NGI The Weekly Gas Market Report | E&P | Mexico | NGI All News Access

Mexico Uncertainty, GOM Challenges Concern Hornbeck Offshore

Gulf of Mexico (GOM) vessel supplier Hornbeck Offshore Services Inc. reported increased revenues in the third quarter, but the CEO warned that the market for supply vessels, tankers and barges remains “very challenging,” with operators unlikely to enter into long-term contracts without confidence on commodity prices and rising uncertainty over energy development in Mexico.

Hornbeck reported revenue totaling $53.7 million in 3Q2017, a 3.5% increase from the year-ago quarter ($51.9 million) and a 43.6% sequential increase ($37.4 million). At the end of September the fleet, which primarily serves the U.S. GOM and Latin America, totaled 62 offshore support vessels (OSV) and eight multi-purpose supply vessels.

“I think we positioned ourselves effectively in an otherwise very challenging, competitive landscape that is marked by low demand and a high supply of vessels,” CEO Todd Hornbeck said during a quarterly earnings call last week. “I would be very cautious, however, about taking this quarter’s results as a sign of structural market improvement or that future near-term quarters will be the same or better. In fact, there has been very little change in fundamentals for offshore activities in our core markets.”

The company has 25 vessels under contract in the GOM, and on average 21 vessels were working during the third quarter, which he called “extremely low.”

“One dynamic we are watching is contract roll-offs of deepwater drilling rigs and the rates in terms of their re-pricing,” Hornbeck said. “Of the 25 contracted rigs, about 70% are presently working at pre-downturn day rates of $400,000/day or greater. So, there is a large overhang of rigs contracted at high rates.”

The company is seeing a trend where rigs are re-contracted for short-term charters at rates significantly lower than pre-downturn levels. Rig day rates in the mid-$100,000 range are not unusual, he said.

“That tells us there is an appetite for rig utilization at extremely low day rates, and that rig owners are willing to work at that pricing, at least for now,” Hornbeck said. “That dynamic is necessary for the currently more poor market conditions to not become even worse.

“In other words, GOM conditions for OSVs could deteriorate further if demand for even low-price rigs is not there or rig owners decide they would rather be idle than work at such low rig rates. We think that something far more fundamental in the overall picture for all supply and demand is needed to cause a sustained pickup in offshore drilling activity in the deepwater GOM.”

Despite the company providing services to new international players in Mexico’s recently opened offshore sector, “two significant headwinds” are cause for concern: July’s presidential election, and a dispute between international firms and the state-owned oil company, Petróleos Mexicanos (Pemex).

A presidential election scheduled in Mexico next year “may introduce new political opposition to further opening third-party exploration efforts in Mexico, or worse, a return to prior nationalistic policies.” Meanwhile, “a dispute over resource ownership appears to be taking shape between Mexico and the new international players that have had drilling success in the fields adjacent to Pemex’s own fields.

“This squabble might slow down drilling plans until the rules of the game are better understood by new market entrants. Unfortunately, this increased uncertainty for our customers will likely forestall what we had hoped would be a near-term resurgence in demand for our vessels there.”

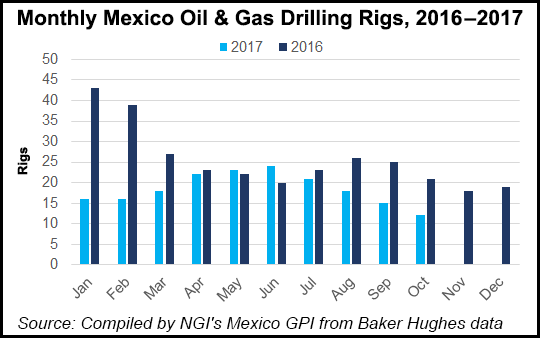

Drilling activity in Mexico has taken a significant downturn in recent months. According to Baker Hughes data, recent rig activity in the country peaked at 24 in June, but has fallen each month since, averaging just 12 in October.

Net losses in 3Q2017 totaled $19 million (minus 51 cents/share) in 3Q2017, compared with a year-ago net loss of $16.5 million (minus 45 cents) and a sequential net loss of $19.5 million (minus 53 cents).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |