NGI Data | Markets | NGI All News Access

December NatGas Rebounds After Bearish Week; Spot Market Not Sweating Cold Forecast

Natural gas futures rebounded Friday on a colder medium-range weather outlook after retreating for most of the week. In the spot market, a cold system that was expected to move in over the weekend wasn’t enough to spur buyer interest in locking in three-day deals, and the NGI National Spot Gas Average fell 6 cents to $2.91/MMBtu.

December natural gas broke a four-trading-day losing streak Friday, going as high as $3.127 before settling 4.4 cents higher at $3.097. January settled 3.8 cents higher at $3.191.

Bespoke Weather Services told clients Friday that it’s outlook is “not yet bullish despite the recent rally in prices. Since the settle prices have wandered up quite a bit, seemingly supported by the strip as a whole and accordingly we do not see as much of this move being driven by” some colder trends that emerged overnight in the European forecast ensembles.

“What we see here is a similar situation to last weekend in that there is asymmetrical risk before market close; last weekend prices attempted to pull back but weather kept propping them up, whereas this weekend prices kept attempting to rally while weather kept beating them back down,” Bespoke said. Traders may be going long heading into the weekend hoping “recent modest tightening gets realized in a re-test of nearby highs.

“Given current weather forecast risks this does not seem an entirely bad idea; forecasts past day 10 are clouded in an incredible amount of noise, and we have seen believable medium-term colder trends today that have us thinking” more gas-weighted degree days could show up in the forecast by Monday.

The underlying fundamentals continue to look bullish for natural gas, according to Tudor, Pickering, Holt & Co. (TPH).

The Energy Information Administration on Thursday reported a “bullish 18 Bcf draw versus normal 13 Bcf injection on roughly normal temperatures,” TPH said in a note to clients Friday. “This suggests the market is 3 Bcf/d undersupplied (as was most of the shoulder period) and much better than last week’s slight oversupply (15 Bcf injection on similar temperatures).

“We like winter gas with bullish storage levels (currently 3,772 Bcf, more than 100 Bcf below normal and 227 Bcf below year-ago levels) and the market meaningfully undersupplied,” TPH said. “A touch of colder than normal temperatures in December should move natural gas prices higher. Weekly storage remains important to calibrate the market.”

Bank of America Merrill Lynch Global Research observed in a note that after pushing to a seven-month high last week at $3.20/MMBtu, the prompt-month “quickly capitulated” despite cold weather “as production pushed to new record highs. Interestingly, back-end prices never participated in the rally in the first place. The U.S. natural gas forward curve is unusually flat now, with relentless producer hedging keeping a lid on back-end prices. We continue to believe that underlying fundamentals are painting a far more positive picture than current forward prices imply and see upside to winter and calendar 2018 gas contracts.”

November is off to a cold start, Barclays Research analyst Nicholas Potter said in a recent note.

“After two warm winters in a row, November has thus far been a chilly one. Through the first half of November, heating degree days have outpaced last year’s by 52%, boosting residential/commercial demand by 34% year/year” and supporting natural gas prices, Potter said.

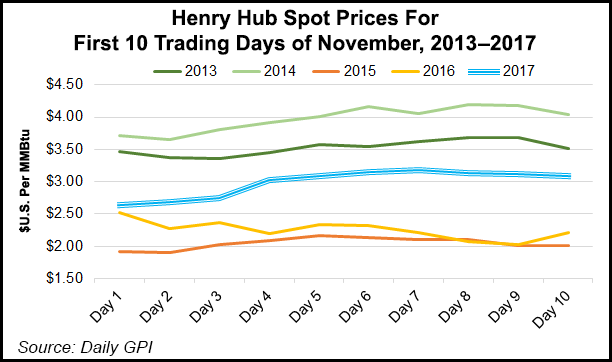

That boost in demand has shown up in the spot market. Through the first 10 trading days of November, Henry Hub spot prices have averaged $2.99, a significant improvement over comparable periods in 2016 and 2015, when prices averaged $2.26 and $2.05, respectively, Daily GPI historical data show.

Meanwhile, gas for weekend and Monday delivery weakened Friday, with prices in the Midwest and Northeast unable to rally on some cold temperatures in the near-term forecast.

NatGasWeather.com said the first of three distinct cold weather systems on tap through the remainder of November is expected to “sweep into the central and northern U.S. this weekend, reaching the East Sunday. This will bring a surge in national heating demand, with lows of teens to lower 30s across the Great Lakes to the Northeast, aided by a cold front advancing deep into the southern U.S., including Texas, where lows of 30s and 40s are expected.”

In the Northeast, Algonquin Citygate gave back the previous day’s gains and then some, falling 64 cents to $3.27, while further south, Transco Zone 6 NY was down 4 cents to $3.12.

Appalachia prices retreated from the previous day’s gains, with Dominion South down 4 cents to $2.54, while Columbia Gas dropped 5 cents to $2.92.

Prices in the Midwest and Midcontinent were down slightly, with Chicago Citygate falling 4 cents to $2.99 and Joliet down 2 cents to $2.99.

Out West, weak demand helped SoCal Citygate avoid a major price blowout despite yet another import restriction on its system.

Genscape Inc. reported that Southern California Gas (SoCalGas) was dealing with “an unplanned, indefinite restriction on imports at Otay Mesa along the border with Mexico.” SoCalGas attributed the outage to gas quality issues and had not specified an end date, Genscape said in a note to clients Friday.

“Without the ability to import at Otay,” where flows have increased recently due to restrictions on other import lines, “SoCal will need to rely more on storage withdrawals; three of its four fields are at their current maximum capacity, but their largest — Aliso Canyon — remains restricted,” Genscape said.

Without Otay Mesa SoCal would only be able “to meet a maximum system-wide demand of around 2,650 MMcf/d without drawing from storage. Putting that number in perspective, demand has exceeded that level on 57% of days in the past two winters; similarly, demand in the second half of November during those years exceeded 2,650 MMcf/d 55% of the time.”

The impact of the additional restriction at SoCal Citygate hardly showed in Friday’s spot market (though December forward prices did react); day-ahead prices added just a penny to $3.26. Other prices in California fell, with Malin down 6 cents to $2.79 and SoCal Border Average tumbling 8 cents to $2.88.

“It looks like SoCal is dodging a bullet here,” Genscape’s Rick Margolin, senior natural gas analyst, told NGI Friday. “Demand is lurking below the 2.3 Bcf/d mark with mild temperatures, and likely to stay there with the start of the weekend and forecast calling for more mild weather. Last November month-to-date demand averaged 2.43 Bcf/d.

“At the same time, the pressure on in-market generation is being eased due to the return to full operations of transmission lines from the Pacific Northwest and the Pacific Northwest drought ending; the return to service of a pumped hydro storage facility near Visalia; and abnormally strong wind output.”

The soft demand for exports to the west seems to have weighed on spot prices in West Texas. El Paso Permian fell sharply for the second day in a row, dropping 18 cents to $2.34. After giving up 13 cents on Thursday, Waha fared a little better Friday, finishing 5 cents lower at $2.52.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |