NGI The Weekly Gas Market Report | Markets

Moderating Temperature Outlook Put Downward Pressure on NatGas Forward Curve Last Week

Earlier this month, all eyes were on a cold front that sent temperatures plunging to lows in the teens and 20s and forward prices rallying to double-digit gains. Last week, most of those gains were wiped out as weather forecasts suggested the rest of November would see only brief periods of cold, and overall, lower-than-normal demand, according to NGI’s Forward Look.

The week began with futures/forward prices on a rollercoaster rise as forecaster weather models varied, leaving traders with mixed market signals. Monday morning started off with the Nymex futures in negative territory, but early storage estimates and a report from the Commodity Futures Trading Commission that reflected plenty more buying opportunity in the market brought the front of the curve roaring back. Still, the Nymex December futures contract ended the day at $3.167, down 4.6 cents on the day.

Prices continued to deteriorate from there, falling each of the next three days as weather models only became less supportive for the remainder of November. By Thursday, the Nymex prompt month had fallen to within a stone’s throw of the 200-day moving average.

Thursday was the fourth straight down day, but the December 2017 futures price chart showed the gap down to $2.99 remaining open, analysts with Mobius Risk Group said. “When coupled with a 200-day moving average of $3.013, there are tantalizing selling opportunities for technical traders. However, the $3.05 threshold has shown considerable resistance the past couple of days, and temperatures are forecast to cool substantially by Sunday…”

Indeed, not even a supportive storage report last Thursday from the U.S. Energy Information Administration (EIA) was enough to sway prices. The EIA reported a 18 Bcf withdrawal from storage inventories for the week ending Nov. 10, close to what the market was expecting but far below the year-ago injection of +34 Bcf and the five-year average of +12 Bcf. At 3,772 Bcf, inventories are 271 Bcf less than last year at this time and 101 Bcf below the five-year average of 3,873 Bcf.

Traders brushed off the supportive storage report, sending the Nymex prompt month last Thursday down 2.7 cents to $3.053. January settled 2.6 cents lower at $3.153.

“December natural gas prices again reversed a bit lower…off a supportive EIA print, which tends to indicate a bit more downside ahead in the coming days,” said Bespoke Weather Services after the market closed Thursday. “However, we did note later contracts rally into the settle off perceived tightness, and see downside as increasingly limited unless we begin to shed GWDDs (gas-weighted heating degree days).”

Weather models overnight Thursday did just the opposite as the European weather model added several GWDDs in the medium range. Global weather guidance, however, was more bearish for the long term, which left the market with a lack of clarity heading into the weekend.

As of Friday morning, “we are seeing support from the natural gas strip gradually erode amidst concerns that any colder trends in the medium-range will be canceled out by further warmer trends in the long-range, and the European Centre for Medium-Range Weather Forecasts ensemble flip to colder weather “may have been a one-off event (traders will be watching closely as the next run comes out just before the weekend close),” Bespoke said.

The Harrison, NY-based forecaster said it sees some risks for prices to pop a bit further with the most accurate guidance adding cold risks, following up from its bullish risks Thursday afternoon. Any upside above $3.16 would be limited, however, and it said there was room for prices to reverse again Friday and test $3.05 support for the third time.

The Nymex December futures contract traded in a tight range last Friday of about 5 cents, eventually settling at $3.097, up 4.4 cents on the day.

“We essentially see the data as being cold enough to continue increasing deficits in supplies, and with the European trending colder over the past 24 hours, the markets could be starting to realize the pattern should be considered at least somewhat bullish,” forecaster NatGasWeather said. This is what the Global Forecast System model had been saying all along, it said, which was consistently holding on to above-normal heating degree days.

The weather pattern from Nov. 29 to Dec. 2 currently isn’t looking cold enough, but with three systems lined up, there’s plenty to play out first, the forecaster said.

Meanwhile, analysts at BofA Merrill Lynch Global Research said Friday they continue to believe that underlying fundamentals are painting a far more positive picture than current forward prices imply and see upside to winter and calendar year 2018 (Cal 18) gas contracts. With October inventories coming in slightly higher than expected, however, the group reduced its Cal 18 forecast to $3.30 from $3.50/MMBtu.

“Two ultra-warm winters have masked a tightening in fundamentals in the U.S. natural gas market in the past couple of years, but stocks have now normalized to a large extent,” analysts said.

At normal weather and given the large structural demand increase, the group expects a storage withdrawal of 2.3 Tcf this winter, which should leave inventories at 1.5 Tcf by the end of March.

“This requires a stronger price signal. As a high point target, we believe U.S. Nymex Henry Hub natural gas prices could briefly break through $4/MMBtu under slightly colder-than-normal weather,” analysts said.

Still, it’s hard to ignore the ample gas supplies that continue to reach new heights. Lower 48 production sat around 75 Bcf/d on Friday, but soared above 76 Bcf/d earlier in the week.

But the BofA Merrill Lynch analysts see a tightening in U.S. gas balances — mainly from liquefied natural gas exports — that outpace production growth in 2018. “Eventually, increased output will come to the rescue, but only later in the year due to a large number of pipeline construction delays.”

Northeast Markets Hammered As Demand Tanks

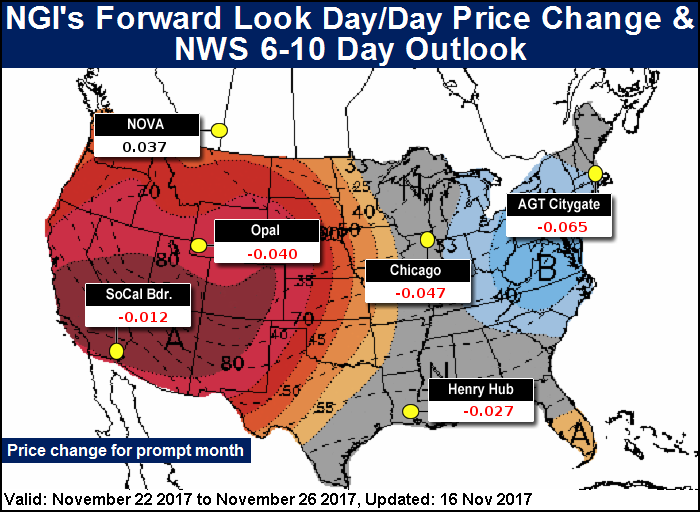

Taking a closer look at the markets, most pricing hubs followed the Nymex down, with December foward prices averaging 16 cents lower between Nov. 10 and 16, according to Forward Look. January forward prices tumbled an average 19 cents, while the balance of winter (January-March) plunged an average 18 cents.

As it has been the case in recent weeks, most of the week’s action was concentrated at the front of the curve, with declines of less than a nickel further out the curve. The Nymex Cal 2018 strip, however, was down 6 cents to $3.04, while Cal 2019 managed to move up 1 cent to $2.93 and Cal 2020 picked up 2 cents to hit $2.88, Forward Look data shows.

Northeast markets took on a much harder punch as cash prices plunged throughout the better part of the week. New England prices posted the most substantial declines across the country as demand was projected to fall from a high of 3.44 Bcf/d Friday down to an average 2.86 Bcf/d for Thanksgiving week and to an average 2.758 Bcf/d for the Nov. 27-Dec. 1 work week, according to Genscape Inc.

At the Algonquin Gas Transmission City-gates, December forward prices tumbled 65 cents from Nov. 10 to 16 to reach $5.80, while January plunged 62 cents to $8.85 and the balance of winter (January-March) dropped 53 cents to $7.68.

Tennessee zone 6 200 leg saw similar action, with December falling 65 cents during that time to $5.826, January sliding 66 cents to $8.859 and the balance of winter (January-March) shedding 57 cents to $7.71, Forward Look data show.

Cash prices, meanwhile, were down $1.68 during the same time period at Algonquin and down $3 at Tennessee zone 6 200 leg, according to the NGI Daily Price Index.

Other Northeast points posted considerable losses as well. Transco zone 6-New York December dropped 58 cents from Nov. 10 to 16 to reach $4.147, January slid 29 cents to $7.035 and the balance of winter (January-March) fell 26 cents to $5.99.

AECO Volatility Returns; Mainline Flows Skyrocket

Across the northern border, some extreme volatility returned to Western Canada, where prices recently enjoyed a rally resulting from increased flows on the TransCanada Corp.’s Mainline because of a new toll structure that went into effect earlier this month.

Mainline flows to Ontario (measured as the net of flows out of Empress, AB, and deliveries to demand and interconnect points in Saskatchewan and Manitoba) spiked on Nov. 1 — the start date of the new tolling structure — and have been averaging about 1.55 Bcf/d this month to date, according to Genscape. That represents a 103% increase from October levels.

The currently revised tolling structure significantly simplifies and reduces the long-haul rate to C77 cents/GJ (63 cents/MMBtu) from the previous rate of about C$1.43/GJ ($1.19/MMBtu).

Last week, however, prices at AECO (both in cash and forward markets) decreased significantly as the abundance of gas from both Western Canada and the Marcellus/Utica shales continues to challenge the forward market in particular.

Solomon Associates’ Cameron Gingrich, director of natural gas services, said even as flows on the TransCanada Mainline have increased since the new toll structure has been in effect, there is a limited ability to “free ride” on this deal, meaning there would be limited price bump at AECO for producers not taking capacity.

“This is due to the fact that producers who take pipeline capacity typically base load it with their own supply (therefore the secondary transport market will be less liquid) and the marginal capacity out of Western Canada will still be the firm transport floor on the TransCanada Mainline, which is uneconomic,” Gingrich said.

With the recent weakness in AECO spot prices (averaging just above $2 for gas day Friday), under-hedged producers concerned that basis prices would follow were selling basis last week, hoping to sell into a Nymex rally this winter, another Alberta source familiar with AECO said.

Gingrich said producers that hedge are essentially buying insurance. “What happens to the premium on a home insurance policy after a disaster? It tends to go up due to increased perception of risk.

“This past summer, banks and marketers writing insurance/hedges on AECO saw negative pricing — a big disaster for them in the gas market — and they had to pay out big to producers who had hedged production. Hedges have come off, but now the premium for writing 2018 AECO hedges has skyrocketed to Henry -$1.55 for producers who do not have a well thought-out monetization strategy.”

As of Thursday, AECO December basis had dropped to minus $1.40, while January basis had fallen to minus $1.502 and the balance of winter (January-March) had slid to minus $1.52, according to Forward Look. Summer 2018 basis was down to minus $1.57, while the winter 2018-2019 strip was at minus $1.25.

Producers hedging in today’s market will soon be judged by stockholders next to peers receiving 2018 AECO equivalent of Henry -0.90 (Dawn-LTFP toll-NGTL toll), Gingrich said. Those producers now have to either pay the premium or risk having to report to investors a downside pricing disaster in the AECO market if prices were to crash again.

“With spreads widening, it looks like they are playing it safe and paying the increased premium,” Gingrich said.

California Troubles Continue, Forwards Spike

Last week was another strong one for Southern California as tight conditions in the state were made worse on Thursday when Southern California Gas (SoCalGas) announced an unplanned, indefinite restriction on imports at Otay Mesa along the border with Mexico. SoCalGas stated the point is “unavailable due to gas quality issues” and did not provide an end date.

Market reaction to the news was swift, with SoCal City-gates December forward prices adding 6 cents Thursday to $4.781, according to Forward Look. The SoCal prompt month was up 22 cents for the period between Nov. 10 and Thursday, while prices have increased about 83 cents since December moved into the prompt-month position.

Interestly, the rest of the SoCal City-gates forward curve softened like the rest of the country. January slid 7 cents from Nov. 10 to 16 to reach $4.233, while the balance of winter (January-March) fell 14 cents to $3.70, Forward Look shows.

Without the ability to import at Otay, and with imports along other lines already restricted, SoCalGas may need to rely more on storage withdrawals; three of its four fields are at their current maximum capacity but the largest — Aliso Canyon — remains restricted.

SoCalGas had been importing about 150 MMcf/d from Mexico at Otay Mesa over the previous two weeks, a significant jump compared to the four months of zero flow from June through early October, according to Genscape. The increase in imports at Otay resulted from restrictions on SoCalGas’ more typical import paths from the Desert Southwest, most notably at Needles and Topock. The most recent of those restrictions began on Oct. 1 following an explosion on SoCalGas Line 235-2, limiting flows at the Needles points to zero — an 800 MMcf/d capacity reduction.

Without Otay Mesa, SoCalGas import capacity is down even further, Genscape said. Relative to Nov. 15 scheduled capacities, SoCalGas may only increase its imports about 300 MMcf/d, the Louisville, KY-based company said.

With about 100 MMcf/d of potential California production increases compared to previous two-year highs, Genscape estimated that SoCalGas could bring in an additional 400 MMcf/d from non-storage sources while Otay Mesa remained restricted. The increase would allow SoCalGas to meet a maximum system-wide demand of 2,650 MMcf/d without withdrawing from storage.

“Putting that number in perspective, demand has exceeded that level on 57% of days in the past two winters; similarly, demand in the second half of November during those years exceeded 2,650 MMcf/d 55% of the time,” Genscape said.

Injections are prohibited at three of four of the SoCalGas fields (including Aliso Canyon) because of high inventories, with the fourth field (Goleta) estimated to have only an additional 5 Bcf of remaining capacity. Although the SoCalGas stated system-wide firm withdrawal capacity is only 85 MMcf/d, this does not incorporate the 500-650 MMcf/d of withdrawal capacity from Aliso Canyon, which the California Public Utility Commission has directed the utility to use as a last resort to prevent curtailments.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 1532-1266 |