NGI The Weekly Gas Market Report | Markets

Winter At Last! Plunging Temps Sent NatGas Forwards Surging Last Week

Natural gas forwards markets shot up an average 25 cents between Nov. 3 and 9 as all the hype about an approaching cold front came to fruition late in the week, sending temperatures plunging to near-record lows, according to NGI’s Forward Look.

Last week started off with a bang, with Nymex December futures jumping 15 cents and to within a nickel of the 40-day high as weather forecasts for the week turned colder over the weekend. The frigid conditions were over the northern Plains as of Thursday and expected to sweep across the Great Lakes and Northeast during the next few days, with lows dropping into the teens and 20s, with single digits near the Canadian border, according to NatGasWeather.

Strong spot pricing and storage inventory comparisons fueled the rally even further as the futures curve continued to strengthen throughout the week, albeit far less significantly. By Thursday, the market appeared to have already priced in an anemic storage build. Despite some intraday selling action, the cold conditions kept the Nymex December futures contract supported enough to end the day up 2 cents to $3.20, just above key technical resistance.

“At some point over the next week or two, we are likely to see a larger pullback than we have seen (in overnight trading); a few bearish weather model runs could easily still pull us back 5-10 cents, and there are some risks past Day 14 that the pattern turns temporarily less favorable for cold, which would prove to be a bearish catalyst,” forecasters at Bespoke Weather Services said.

Still, last week’s cold spell was enough to have a significant impact on storage inventories. The U.S. Energy Information Administration (EIA) reported a 15 Bcf build into storage inventories for the week ending Nov. 3, far below both the 54 Bcf year-ago injection and the 45 Bcf five-year average. Thursday’s inventory report closed the book on the traditional storage injection season, which saw supplies reach 3,790 Bcf. That’s below the five-year average of 3,861 Bcf and well below year-ago inventories of 4,009 Bcf.

While Thursday’s storage report highlighted the rapid pace with which the storage deficit can increase, analysts at Tudor, Pickering, Holt & Co. (TPH) said it’s still too early to predict how the winter season will play out as weather-adjusted data suggests the market is no longer 3 Bcf/d undersupplied, but balanced.

“Early cold and below normal storage levels a good way to start winter,” TPH said in a note to clients Friday. “A great start would include an undersupplied (not balanced) market. Next two weeks will determine good or great.”

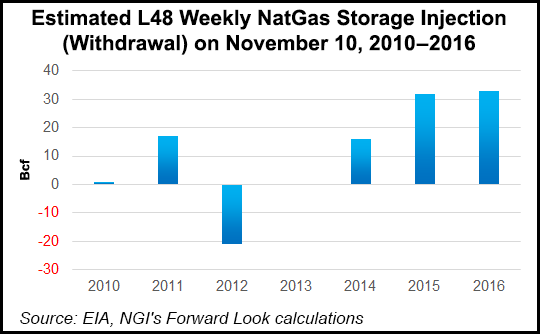

Meanwhile, NGI’s Patrick Rau, director of strategy and commodity research, said preliminary estimates are showing a storage withdrawal for the next EIA report (which would reflect the current cold snap), which is certainly bullish relative to recent history. The weekly change in U.S. gas storage on Nov. 10 has ranged from -21 Bcf to +33 Bcf during the last six years, with an average of +11 Bcf. Last year, there was a +33 Bcf injection, he said.

“Given these things, I don’t think there are too many traders who would be comfortable shorting this market too heavily, especially considering the December contract broke above and held the key $3.16-3.17 level marked by the previous reaction high in September,” Rau said.

Genscape’s Eric Fell, senior natural gas analyst, agreed this week’s big price move and the next EIA report, which all signs point to being a bullish one, are all about the weather. The current cold snap is expected to elevate Lower 48 demand Friday to 86 Bcf/d, up 1 Bcf/d from Thursday and up 10 Bcf/d from Nov. 6.

“The market has been very tight all year, so I don’t think that is a revelation to anyone unless they’ve literally had their head stuck in the sand,” Fell said. “The issue is that we have had two extremely mild winters in a row, as well as a very mild end to the summer from August to October.”

Based on Friday’s weather forecast through Nov. 24, November is on pace to be more than 20 heating degree days (HDDs) colder the 30-year normal, while last November was 120 HDDs milder than the 30-year. In fact, there wasn’t a single month in either of the last two winters that was colder than normal, Fell said.

Weather guidance late last week showed a mix of cooler and warmer periods for the next couple of weeks, with the strongest potential for cold around Nov. 22, Bespoke said. The Harrison, NY-based company said it viewed the market as ready for a pullback following six straight days of gains, and a few gas-weighted degree day losses may be all the catalyst necessary to pull back from resistance, it said.

On Friday, the Nymex December futures contract traded in a tight range of about 5 cents before eventually settling at $3.213, up 1.3 cents on the day.

Still, Bespoke said it viewed the futures strip still as moderately supportive with bullish power burns, although elevated production levels of around 75+ Bcf/d and strong overhead resistance are likely keeping prices from breaking out significantly heading into the weekend.

Estimates show Lower 48 production on pace to average around 76 Bcf/d for the coming winter, a gain of more than 5 Bcf/d over last winter. The supply increase is being met with the in-service of several highly anticipated pipelines aimed at moving that supply to market.

FERC on Nov. 2 gave the green light to Columbia Gulf Transmission LLC to start up the 1 Bcf/d Rayne XPress Expansion Project, adding to the list of Appalachian natural gas takeaway expansions coming online in time for winter heating season.

Rayne would deliver additional Marcellus and Utica shale gas to markets on the Gulf Coast. The Columbia Gulf Pipeline consists of 3,341 miles of pipe running through Louisiana, Mississippi, Tennessee and Kentucky.

Rayne joins Texas Eastern Transmission LP (Tetco)’s Adair Southwest and Access South expansions in opening up additional takeaway capacity for trapped Appalachian volumes. The Tetco projects also began in-service during the first week of November.

Meanwhile, Energy Transfer Partners LP’s 3.25 Bcf/d Rover Pipeline has also begun service, taking about 1 Bcf/d east-to-west out of the basin and opening up avenues for Appalachian gas also to reach Gulf Coast markets. Rover east-to-west volumes are likely to increase when the project’s next phase comes online, scheduled for the end of the year.

One glaring omission from the pipelines that have begun service is Columbia Gas Transmission LLC’s 1.5 Bcf/d Leach XPress, which was first announced in 2014 by Columbia Pipeline Group (CPG), which planned the Rayne and Leach projects at a combined cost of $1.75 billion. CPG was acquired by TransCanada last year. The in-service date for Leach XPress has since been pushed back to January 2018.

Genscape said the new date has a medium to high chance of additional delay, especially as it remains unknown why the project was delayed for two months beyond the Nov. 6 date suggested by the tariff filed just over 30 days ago.

“As Leach XPress project is majoritively a greenfield pipeline which requires the new pipeline (designated LEX) in order to provide gas to the newly improved R-System in central Ohio, we do not expect any partial service phases from this project. The R-System maintenance has concluded, and the new capacity is likely available from a hardware standpoint (pending FERC’s authorization to use it), but TCO needs the new LEX pipe in order to fill that capacity with southbound gas,” the company said.

Southern California markets continued to reflect tight conditions in the state as prompt-month forward prices put up gains double that of the benchmark Henry Hub. In addition to the limited import and storage capacity in the region, the state will also have to contend with additional planned maintenance on its 2001 Line, which will primarily cut into imports from El Paso at Ehrenberg.

Already, SoCal has increased its imports from Mexico notably at the Otay Mesa point following the onset of the third unplanned remediation event (the L235-2 explosion and force majeure). Otay Mesa normally posts zero or negligible flows, but since mid-October, volumes have been on the rise and have reached nearly 200 MMcf/d on some days, according to Genscape.

“These are essentially Permian molecules which SoCal would normally be able to receive directly from El Paso. However, with SoCal’s import capacity limited, this gas is flowing from EPNG to North Baja, then into Mexico at Ogilby and back to the U.S. at Otay Mesa,” Genscape said.

Although Otay Mesa still has another ~200 MMcf/d of available capacity, flows are maxing out at Ogilby, the Louisville, KY-based company said. That upstream limitation has corresponded with upward pressure on SoCal Citygate basis in order to continue to incentivize imports.

And while the latest planned maintenance event is only expected to last four days, the news of additional restrictions led to two straight days of gains in the cash market, which then spilled over into forwards.

SoCal Citygate’s December forward prices jumped 41 cents from Nov. 3 to 9 to reach $4.565, according to Forward Look. Spot prices for Friday’s gas day averaged $4.84, NGI Daily GPI data show.

Forward prices through the coming winter were also substantially higher, perhaps reflecting the market’s lack of confidence in SoCal’s ability to meet winter demand. SoCal February forward prices shot up 41 cents from Nov. 3 to 9 to reach $4.32, while the balance of winter (January-March) soared 27 cents to $3.85. The rest of the strip posted more modest gains of less than a dime.

Meanwhile, Appalachian pricing hubs continued to trail other regional markets despite the recent infrastructure additions coming into service in the region. A short-term maintenance on Dominion Transmission’s PL-1 Line that began Thursday also could be keeping a lid on gains at the pricing hub.

In a notice posted Thursday, Dominion said deliveries at 15 meters, located south of Chambersburg Station in Franklin County, PA, will be limited to primary only, until further notice. In order to serve the affected delivery point locations south of Chambersburg, Dominion will be able to effectuate secondary deliveries if the gas is sourced from the following two interstate interconnect locations via displacement – interconnect with Cove Point, “DTI – Loudoun” (meter 40704), or the interconnect with Transco, “Nokesville” (meter 40303).

While Dominion did not give a projected end date for the restrictions, similar events held this year have typically lasted between three and six days, Genscape said. Two outlier events, however, last more than 14 days.

Dominion South December forward prices climbed 13 cents from Nov. 3 to 9 to reach $2.545. The gain was 9 cents less than that seen at the Henry Hub, but the increase did snap a several weeks-long slide for the Appalachian point.

Tennessee zone 4 Marcellus December prices were up 11 cents during that time to reach $2.265, while January prices were up 15 cents to $2.546 and the balance of winter (January-March) was up 16 cents to $2.55.

Meanwhile, New England points screamed higher as some of the coldest conditions were expected in that region. With high temperatures topping out in the upper 30s to low 40s, and overnight lows slipping to the 20s, Genscape projected demand to reach 3.76 Bcf/d on Friday, 1 Bcf/d above the previous seven-day average. Weekend demand was expected to average 2.9 Bcf/d, up from 2.075 Bcf/d during the Nov. 4-5 weekend.

Genscape expects demand to wane steadily throughout this week, averaging just 2.664 Bcf/d.

Still, the surge in demand on Friday led to gains of several dollars in the cash market, and gains of more than $1 in forwards. At Algonquin Gas Transmission City-gates, December forwards shot up $1.15 from Nov. 3-9 to reach $3.376, Forward Look data show. January rose 73 cents to $9.328, and the balance of winter (January-March) climbed 66 cents to $8.13.

At Tennessee zone 6 200 leg, December was up $1.19 during that time to $6.45, January was up 80 cents to $9.423 and the balance of winter (January-March) was up 73 cents to $8.25.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 1532-1266 |