Regulatory | Infrastructure | Mexico | NGI All News Access | NGI The Weekly Gas Market Report

Mexico Officials Hope Third Time’s A Charm on Planned Round Three Unconventionals Auction

Mexican authorities are planning a third attempt to auction several blocks of unconventional sources of energy, particularly shale, of which it is reckoned to hold the world’s sixth largest reserves, though so far almost completely untapped.

In addition, state oil and gas company Petroleos Mexicanos (Pemex) has revealed plans to launch a major drilling offensive in the quest for unconventionals.

“About two thirds of our country’s energy potential consists of unconventional resources,” Hector Moreira, a member of Mexican upstream regulator, the Comision Nacional de Hidrocarburos (CNH), told a commission extraordinary session on Tuesday. “That’s why it’s really important for the country to develop its unconventional resources.”

Round One, the first series of upstream auctions since the 2013 energy reform that ended 75 years of a state monopoly, was scheduled to include a sale of unconventional blocks. However, that plan was scrapped on grounds that practices such as hydraulic fracturing had to be regulated, particularly the use of water in the arid regions, which are believed to hold the most potential for unconventional resources.

Round Two also included an unconventionals auction, this time with regulations on the use of water that were described as strict and in keeping with the best of international standards.

But Round Two came and went without the unconventionals auction. Nor was there any substantial official explanation for its absence.

However, a source told NGI that the reason for the absence was concern over “political noise” that could be created in 2018, an election year.

As in most other countries, Mexico has a powerful environmental lobby, but it also has a large majority of the population that was educated in a school system that regarded the former state oil monopoly as a leading symbol of national sovereignty.

While Mexico has suffered severely from criminal violence in recent years, political upheaval is relatively rare. It came as a major shock when a big gasoline price increase that was meant to phase in a free market turned into widespread riots that included burning police vehicles and store lootings early this year.

Now Round Three has been launched, with 35 shallow-water blocks to be auctioned in late March of next year. An unconventionals auction also has been pencilled in, but not until well after the election, which is to take place in July.

Under the bidding system, CNH has to suggest auctions for a round, the Finance Ministry has to work out the financial arrangements, including the bidding process, and the Energy Ministry would approve or reject what has been proposed.

In the case of the unconventionals auction of Round Three, the ministry is getting a little ahead of the game.

Sources said that areas where unconventional auctions are to be held are likely to receive a government goodwill offensive. The two areas where the auctions are expected to be held are in the Burgos Basin south of the Texas border and in Tampico-Misantla. The Mexican states concerned, Coahuila and Tamaulipas, are governed by parties that support the energy reform.

The state authorities would be helped by the local business communities, assuming that all goes well, to create a favorable atmosphere within the community that would stave off protests over practices such as fracking. That at least is the theory.

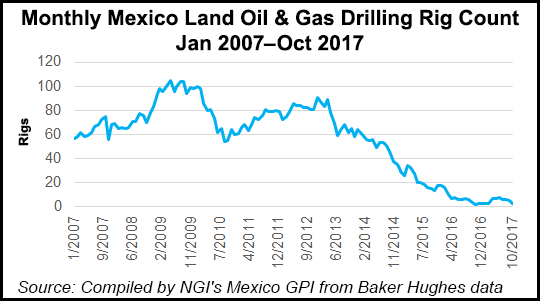

The CNH session in which Moreira was speaking fully approved the latest Pemex exploration plans that include doubling efforts to develop unconventionals and on land in general. The trend marks a substantial change in a country where offshore exploration and production has been dominant for years.

The recent Pemex Ixachi-1 discovery is the first in 15 years on land, perhaps contributing to launch the new trend.

Meanwhile, the CNH at this week’s session also imposed a $1.9 million fine on Mexico-based Canamex Energy Holdings, which renounced its right to an onshore block on the southern Gulf Coast that it won in Round One.

CNH President Juan Carlos Zepeda explained that Canamex said that its bid in the auction, an additional 85.69% of royalties, left it well short of meeting its costs at current prices. The 1.3 auction was an attempt to attract newcomers to the industry with a view to building a private sector in Mexico that had not existed since the oil nationalization of 1938. The auction, held late last year, created fierce bidding that in some cases was unrealistic in view of current prices, some analysts had said.

At the time, the Finance Ministry, which sets the financial terms of the auctions, fixed a minimum of 5% additional royalty, but there was no upper limit. Since then, upper limits have been set in each auction according to the estimate of the market value of each block as a strong disincentive to unrealistic bidding.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |