Shale Daily | E&P | NGI All News Access | NGI The Weekly Gas Market Report

California Resources Seeking Another JV to Boost Onshore Operations

California Resources Corp. (CRC) is looking for more joint venture (JV) partners and is envisioning better natural gas prospects in the state’s major basins.

CRC, which produced 128,000 boe/d in 3Q2017, drilled 77 wells in the three-month period, including 49 from separate JVs inked earlier this year with Benefit Street Partners LLC and Macquarie Infrastructure and Real Assets.

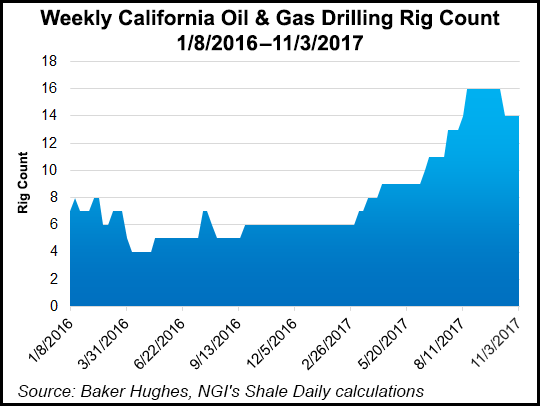

CRC has gone from zero to nine active rigs this year, and six of the rigs have been tied to JV-funded operations, CEO Todd Stevens said during a conference call Monday to discuss third quarter results. CRC expects soon to complete another JV, he said.

“We’re actively in discussions with lots of folks, both upstream and downstream,” Stevens said.

CRC is biased toward the upstream side for JVs, and it has divested some small assets along the way in the midstream. “Whatever we do has to make sense from the standpoint of value and our debt-reduction strategy. As I have said all along, we’re not conducting any fire sales.”

On the midstream side, CRC is looking for possible monetizations, but Stevens said that those transactions trade “balance sheet leverage for income statement leverage,” so it has be something that makes sense to management and will reduce debt.

Global oil prices have reached “an inflection point” and are climbing after bottoming out, Stevens said. CRC has stepped up its natural gas activity and is anticipating price movement there too.

“We have some exploration prospects with partners, and we’ve done some workovers,” he said, adding that eventually there may be some gas activity on which CRC will partner. “We have done some of this on a small scale, but I think it could be in large scale at some point in the future.

“Gas in California is something on which the [price] bases has got to get better because there are going to be shortages, particularly as weather patterns change and Aliso Canyon stays at minimal use at this point in time.”

Aliso, California’s largest underground gas storage facility, has 86 Bcf of capacity, but after reopening following a four-month-long gas leak, it has been limited to 29 Bcf.

CRC reported a net loss in 3Q2017 of $133 million (minus $3.11/share), compared with net income of $546 million ($13.04) for the same period in 2016. On an adjusted basis, CRC showed a net loss of $52 million (minus $1.22), compared with a year-ago adjusted net loss of $71 million (minus $1.74). Total revenue in 3Q2017 was $445 million, compared with $456 million a year ago.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |