Shale Daily | E&P | NGI All News Access | NGI The Weekly Gas Market Report

Helmerich & Payne’s U.S. Land Activity Hits Zenith During Fiscal 2017, Says CEO

U.S. land operations for contract driller Helmerich & Payne Inc. (H&P) are hitting on all cylinders, with the onshore market share up 5% from a year ago, the Tulsa operator said Thursday.

In delivering its fiscal 2017 and fourth quarter results, H&P credited gains in revenue to stronger domestic onshore activity and more customers. U.S. land revenue days, a measure of activity, rose year/year by 6%, with adjusted average rig margin/day increasing 5%.

The contracted U.S. onshore rig count also climbed from fiscal 2016 to 197 from 102. And H&P claimed 37 more U.S. land customers than it had a year ago.

“Fiscal 2017 witnessed the largest ramp up of U.S. land rig activity in the company’s history, which more than doubled even in the face of oil price uncertainty and volatility,” said CEO John Lindsay. “We began the year with 95 rigs running in U.S. land and closed the year with 197 rigs after reactivating 102 FlexRigs while upgrading 91 of those to super-spec capacity.”

H&P’s existing fleet includes 350 land rigs in the United States, 38 international land rigs and eight offshore platform rigs. The global fleet has 388 land rigs total, including 373 alternating current (AC) drive FlexRigs.

The “headlines” in the past quarter, Lindsay said, “were dominated by oil price uncertainty, which remained range-bound in the mid $40s and set expectations for a substantial rig count reduction for the balance of 2017.

“Even with that cautious outlook, H&P was able to grow its rig count and leading edge pricing due to the value proposition we provide to customers.” There’s also “some improvement in our international markets, with the rig count significantly increasing during the quarter.”

An increase in oil prices over the past few weeks “could provide opportunities for rig count growth and higher dayrates, improving our key financial metrics.”

The entire U.S. super-spec fleet today totals around 400 rigs, and “appears close to being fully utilized” by exploration and production (E&P) companies.

“With nearly full utilization and bolstered by continued demand by E&Ps for rigs capable of effectively drilling more complex horizontal wells with longer laterals, we believe the rig replacement cycle continues,” Lindsay said.

H&P also is positioned to grow its active rig count without building rigs, whether “under improved commodity pricing or the range-bound pricing we experienced most of this past year.” If needed, H&P still has 100 existing FlexRigs eligible for upgrades to super-specs; about one-third of them already are active.

“Clearly, demand will drive those decisions,” said the CEO. “We are optimistic that customers will be willing to sponsor the investment to upgrade rigs to super-spec capacity through higher dayrates and term contracts.”

Net losses year/year in the fourth quarter were nearly flat at $23 million (minus 21 cents/share) from $22 million (minus 22 cents). Operating revenue totaled $532 million, with net operating cash of $121 million. Fiscal 2017 net losses more than doubled year/year to $128 million (minus $1.20/share) from $56.8 million (minus 54 cent).

U.S. land operating revenue in the final quarter increased sequentially to $439,404 from $405,516. Operating losses narrowed by $4 million (48%) sequentially, primarily from the increase in revenue days and higher average rig margins.

Operational improvement in the U.S. onshore was offset by one-time charges of $15.4 million related to abandoning used drilling rig components for upgrades. Similar noncash charges totaled $7.7 million during fiscal 3Q2017.

In its operational outlook for the fiscal first quarter, H&P is estimating U.S. land revenue days should increase by 4-5% sequentially, with average rig revenue/day of about $21,700 and rig expense/day averaging $14,100.

Spot pricing in the U.S. land market has increased by about 5% since the end of July, the company noted. Since the end of July, H&P has upgraded 21 AC-drive FlexRigs, resulting in 161 in the fleet today with rig specifications “in highest demand,” management said.

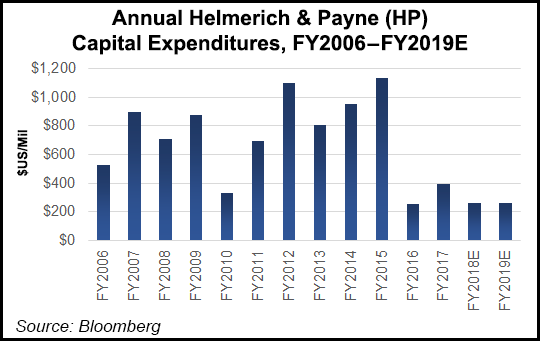

Capital expenditures in 2018 currently are estimated at $250-300 million.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |