NatGas Futures Slide as EIA Set to Report Season’s First Draw; Cash Mixed

Natural gas futures slid further Wednesday, with the market vexed by disagreement in the major weather models and waiting to see if Thursday’s storage inventory report — expected to show the season’s first withdrawal — can give a nudge in either direction.

Changes were modest in the sport market; outside of volatility in California and strength in Appalachia, most regions gained a few pennies to a nickel, and the NGI National Spot Gas Average finished 2 cents higher at $3.01/MMBtu.

In the futures market, December natural gas finished lower for the third consecutive day, giving up 2.2 cents to settle at $3.080. January settled 2.4 cents lower at $3.179.

Predictions for Thursday’s 10:30 a.m. EDT storage inventory report from the Energy Information Administration (EIA) point to the season’s first withdrawal for the week ended Nov. 10.

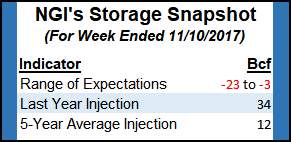

A Reuters survey of traders and analysts is calling for a 14 Bcf withdrawal, with a range of -3 Bcf to -23 Bcf. Stephen Smith Energy Associates, which revised its estimate Tuesday, is now projecting a slightly smaller withdrawal of 14 Bcf for the week ended Nov. 10. ION Energy’s Kyle Cooper is forecasting a 17 Bcf withdrawal, while PointLogic Energy is calling for a 6 Bcf withdrawal.

By historical comparisons, a withdrawal for the period would be bullish. Last year, 34 Bcf were injected, while the five-year average stands at +12 Bcf.

The market has priced in a withdrawal at this point, Price Futures Group Senior Market Analyst Phil Flynn told NGI. “The market’s reacting to what’s going to happen after that. We do have a divergence in the expectations of what the weather’s going to be…and right now the market’s having a hard time grasping that.”

Traders, especially the technicians, have been eyeing the gap-up in the chart from last week spanning $2.98 to $3.05, and are now looking for that gap to be filled.

“The thing is, if they don’t fill the gap to the downside” after Thursday’s report, “they might not for the rest of winter,” Flynn said. “But if we get a bearish report and it starts to go down, then we could fill the gap. So we’re all basically waiting with bated breath right now to see how that number comes out.”

Meanwhile, the Global Forecast System (GFS) and the European weather model just can’t seem to agree, according to forecasters, with some warmer risks for late November showing up in the European model prompting selling this week while the GFS remains colder.

“The mid-day GFS weather model was again colder than the rest of the data, just not quite as cold as it had been in previous versions,” said NatGasWeather.com. Meanwhile, the European model “was a bit colder compared to its previous runs” for weather systems moving through the Northeast Nov. 23-24 and through the central and eastern United States Nov. 26-27.

“Overall, both models gave in modestly to being a little closer to each other,” the firm said. “To our view, the markets are probably going to be at least somewhat relieved to see the European trend colder overall.”

Like the futures, the spot market seemed to be in something of a holding pattern Wednesday, with wintry weather expected to sweep through key demand markets next week.

AccuWeather said Wednesday that “following mild, wet weather to end this week, progressively colder air will unleash rounds of lake-effect snow from the Upper Midwest to the interior Northeast for travel during the week of Thanksgiving.”

Day-ahead prices at Henry Hub climbed 3 cents to $3.11.

Northeast prices showed unusual restraint. Algonquin Citygate added 1 cent to $3.39, while Iroquois Waddington tacked on 7 cents to $3.32. Transco Zone 6 New York fell 4 cents to $3.11.

In Appalachia, Dominion South gained 7 cents to $2.54, while Tetco M-2 30 Receipt jumped 11 cents to $2.57.

In the Midwest, Chicago Citygate added 10 cents to $3.10, while in the Midcontinent, Northern Natural Demarcation added 4 cents to $3.

Out West, points in the Rockies were mixed. The Cheyenne Hub fell 4 cents to $2.80, while Opal added 1 cent to $2.84. SoCal Citygate, still dealing with import constraints, continued its volatile ways, giving up 49 cents to $4.24.

In Canada, NOVA/AECO recovered C14 cents Wednesday to finish at C$2.00/gj after dropping C31 cents Tuesday.

After trading in the negatives in early October amid infrastructure constraints, NOVA/AECO prices improved significantly for the first two weeks of November, averaging C$2.39/gj compared to about C92 cents/gj in October.

The improvements have coincided with an increase in flows on TransCanada’s Mainline after the operator implemented a toll discount designed to entice Western Canadian producers.

“It appears TransCanada’s revised Mainline tolling structure is so far supporting higher flows from Alberta into Ontario,” Genscape Inc. said in a note to clients Wednesday. “Mainline flows to Ontario (measured as the net of flows out of Empress, Alberta, and deliveries to demand and interconnect points in Saskatchewan and Manitoba) spiked Nov. 1 — the start date of the new tolling structure — and have been averaging about 1.55 Bcf/d so far this month. That represents a 103% increase from October levels.

“This magnitude of October-to-November increase was the norm back in the early 2010s, but became greatly diminished in 2013 and beyond as the escalation of tolls on the Mainline drove shippers away to other systems capable of exporting AECO production and supplying the Dawn Ontario market.”

But the NOVA/AECO spot price has now fallen C59 cents since last week, when it traded as high as C$2.59/gj on Nov. 7.

Forward basis at NOVA/AECO also widened noticeably this week, selling off Friday to Monday by more than 10% all the way into the summer strip, according to NGI’s Forward Look.

December forward basis at NOVA/AECO went from negative $1.295 to negative $1.531, while January forward basis widened from negative $1.337 to negative $1.599, Forward Look data show.

An Alberta source familiar with AECO told NGI that while the increased Mainline flows have helped spot prices, the combination of gas coming out of Western Canada and out of the Marcellus and Utica shales in the Northeast, is challenging AECO forward curves.

With the recent weakness in AECO spot prices, under-hedged producers concerned that basis prices would follow were selling basis this week, hoping to sell into a Nymex rally this winter, the source said.

Also in Canada, WestCoast Station 2 fell C60 cents to C10 cents/gj Wednesday.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |