada’s second-richest shale deposit after the Montney formation, which straddles northern British Columbia and Alberta with estimated marketable resources of 449 Tcf of natural gas, 14.5 billion bbl of NGL and 1.1 billion bbl of oil.

Numerous producers, including Chevron Canada Ltd., Encana Corp. and Shell Canada Ltd., are in the early stages of Duvernay supply development, using northern adaptations of horizontal drilling and hydraulic fracturing.

After three years of field trials, Chevron Canada last month said extended supply development was in the Kaybob Duvernay area of west-central Alberta. Pembina Pipeline Corp. also agreed to construct a C$290 million ($230 million) first stage processing facilities for a long-range drilling campaign.

“The Duvernay formation is one of the most prospective liquids-rich shale plays in North America,” said Chevron Canada President Jeff Gustavson.

Resource endowment estimates and production forecasts are both liable to grow as industry gains experience and efficiency, the forecast stated. “Duvernay Shale economics are very sensitive to declines in well costs. As well costs fall, increases to oil and gas prices cause economic resources to grow more rapidly.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |