Shale Daily | E&P | NGI All News Access | NGI The Weekly Gas Market Report

SRC Builds DJ Inventory in $608M Deal with Noble Energy

Houston-based Noble Energy Inc. agreed late Wednesday to take $608 million from SRC Energy Inc. for a package of natural gas-heavy assets in the Denver-Julesburg (DJ) Basin.

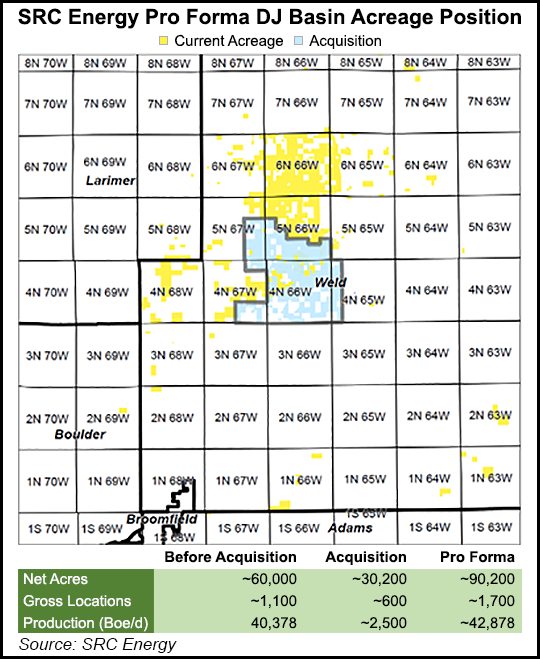

The 30,200 net acre leasehold to be sold is in Weld County, CO, and producing about 4,100 boe/d.

SRC, a pure-play DJ operator that formerly was Synergy Resources Corp., works in the DJ’s Wattenberg field almost exclusively.

“This transaction solidifies SRC’s position as a leading DJ Basin operator with a deep inventory of efficient, high return development opportunities combined with a conservative balance sheet,” said CEO Lynn A. Peterson. “The operating efficiencies that we have gained over the past few quarters will transfer smoothly to this new acreage.

“We will begin working on our expanded position immediately with planning, permitting and infrastructure buildout. As substantially all of the acreage is held by production, we will take a measured approach before adding additional capital.

Peterson formerly helmed Kodiak Oil & Gas Corp., a mega-Bakken Shale operator that was bought out three years ago by Whiting Petroleum Corp. During his Kodiak tenure, Peterson helped to transform the portfolio to not only compete but to grow.

Since taking over at SRC, Peterson has clinched more deals to build the DJ portfolio by leaps and bounds. Last year he made two other deals worth $505 million with Noble to add 33,100 net acres in the Wattenberg field.

The latest deal would represent a 50% jump in SRC’s leasehold to around 90,000 net acres. The Noble transaction also boosts SRC’s drillable locations by 55%. Multiple development pads already are permitted, and substantially all of acreage is held by production. More than 600 gross locations would support mid-to-long lateral well designs, SRC noted.

The Noble transaction is set to be completed in two separate deals, with acreage and nonoperated production included in the initial closing by the end of December, followed by a second closing for operated producing properties by mid-2018. The initial closing represents more than 90% of the total transaction value.

“This sale of acreage in our Greeley Crescent and Bronco development areas represents an acceleration of value as it was not likely to be developed by us for a number of years,” said Noble operations chief Gary W. Willingham.

“Our DJ Basin activities, both now and for several years to come, will remain focused on the northern and eastern parts of the basin. This is where we have a deep inventory of long lateral drilling opportunities in an oilier part of the basin and where our infrastructure provides a competitive advantage.”

Proceeds from the transaction would be used to strengthen the balance sheet, he said.

About half of the acreage is in Noble’s Greeley Crescent area with the other half in the Bronco area. Noble Midstream Partners LP maintains the acreage dedication for in-basin oil gathering, produced water gathering and fresh water delivery.

Nonoperated production associated with the transaction totals around 2,500 boe/d. Operated production, assumed at the time of the second closing, is estimated at 1,600 boe/d.

The leasehold being sold is 50% weighted to gas, 30% to liquids and 20% to oil. The acreage represents 8% of Noble’s DJ holdings, while the production represents about 4% of the total.

Post the transaction’s completion, Noble still would have about 335,000 net acres in the basin.

Tudor, Pickering, Holt & Co. acted as the lead financial adviser for Noble while Bracewell LLP acted as outside legal adviser.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |