NGI Data | Markets | NGI All News Access

EIA Reports Winter’s First Withdrawal; NatGas Bulls Not Impressed

The Energy Information Administration (EIA) reported the first storage withdrawal of the season Thursday, but natural gas bulls seemed unimpressed even as the final number came in slightly tighter than market expectations.

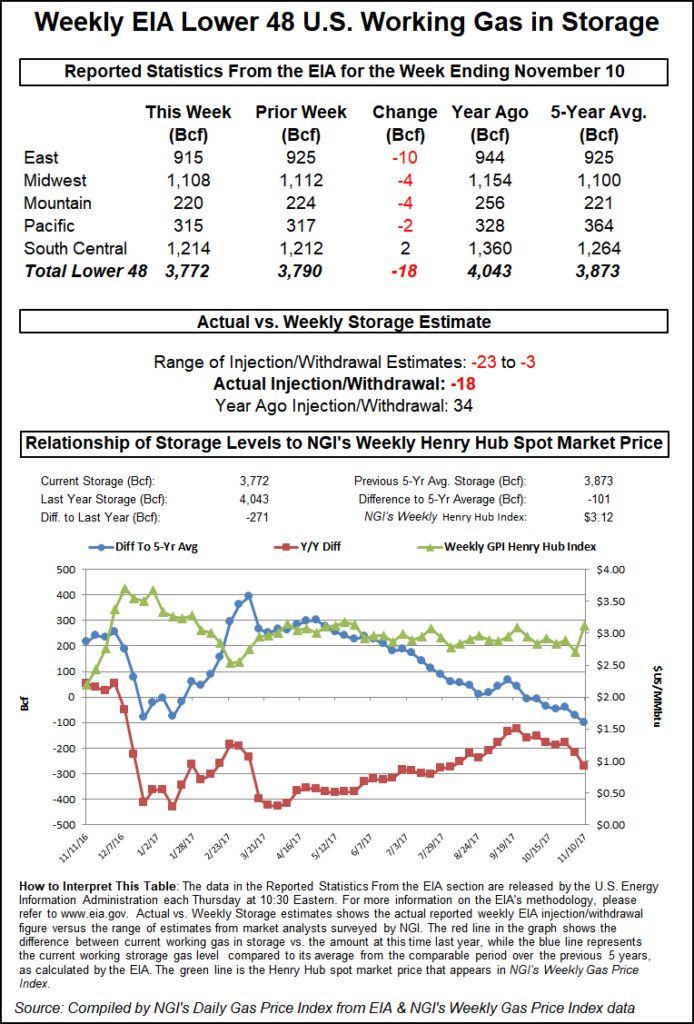

EIA reported an 18 Bcf net withdrawal for the week ended Nov. 10. Last year, 34 Bcf was injected, and the five-year average for the period is a build of 12 Bcf.

The bulls struggled to find inspiration in the final number. After trading as high as $3.11 earlier in the morning, the December contract fell following the 10:30 a.m. EDT release, going as low as $3.07 and generally staying within a penny or so of Wednesday’s $3.080 settlement. By 11 a.m. EDT, December was trading right nearly even at $3.080.

The market had been looking for a withdrawal of around 14 Bcf, based on the average from a Reuters survey of traders and analysts. Responses to that survey ranged from -23 Bcf to -3 Bcf.

Stephen Smith Energy Associates had projected a withdrawal of 14 Bcf. ION Energy’s Kyle Cooper had predicted a 17 Bcf withdrawal, while PointLogic Energy had called for a 6 Bcf withdrawal.

“Again we saw a print that was relatively close to market estimates, though this one was slightly tighter than expected,” said Bespoke Weather Services in a note to clients. “The print reflected strong power burns that we observed last week, though those are easing this week as cash falters a bit more.

“We see the print as adding a bit more support for the gap from $2.98-$3 that remains at risk of being filled, though we are now more sensitive to any additional gas-weighted degree day (GWDD) additions, which could keep us from falling quite as far. Still, initial volatility around the print indicates we likely need more long-range GWDDs to break upwards.”

The report period featured a blast of cold temperatures that swept through the Midwest and Northeast late in the week and into the weekend, a development that prompted an early-week surge in the December contract and led to broad-based gains in the cash market.

Natural gas markets have pulled back this week, weighed down by moderating demand in the short-term and mixed signals in the weather outlook for late November.

Total working gas in underground storage now stands at 3,772 Bcf versus 4,043 Bcf a year-ago and a five-year average of 3,873. The year-on-five-year deficit grew by 30 Bcf week/week, from -71 Bcf to -101 Bcf, EIA data show.

Every region outside of the South Central reported a withdrawal for the week, led by the East, which reported a -10 Bcf flow.

The Midwest and Mountain regions each withdrew 4 Bcf, while the Pacific withdrew 2 Bcf, according to EIA. The South Central region saw a net injection of 2 Bcf, including 5 Bcf added to salt storage and 3 Bcf withdrawn from nonsalt.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |