NGI The Weekly Gas Market Report | LNG | Markets | NGI All News Access

LNG Exports Won’t Make Or Break Gas Market, But E&Ps May Benefit

Vast supplies of low-cost natural gas have put the United States on track to becoming the largest exporter of liquefied natural gas (LNG) within the decade. But before reaching that level of global dominance, a handful of export facilities due to begin service over the next year will provide some much-needed relief to producers in key unconventional plays and serve as a test for a gas market contending with new demand.

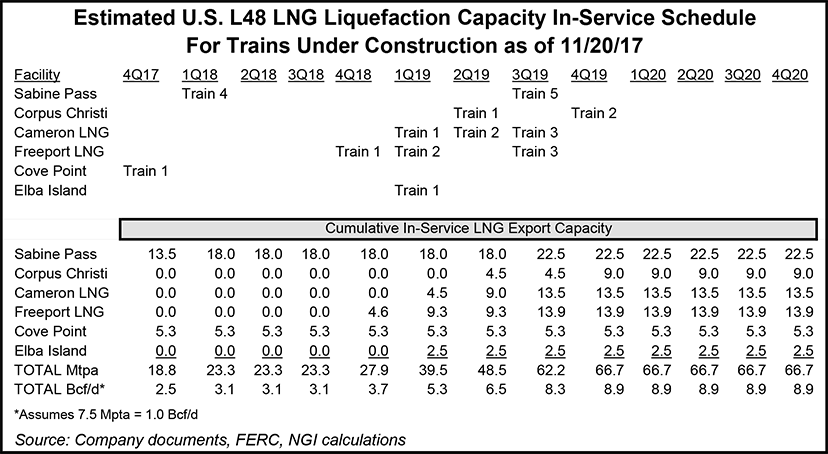

Nearly 20 Bcf/d of U.S. approved LNG export facilities are either under construction or waiting to break ground. Already, the United States is exporting roughly 3 Bcf/d of LNG, and that number will grow by more than 1 Bcf/d over the next year as the fourth train at Cheniere Energy Inc.’s Sabine Pass, along with Dominion Resources Inc.’s Dominion Cove Point LNG and Kinder Morgan Inc.’s (KMI) Elba Island LNG facilities enter service.

Still, the new demand won’t make or break the natural gas market. Even with new demand coming from LNG exports, analysts expect weather to remain the key driver for the gas market. Exports, in general, increase baseload demand almost year-round, said RBN Energy gas analyst Sheetal Nasta.

“Of course, we can’t assume they’ll operate at full capacity all the time. So maintenance outages, either on the pipeline or terminal side, could still cause some disruptions/volatility,” Nasta said.

But weather is the key factor the market is watching even as more exports begin commercial service during the height of the winter season. In fact, if the coming winter is a repeat of the last two mild winter seasons, overall demand may not be enough to offset the production growth occurring at the same time, even with incremental LNG export demand.

“Part of why we’ve seen prices go up recently is because we finally had more normal weather in October and in the past week or so, we’ve also seen some much colder-than-normal weather,” Nasta said.

To illustrate how fickle the gas market is, as of Tuesday (Nov. 21), the New York Mercantile Exchange (Nymex) December contract sat at $3.017, more than 20 cents below prices two weeks prior as warming trends in the long-range weather forecasts pressured the market.

For the coming winter, under a scenario where production averages 74-75 Bcf/d, imports are flat to last winter and LNG exports run at full capacity all season, “then you’re going to have 3.5-4.5 Bcf/d more supply in the market this winter than last, and only 3.0 Bcf/d more demand winter on winter,” Nasta said. That includes Mexican exports averaging 4.5 Bcf/d and power, residential/commercial and industrial demand remaining relatively flat to last year.

Meanwhile, 6.0 Bcf/d of new takeaway capacity is coming online this winter, which could boost production even more. The largest among those is Energy Transfer Partners LP’s 3.25 Bcf/d Rover Pipeline, which has begun flowing gas with the second part of the project’s Phase 1 expected online before year’s end.

Columbia Gulf Transmission LLC’s 1 Bcf/d Rayne XPress and Texas Eastern Transmission LP’s (Tetco) Adair Southwest and Access South expansions also have begun service. The in-service date for Columbia Gas Transmission LLC’s 1.5 Bcf/d Leach XPress has since been pushed back to January 2018.

Nasta said the market could see a little more demand from exports to Mexico over the next few months too, which could help the market overall.

“But in general, with another mild winter like last year and production near 75 Bcf/d, the balance would be bearish compared to last winter when production averaged only 70.5 Bcf/d. If we get close to normal or below-normal temperatures for much of this winter, however, the balance could end up tightening significantly.”

PA Consulting analyst Michael Bennett agreed that while the market is tight, it also has been waiting for LNG export demand to emerge for years.

“Weather will be and always has been the great unknown with gas markets. 2018 will certainly be a test given that Sabine’s train 4 and Cove Point alone could add an additional 1.2 Bcf/d of demand, but production has started to climb as of late and increased demand could open the door for further production gains,” Bennett said.

However, the high demand experienced to date could foretell what’s to come if cold weather arrives, Bennett said.

“Demand peaked in the upper 90s Bcf/d on Oct. 10, representing some of the highest early winter demand on record,” he said. “This was possible due in part to new export dynamics from both Mexico and LNG. With storage inventories sitting roughly 100 Bcf below the five-year average, a cold winter and this new baseload export demand could result in much larger swings in demand and spot prices.”

If milder temperatures are on tap for the remainder of the winter season, LNG exports would then provide a buffer to prevent a complete fall-out of prices, said BTU Analytics analyst Matthew Hoza.

The Lakewood, CO, analytics company is projecting demand to average 97 Bcf/d this winter, assuming normal weather, “which seems to be a bigger and bigger if,” Hoza said. BTU expects production to average 85 Bcf/d.

Relieving Pennsylvania Takeaway

While LNG exports are not expected to have a material impact on the market immediately, the emergence of new demand should lead to changing dynamics on a regional level, Hoza said. Cheniere’s Sabine Pass facility has the benefit of being located on the Gulf Coast, while Dominion’s Cove Point, for example, would have direct access to the vast supply from the Marcellus and Utica shales.

Cove Point would able to receive gas from Transcontinental Gas Pipe Line Co. (Transco), Dominion and Columbia Gas pipelines, and the project would benefit Appalachian producers, Hoza said, especially once Transco’s Atlantic Sunrise pipeline goes online.

Cabot Oil & Gas Corp. plans to move up to 850 MMcf/d to the terminal via Atlantic Sunrise, but the 1.7 Bcf/d project is not expected in service before mid-2018. The operator is one of a handful of dominant producers active in the bottlenecked northern tier of the Marcellus.

Construction resumed on the project earlier this month after the U.S. Court of Appeals for the District of Columbia denied an emergency motion to stay FERC’s certificate for the expansion. Work was halted for three days while the three-judge panel ordered a temporary administrative stay of the project’s certificate on Nov. 6, forcing Transco parent Williams Partners LP to suspend construction while the court considered an emergency motion filed by a coalition of environmental groups. The court had limited the stay only to construction in Pennsylvania and not other operations outside the state or partial service that was started on the project over the summer.

Atlantic Sunrise would move natural gas from a constrained area in northeastern Pennsylvania to Mid-Atlantic and Southeast markets. Brownfield construction on mainline replacements and equipment modifications started months ago, while greenfield construction started in September.

“Cove Point has said they have other ways to get the gas there, so it’ll be interesting to see how flows evolve there,” Nasta said.

KMI’s Melissa Ruiz, director of corporate communications, said while the gas coming from the Elba Island’s interconnect with Transco is likely to originate from Pennsylvania and Ohio, it could also be sourced from conventional Gulf of Mexico resources off the Transco system through Elba Express Pipeline or from various sources along the Southern Natural Gas (SNG) system.

KMI’s Elba Express Pipeline is a 200-mile system that extends from the Elba Island LNG terminal to the Transco pipeline in Hart County, GA, and Anderson County, SC.

“Transco connects to Elba right near the intersection of Transco zone 4 and zone 5, and I think Transco is still flowing net northbound through part of zone 5, (where the null point on Transco is). Atlantic Sunrise will change that,” Nasta said.

PA’s Bennett agreed, noting backhauls on Transco that would bring Marcellus/Utica supplies to Elba Express may mean that gas would compete with Northeast demand in the winter months. It could present an opportunity for the null point on Transco to swing if Gulf Coast volumes are priced low enough.

Tetco’s Access South can also deliver into SNG. Access South is one of two pipeline reversal projects that Tetco has recently brought online; the other is Adair Southwest. They each target Marcellus/Utica production. Combined, the brownfield projects are designed to add 520,000 Dth/d of incremental north-to-south Appalachian takeaway capacity on Tetco, which runs from the Gulf Coast to the Northeast.

Tetco’s initial in-service request to FERC included 416,000 Dth/d of the total designed capacity [CP16-3]. The pipeline expects to ramp up to 500,000 Dth/d on the expansions later this month.

Exports Won’t Egg E&Ps To Ramp Up

Meanwhile, the growth in LNG exports, particularly on the East Coast, has undoubtedly been a consideration for some E&Ps making their production plans for 2018. While most producers are making decisions based on numerous market dynamics and financial obligations, both Cabot and Antero Resources Corp. have supply contracts with off-takers at the Cove Point facility.

“Unless these producers have enough drilled but uncompleted wells to support an extra 600 [Mcf] or so a day of demand, they have most certainly been preparing for this new demand,” Bennett said.

With Cabot being subscribed to large amount of the Atlantic Sunrise project, the producer can opt to send these molecules to the Atlantic Seaboard and Southeast in the event gas is not needed at the Cove Point, which will put downward pressure on pricing in these regions, he said.

For others producers, however, the recurring theme in most E&P 3Q2017 earnings calls was spending within cash flow.Speaking during the 3Q2017 call, Devon Energy Corp. CEO Dave Hager was blunt. “We fully acknowledge that our industry in general has not delivered acceptable returns. And that we are absolute — and I would include Devon in it — we are absolutely committed, on a go-forward basis, to deliver acceptable returns at the corporate level to our shareholders.”

During Southwestern Energy Co.’s 3Q2017 earnings call, CEO Bill Way said the focus is on creating value and improving returns on every dollar it invests.

“We’ll take the options of investing at the drillbit and weigh those with debt reduction and any other options that come to the table” to create the highest value-adding plan to go forward,” Way said. This “isn’t about production growth at all costs; it hasn’t been for us, and it won’t be for us going forward. It’s an outcome.”

Chesapeake Energy Corp. CFO Nick Dell’Osso echoed those sentiments on third quarter call, indicating the focus continues to be “value versus volumes.” He said the operator would “remain flexible with our capital should prices rise or fall dramatically, but we do not plan to chase capital higher as a result in the recent modest increase in the 2018 strip.”

LNG Exports At A Glance

More than 1 Bcf/d of LNG exports will soon hit the U.S. gas market, laying the groundwork for a major structural shift toward more flexible and globalized gas markets.

Cheniere, the first mover in the Lower 48 for exports, achieved first production at the fourth train of its six-train Sabine Pass in Louisiana last summer. Commissioning cargoes have boosted deliveries to more than 3 Bcf/d. The company is on track for that cargo to see a date of first commercial delivery (DFCD) in the first half of 2018, management said.

For the first five LNG trains at Sabine Pass, 19.75 of the 22.5 million metric tons/year (mmty) nominal production capacity (about 88%) has been contracted to third party, foundation customers on a long-term free-on-board basis under sale and purchase agreements (SPA). Foundation customers include Royal Dutch Shell plc, Gas Natural Fenosa, Korea Gas Corp., Gail (India) Ltd., Total SA and Centrica plc. Any excess capacity not sold under long-term SPAs to foundation customers is available for Cheniere marketing.

During the quarter, Cheniere exported a total of 44 LNG cargoes from Sabine Pass, said CEO Jack Fusco said during the 3Q2017 earnings call. A total of 144 TBtu of LNG was loaded during the quarter, including 18 TBtu of commissioning cargoes. To date, a total of 200 LNG cargoes have been exported from Sabine Pass to 25 of the world’s 40 importing countries. Cheniere also is building an export terminal in Corpus Christi, TX.

Meanwhile, Cove Point is underway with commissioning activities in Maryland. The project is nearly completed and in the final phase of start-up, according to Community Relations Manager Karl Neddenien.

“We have completed the initial operating run on our auxiliary boilers, steam turbine generators, Frame 7EA combustion turbines and numerous motors, pumps and compressors that are part of the liquefaction process,” Neddenien said.

The facility, with a capacity of about .75 Bcf/d, would be bidirectional, offering import and export capability. Commercial service at the facility — the first on the East Coast — should begin by the end of the year.

Cove Point’s marketed capacity is fully subscribed under 20-year service agreements. Pacific Summit Energy LLC, a U.S. affiliate of Japan’s Sumitomo Corp., as well as Gail (India) affiliate Gail Global (USA) LNG LLC, each have contracted for half of the marketed capacity. Sumitomo has agreements to serve Tokyo Gas Co. and Kansai Electric Power Co. Inc.

Finally, KMI, which has partnered with EIG Global Energy Partners, is expecting to bring online its 10-train Elba Island LNG facility beginning in mid-2018. Capacity at the 2.5 mmty facility is fully subscribed by Shell.

“Construction activity at Elba Island is well underway, and the first unit has been completely shipped and delivered to Elba Island and has already been placed on its foundation,” said KMI’s Ruiz.

The Elba Island facility differs from the other U.S. facilities as each of the 10 modular units is rated at about .25 mmty, or 35,000 Mcf/d. Each unit was built in Texas and shipped in components to be erected on site in a sequential manner over one year, with the final unit expected to be placed in service by mid-2019, Ruiz said.

Each of the units is a standalone liquefaction facility that can be erected, commissioned and operated independently. The LNG outflow from each unit would flow into the existing common storage and loading facilities on Elba Island, she said.

“At the time the project was originally conceived, modular liquefaction units such as these were not common; however, in recent times other developers have begun to see the advantages associated with smaller liquefaction units similar to those being installed at Elba,” Ruiz said. “These smaller-type modular liquefaction units provide increased operating flexibility at a competitive cost in the marketplace.”

Indeed, Cheniere in October proposed to FERC a new design for trains 4 and 5 at the Corpus Christi facility, which would instead use seven smaller trains and increase the throughput capacity to 9.5 mmty, or 1.36 mmty at each mid-scale train [No. PF15-26-000]. The original capacities of the proposed trains 4 and 5 were 4.5 mmty each (9 mmty total).

The new design provides an extra 0.5 mmty in total throughput capacity. Trains 1 and 2, currently under construction, fall under stage 1 of development. Stage 2 would add train 3, which is awaiting a final investment decision. The new Stage 3 plan calls for seven mid-scale electric drive trains, as opposed to the natural gas-driven compressors used at Sabine Pass and at the first three trains at Corpus Christi.

Cheniere expects to file its application with the Federal Energy Regulatory Commission early next year, and also plans to update its worldwide free/non-free trade agreements because of increasing the throughput.

In a bullish outlook for the growth of overall U.S. LNG exports by 2024, Mizuho Securities LLC’s energy research group said the expansion includes small-scale and mega projects. Smaller facilities are looking to drive down costs significantly, according to analyst Tim Rezvan. U.S. exports are expected hit a projected 53 Bcf/d, or 400 mmty, in 2024, compared to 2016 totals of 34 Bcf/d, or 260 mmty, he said.

“The United States is expected to be competitive in fighting for market share, given the deep inventory of low-cost natural gas available,” Rezvan said.

Meanwhile, Sempra Energy’s Cameron LNG project in Hackberry, LA, previously expected to come online next summer, has been pushed to 2019 because of engineering, procurement and construction issues by a principal contractor, Chicago Bridge & Iron Co. NV. During a 3Q2017 earnings conference call, Sempra CEO Debra Reed reiterated that the first three trains would be operating in 2019.

“We firmly believe that from everything we see now that Cameron will be liquefying gas on all three trains come 2019,” Reed said. “They’ve made a lot of progress on construction, and things seem to be going very well,” with little impact from last summer’s Hurricane Harvey.

Export Model Not One-Size-Fits-All

The U.S. LNG export business, still in its infancy, is sure to lead to changes as fundamentals and market conditions change. It’s a major consideration for companies like KMI, who opted to have the facility’s capacity fully subscribed as a means of protecting itself from the fluctuations that could arise in the market.

“Unlike some other developers who do not have their facilities fully subscribed and have decided to participate in LNG market volatility by selling LNG commodity themselves, we have chosen to implement a tolling model which provides us with a low-risk, long-term steady revenue stream associated with a fully subscribed facility,” KMI’s Ruiz said.

Cheniere, meanwhile, not only processes the gas into LNG under a tolling model, the company also procures supply used for feedstock. Once the natural gas is liquefied, the customer takes delivery at the tailgate of the terminal. As a result, Cheniere is expected to become one of the largest buyers of natural gas in the U.S. once all of the trains are operational.

Cheniere’s gas procurement business has secured long-term transportation capacity on many pipelines to ensure reliable gas deliverability and diverse access to multiple producing basins. It also entered into several supply arrangements to purchase natural gas from suppliers at prices discounted to applicable market indices.

With no one-size-fits-all approach in the LNG export business, PA’s Bennett said 2018 is going to be a test for the U.S. LNG market. He likened the LNG market in 2018 to the power market in 2016, when most of the coal retirements resulted from the Environmental Protection Agency’s Mercury and Air Toxics Standards, and Henry Hub pricing around $2.50.

“It was a good test of the new dynamics and baseload shifts in power burn, and the market got a feel for how high burn could actually go,” he said.

Most available information indicates that cargos will be indexed to Henry Hub, which makes hedging easier. Contract holders have typically paid a fixed fee for the right to export LNG, somewhere in the $2-3.50/Mcf range, and then they pay Henry Hub +15% when they actually export gas, Bennett said.

“Depending on the specifics of the offtaker’s contracts at Cove Point and Elba Island, we could see capacity holders decide to sell their gas in the U.S. spot market if regional prices spike high enough. This is especially true for Cove Point, which has direct access to Transco Zone 6 non-NY. Alternatively, we could see those off-takers lift cargos despite spreads to the ultimate destination being negative.”

Most decisions to lift a cargo would be made on a spot basis, he said, assuming the contract holder has no downstream obligations that would make uneconomic netbacks irrelevant. This contract structure is somewhat analogous to firm capacity on natural gas pipelines.

“You pay an upfront fee for the right to move gas, and then pay a small commodity charge when you actually flow volumes, but there is no obligation to move that gas,” Bennett said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |