Slightly Bearish EIA Storage Report Barely Moves NatGas Futures as Market Focuses on Weather

The Energy Information Administration (EIA) reported a net withdrawal from natural gas stocks Thursday that fell on the bearish side of market expectations, but the report failed to move the needle in the January contract as forecast December cold remained the focus.

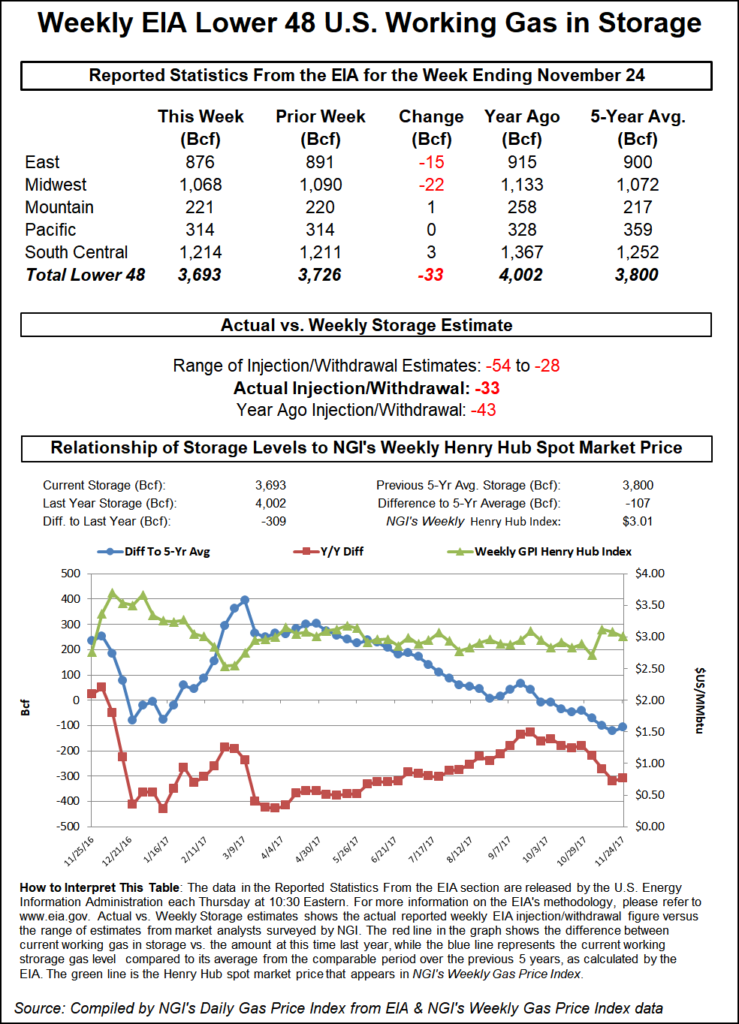

For the week ended Nov. 24, EIA reported a net 33 Bcf withdrawal from U.S. gas stocks. Last year 43 Bcf was withdrawn, and the five-year average for the period is a withdrawal of 47 Bcf.

In the minutes following EIA’s 10:30 a.m. EDT release, the January contract briefly dipped as low as $3.051 before settling back into a choppy pattern in the $3.065-3.080 area that had preceded the report. By 11 a.m. EDT, January was trading around $3.073.

The prompt month opened about 8 cents lower Thursday on some warm changes in the overnight weather data concerning a cold pattern starting next week that drove the market higher this week.

Bespoke Weather Services judged the -33 Bcf figure as “slightly bearish,” coming in “a bit looser than last week’s print but on a 10-week basis is about flat.

“The market appears unimpressed, barely moving off the print as focus is instead on forward weather expectations and increasing production levels,” Bespoke said. “We see this number as confirming our concerns about elevated production being able to absorb additional demand as we move through the winter, and see current market balance as one key reason we have pulled back so significantly from highs despite only limited gas-weighted degree day losses.”

The market had been anticipating a slightly larger withdrawal than the final number.

A Reuters survey of traders and analysts had predicted on average a 37 Bcf withdrawal for the week, with responses ranging from -28 Bcf to -54 Bcf. Kyle Cooper of ION Energy expected a 33 Bcf withdrawal, while Stephen Smith Energy Associates was calling for a withdrawal of 41 Bcf, lower than an original estimate for a 45 Bcf withdrawal. PointLogic Energy models were predicting a 35 Bcf withdrawal.

Total working gas in storage now stands at 3,693 Bcf, versus year-ago stocks of 4,002 Bcf and a five-year average of 3,800 Bcf. The year-on-five-year deficit shrank week/week by 14 Bcf to -107 Bcf, the EIA data show.

By region, the Midwest saw a 22 Bcf withdrawal for the week, while 15 Bcf was withdrawn in the East. The Mountain region saw 1 Bcf injected for the period, and 3 Bcf was injected in the South Central region, including 8 Bcf injected in salt storage and 5 Bcf withdrawn from nonsalt.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |