NGI Data | Markets | NGI All News Access

Trademark Winter Surge for Northeast NatGas Cash; Futures More Muted

A blast of late-week cold sweeping through the Northeast and Midwest meant all the action happened in the spot market Thursday; the Northeast flashed some trademark winter price spikes, and the NGI National Spot Gas Average finished at its highest level since January, adding 31 cents to $3.40/MMBtu.

Futures were more sedate, moving up in muted fashion on a bullish storage inventory build that offered no real surprises. December settled 2.5 cents higher at $3.200, while January also tacked on 2.5 cents to settle at $3.297. December crude oil added 36 cents to settle at $57.17.

It was the cash market that had a story to tell Thursday, and that story was “winter is here.”

AccuWeather forecasts called for lows to fall into the 20s Friday in major population centers across the Northeast and Mid-Atlantic, including Washington, DC, Boston and New York City.

PointLogic Energy analyst Luke Larsen said the firm’s near-term outlook shows “the coldest day from a population-weighted degree day standpoint is still expected to be Friday, as chilly air fully engulfs most of the Midwest and Northeast regions. Record-low temps might be challenged in northern tier cities such as Detroit Friday, as the lows will be in the low 20s, while the record low for the Motor City on this early November day is only 19 degrees.”

Larsen also noted “the quickness of the transition out of this cold pattern.” By Tuesday PointLogic’s weather model has “almost no evidence of the prior event as warmer air fills back in across the eastern U.S. after the Arctic air exits the East Coast.”

Known to be a little volatile when the frosty air moves in, New England price points shot up Thursday. Tennessee Zone 6 200L more than doubled, adding $5.24 to finish at $9.00, as did Algonquin Citygate, which surged $4.72 to $8.19. Iroquois Waddington added $1.12 to finish at $4.58.

Algonquin Gas Transmission put shippers on notice that it would have “limited operational flexibility to manage imbalances” for Friday’s gas day.

Further south, Transco similarly posted notice to shippers that it would be implementing an operational flow order for its Zone 5 and Zone 6 — covering the Mid-Atlantic and Northeast portions of the pipe — for Friday’s gas day due to limited flexibility. Transco Zone 6 New York jumped $2.48 to $5.67, while Transco Zone 5 added 50 cents to $3.74.

In Appalachia, Dominion South failed to build on several days of strong gains this week, retreating 10 cents to $2.48. Other Appalachian points continued to climb. Columbia Gas tacked on 6 cents to $3.06, while Tetco M3 Delivery added 17 cents to $3.07.

Elsewhere in the spot market, price moves were more modest. The Midwest and Midcontinent gained following double-digit moves up Wednesday. Chicago Citygate added 3 cents to $3.34, and Joliet added 3 cents to $3.26. Northern Natural Demarcation gained 6 cents to $3.28.

Out West, SoCal Citygate, still having to make do with limited import and storage capacity, jumped for the second straight day, adding 43 cents to finish at $4.84.

In the futures market Thursday, December traded as high as $3.217 and settled above what some technical traders had viewed as resistance in the $3.13-3.19 range. The last time the prompt-month contracted traded this high was in May; the peak trade that month was $3.431.

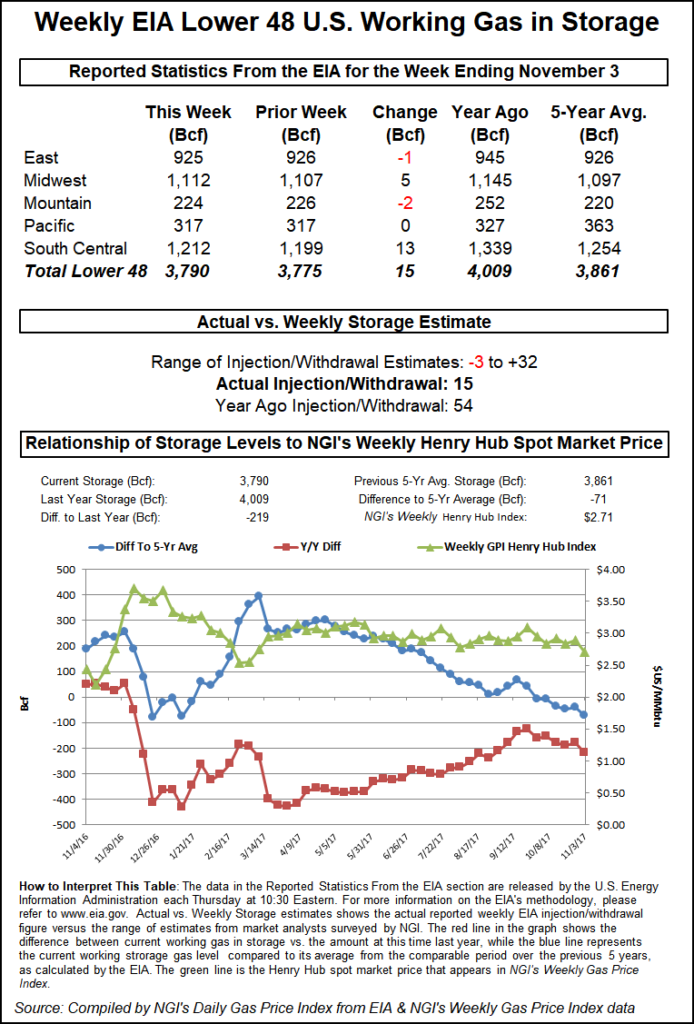

An on-the-nose natural gas storage figure from the Energy Information Administration (EIA) triggered some late-morning selling in the December contract, with traders perhaps expressing their disappointment that the actual number wasn’t a little lower.

The EIA reported a 15 Bcf injection for the week ended Nov. 3, right in line with market expectations. In the minutes following EIA’s 10:30 a.m. EDT publication, the December contract dipped into the $3.180 range after taking out technical resistance earlier in the morning and climbing above $3.210. By 11 a.m. EDT December was trading around $3.190.

“This print once again fell right within market expectations and has resulted in only gradual selling since its release. It was slightly larger than expected, which may put a temporary halt on the rally we have seen as of late and may encourage longs to take profits,” said Bespoke Weather Services in a post-release note to clients.

“However, we do not think the number reflects any material week/week loosening, as it is about on par with last week. Accordingly, we have not adjusted our expected prints over the next three weeks, and see any profit-taking off this print as temporary in the face of broader bullish weather expectations.”

Steve Blair, vice president of Rafferty Commodities Group, said the market seemed a little disappointed in the 15 Bcf figure given talk that the number could come in even lower than the consensus.

“That was a very wide range of estimates…and so sometimes you’ve got to take with a grain of salt the average. It could be that the market was actually looking for a little bit less than that, or it could be that the market got what it expected, is disappointed it wasn’t a smaller injection, and now we’re back to the whole weather scenario,” Blair said.

It could be a case of “buy the rumor, sell the fact, with the market still not believing that we’re heading into winter yet,” he said.

Prior to the release of the figure, consensus was for a build in the teens. A Reuters survey of traders and analysts called for a build of 15 Bcf, with a range of -3 Bcf to +32 Bcf. Kyle Cooper of IAF Advisors was calling for a 14 Bcf injection, and Stephen Smith of Stephen Smith Energy had also estimated a build of 14 Bcf.

Last year 54 Bcf were injected, and the five-year average stands at +45 Bcf.

Total working gas in underground storage now stands at 3,790 Bcf. That’s below the five-year average of 3,861 and well below year-ago inventories of 4,009 Bcf.

The East (-1 Bcf) and Mountain (-2 Bcf) regions saw net withdrawals for the week. The Midwest injected 5 Bcf, while the South Central region injected 13 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |