NGI Data | Markets | NGI All News Access

December NatGas Threatens to Fill Gap After Brushing Off Tight Storage Stats; $2.98-3.00 in Play

Natural gas futures couldn’t muster a move higher Thursday even as the season’s first storage withdrawal came in slightly tighter than market expectations. Flattish demand held the spot market in check, and the NGI National Spot Gas Average fell 4 cents to $2.97.

The December contract slid for the fourth day in row and never looked to rally on the seemingly supportive storage stats, trading as low as $3.046 before settling at $3.053, down 2.7 cents. January settled 2.6 cents lower at $3.153.

The Energy Information Administration (EIA) reported the first storage withdrawal of the season, but natural gas bulls seemed unimpressed, as the prompt-month peaked before the number crossed trading desks.

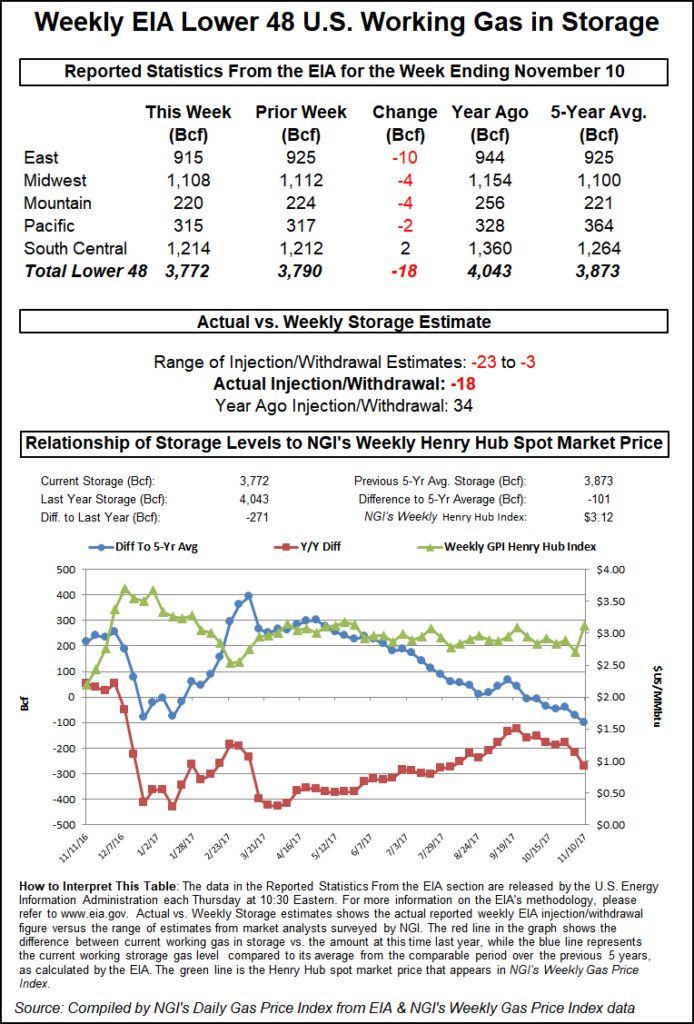

EIA reported an 18 Bcf net withdrawal for the week ended Nov. 10. Last year, 34 Bcf was injected, and the five-year average for the period is a build of 12 Bcf.

The bulls struggled to find inspiration in the final number. After trading as high as $3.11 Thursday morning, the December contract fell following the 10:30 a.m. EDT release, going as low as $3.07 and generally staying within a penny or so of Wednesday’s $3.080 settlement. By 11 a.m. EDT, December was trading nearly even at $3.080.

The market had been looking for a withdrawal of around 14 Bcf, based on the average from a Reuters survey of traders and analysts. Responses to that survey ranged from -23 Bcf to -3 Bcf.

Stephen Smith Energy Associates had projected a withdrawal of 14 Bcf. ION Energy’s Kyle Cooper had predicted a 17 Bcf withdrawal, while PointLogic Energy had called for a 6 Bcf withdrawal.

“Again we saw a print that was relatively close to market estimates, though this one was slightly tighter than expected,” said Bespoke Weather Services in a note to clients. “The print reflected strong power burns that we observed last week, though those are easing this week as cash falters a bit more.

“We see the print as adding a bit more support for the gap from $2.98-3.00 that remains at risk of being filled, though we are now more sensitive to any additional gas-weighted degree day (GWDD) additions, which could keep us from falling quite as far. Still, initial volatility around the print indicates we likely need more long-range GWDDs to break upwards.”

The report period featured a blast of cold temperatures that swept through the Midwest and Northeast late in the week and into the weekend, a development that prompted an early-week surge in the December contract and led to broad-based gains in the cash market.

Natural gas markets have pulled back this week, weighed down by moderating demand in the short-term and mixed signals in the weather outlook for late November.

Given the “lack of upward momentum” this week, natural gas could soon fill the gap from around $2.98-3.05 that developed between the Nov. 3 and Nov. 6 trading days, said Powerhouse’s David Thompson, executive vice president of the Washington, DC-based risk management firm.

“The entire collective assessment of the natural gas futures market caused prices to jump higher” last week, “and now we’ve spent nine trading days where we’ve still stayed above that gap,” Thompson told NGI. “…Will that hold, or will prices collapse through the gap?”

Given “the fact that the inventory number didn’t change anything that dramatically” Thompson said he would look for the “gap to be closed.”

The longs may be losing confidence, he said. “We’re running out of bullish stories. The market charged higher last Monday and then continued to move up strongly the next four days, and then started to run out of steam.”

Bespoke said in an afternoon update that the latest changes in the weather outlook should provide some support as the $3.05 level holds for now.

“Our confidence in us closing the gap has decreased a bit after two unsuccessful days of attempting to break it, and a bit more bullish risk on long-range European guidance has propped up prices after the settle,” Bespoke said. “Granted, the European output verbatim is not bullish; it shows GWDDs below overage over the next 15 days (as we expect) and limited source region cold for any significant cold into early December.”

Total working gas in underground storage now stands at 3,772 Bcf versus 4,043 Bcf a year-ago and a five-year average of 3,873. The year-on-five-year deficit grew by 30 Bcf week/week, from -71 Bcf to -101 Bcf, EIA data show.

Every region outside of the South Central reported a withdrawal for the week, led by the East, which reported a -10 Bcf flow. The Midwest and Mountain regions each withdrew 4 Bcf, while the Pacific withdrew 2 Bcf, according to EIA. The South Central region saw a net injection of 2 Bcf, including 5 Bcf added to salt storage and 3 Bcf withdrawn from nonsalt.

In the spot market Thursday, prices fell at most points outside the Northeast, while Appalachia was mixed.

PointLogic Energy analyst Warren Waite said the firm’s data shows a “leveling off of Lower 48 gas consumption” this week. “Combined power, industrial and residential/commercial demand for gas day Nov. 16 is 70.3 Bcf, awfully close to the prior two-day average of 70.7 Bcf/d and somewhat near Friday’s 69.7 Bcf forecast.

“…Come Friday, the shifts in weather patterns yields a daily consumption decline in the Midcontinent of about 1.9 Bcf, while small demand gains ranging from 0.2-0.5 Bcf take root in other regions. Overall Lower 48 consumption is still expected to decline by 0.6 Bcf.”

Chicago Citygate fell 7 cents to $3.03, while Joliet dropped 7 cents to $3.01. Panhandle Eastern gave up 6 cents to $2.64. Northern Natural Demarcation declined 6 cents to $2.94.

With AccuWeather forecasting temperatures to reach a low of 30 in Boston Friday, Algonquin Citygate jumped 52 cents to $3.91. Iroquois Waddington added 10 cents to $3.42.

In Appalachia, Dominion South notched a 4 cent gain to $2.58, while Columbia Gas fell a penny to $2.97.

A large drop at the volatile and infrastructure-constrained SoCal Citygate led prices lower in the West. SoCal Citygate fell for the second straight day, plummeting 99 cents to $3.25. Kern Delivery fell 10 cents to $2.94.

SoCalGas was estimating lower demand on its system for Thursday and Friday compared to Wednesday. Genscape Inc., meanwhile, was projecting flat to lower demand in the California/Nevada region over the next several days, with demand expected to fall to 5.29 Bcf Saturday versus a recent seven-day average of 6.32 Bcf/d.

Prices in West Texas also took a hit, particularly in the Permian Basin. El Paso Permian fell 13 cents to $2.52, while Waha dropped 13 cents to $2.57.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |