Shale Daily | Bakken Shale | E&P | NGI All News Access | NGI The Weekly Gas Market Report

North Dakota NatGas Flaring Rises, Production Declines in September

North Dakota’s Bakken Shale soon will need more infrastructure to expand natural gas capture processes as flaring moves higher, Department of Mineral Resources Director Lynn Helms said Wednesday.

During his monthly webinar to report state production statistics, Helms outlined a decline in gas production and predicted the Bakken would need at least two more gas processing plants built in the next two years and ultimately up to 2 Bcf/d of added processing capacity.

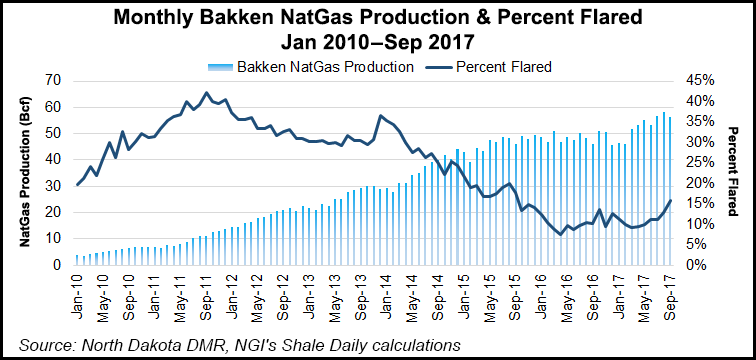

For the first time since 2014, gas production declined sequentially from 60.4 Bcf (1.949 Bcf/d) in August to 58.2 Bcf (1.94 Bcf/d) in September. Average oil production in September was above 1.1 million b/d for the first time in 18 months to 33.2 million bbl. With one less day in the month, September oil volumes fell slightly from the August total of 1.08 million b/d, or 33.7 million bbl.

“We’re rapidly approaching the capacity of the infrastructure that we have out there, so we really need another gas plant or two by 2019 if we’re going to meet an 88% gas capture goal at that time,” said Helms.

“Particularly in the winter months ahead, we’re going to see a struggle to stay above the gas capture goals,” which currently are 85%, Helms said. “A year from now, we’re likely to really see problems because what happens in winter is that a lot of water and liquids drop out in the gathering pipelines making it almost impossible keep those pipes clear so the gas can move. Every winter is a struggle, but when you go in at or below the capture goals, you are in trouble.”

Gas flaring numbers are a concern, with gas capture in September at 83%, below the 85% statewide target.

“The real struggle these days is in gas capture, so what we saw in September is not good news as we had six force majeure events, such as unanticipated maintenance, a pipeline shut down, and road restrictions making it impossible to move gas liquids,” he said.

“What we saw for the first time in the three-year history of the state standards was that we didn’t meet the goal. We don’t think it is something that will be repeated because it looks like it was a worst-case scenario with right-of-way and natural gas liquids takeaway problems and compressor maintenance problems.”

Helms outlined the one-time operating issues that drove flaring volumes to 323 MMcf/d. He cited a maintenance issue at the Garden Creek processing plants, road restrictions, an NGL takeaway issue, rights-of-way issues on the Fort Berthold reservation, a high-pressure pipeline that was shut down and two compressor station shutdowns.

New natural gas liquids (NGL) processing plants are on the drawing board, including one by Oneok Partners LP for eastern McKenzie County and a 200 MMcf/d plant by Oasis Petroleum Inc. for Wild Basin. Kinder Morgan Inc. also has a proposed transfer pipeline that could be built under the Missouri River.

North Dakota probably needs to increase its NGL processing capacity by 10-12% annually, and ultimately it needs to add 1.5-2 Bcf/d, Helms said.

“Industry has invested about $13 billion in gas gathering and processing so far, and our best estimates say we need to invest another $11 billion.”

North Dakota’s rig count was flat from August through October at 56. Prices for Bakken sweet crude gained steadily from August, nearing $43.50/bbl in October and was near $49/bbl on Wednesday.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |